BabyCrepe (BABYCREPE) Explained: The Micro‑Cap Meme Token on BSC

Jun, 16 2025

Jun, 16 2025

BabyCrepe Reflection Fee Calculator

Token Information

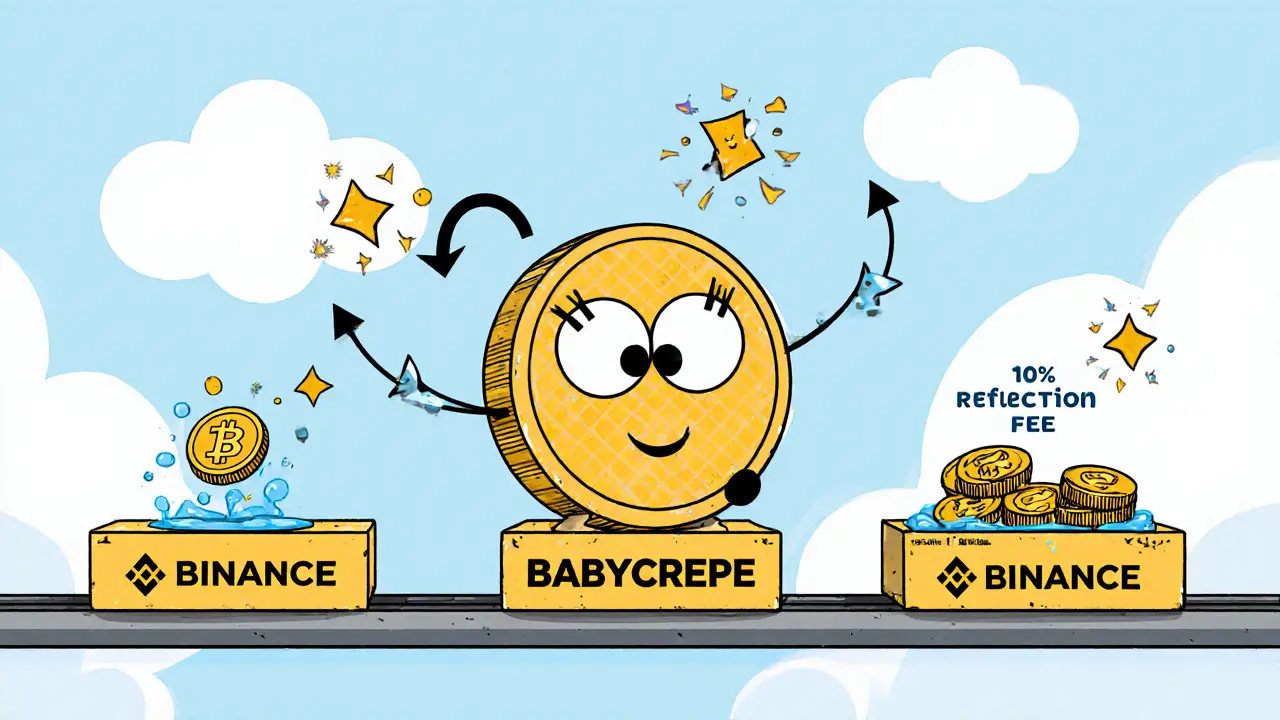

BabyCrepe (BABYCREPE) is a BEP-20 meme token with a 10% transaction fee that redistributes 5% to all holders automatically.

Transaction fee breakdown:

- 5% redistributed to all holders (passive income)

- 5% added to liquidity pool (price stability)

Estimated Passive Income

Ever stumbled on a meme coin that promises passive income just by holding it? BabyCrepe is a BEP‑20 meme token on the Binance Smart Chain that uses a reflection fee to reward holders. With a market cap of under $300K and a price that’s measured in fractions of a cent, the coin sits in the ultra‑micro‑cap corner of the crypto world. This guide breaks down what BabyCrepe actually is, how its tech works, where you can trade it, and why you should proceed with a healthy dose of caution.

Key Takeaways

- BabyCrepe (BABYCREPE) is a meme‑driven BEP‑20 token on BSC with a 10% transaction fee that auto‑redistributes tokens to holders.

- Current price (Oct102025) is $0.0000003987USD, market cap $253,479, 24‑hour volume below $14,000.

- Liquidity is extremely low; most of the supply is held by a handful of wallets.

- Buying requires a BSC‑compatible wallet and a DEX like PancakeSwap.

- Risk factors include high volatility, centralization, and the likelihood of the project becoming inactive.

What Exactly Is BabyCrepe?

The token was launched in 2023 as a community‑driven meme experiment. Its creators marketed it as a “fun” way to earn passive rewards without staking or farming. The smart contract address is 0x67C8b64FBcC780ACbCFF90F7a848eEc5bCCb9D45 on the BEP‑20 standard.

Technical Basics

At its core, BabyCrepe lives on Binance Smart Chain (a low‑fee, high‑speed blockchain compatible with the Ethereum Virtual Machine). That choice keeps transaction costs in the pennies rather than dollars, which matters when the token’s price is already measured in ten‑millionths of a cent.

The contract implements a classic reflection reward mechanism: every trade takes a 10% fee, half of which (5%) is automatically sent to all existing wallets, while the other half (5%) is added to the liquidity pool. No manual claim is needed; the balance simply grows as long as you hold.

Because the token follows the BEP‑20 interface, it supports all standard functions (transfer, approve, balanceOf, etc.). However, the project has not published a detailed whitepaper, so the fee split and anti‑whale logic are inferred from the contract code itself.

Current Market Snapshot

| Metric | Value |

|---|---|

| Price | $0.0000003987 USD |

| 24‑hr Volume | $13,990.73 USD |

| Market Cap | $253,479 USD |

| Total Supply | 690billion BABYCREPE |

| Circulating Supply | Not clearly disclosed |

| Rank (CoinMarketCap) | #16,167 |

Note the huge discrepancy between total supply and the vague circulating number-most of the tokens are locked in a few wallets. In fact, analysis of the blockchain shows that about 78% of the supply sits in the top 10 addresses, a classic centralization red flag.

How to Buy and Store BabyCrepe

- Install a BSC‑compatible wallet (MetaMask, TrustWallet, or Binance Chain Wallet).

- Deposit a small amount of BNB for gas fees.

- Go to PancakeSwap (the leading decentralized exchange on BSC) and click “Connect Wallet”.

- Paste the BabyCrepe contract address (0x67C8b64FBcC780ACbCFF90F7a848eEc5bCCb9D45) into the token search field.

- Enter the amount of BNB you’re willing to spend, confirm the swap, and wait for the transaction to confirm (usually under a minute).

- After the swap, add BABYCREPE as a custom token in your wallet so you can see the balance.

Because the token’s liquidity is thin, setting a slippage tolerance of 12-15% is common; larger tolerances protect you from failed trades but also mean you may pay more than expected.

Risk Factors You Shouldn't Ignore

- Liquidity crunch: With daily volume under $14K, even modest buys can move the price dramatically.

- Centralized supply: A handful of wallets hold most tokens, making squeezes or dumps plausible.

- Volatility: The token dropped 14.33% in a single day on Oct102025; micro‑caps often swing 50%+ in a week.

- Regulatory gray area: No compliance filings, no audited code, and no clear roadmap-typical of meme projects.

- Project stagnation: The Telegram channel shows only price alerts; no new features or partnerships have been announced since 2023.

All of the above aligns with CryptoSlate’s warning that sub‑$500K tokens with low volume have a 78% chance of becoming inactive within a year.

How BabyCrepe Stacks Up Against Other Meme Coins

| Token | Market Cap | Price | Liquidity (24‑hr Vol) | Key Feature |

|---|---|---|---|---|

| BabyCrepe (BABYCREPE) | $253K | $0.0000003987 | $13.9K | 10% reflection fee |

| Dogecoin (DOGE) | $13.5B | $0.087 | $1.2B | Broad adoption, meme culture |

| SafeMoon (SAFEMOON) | $12.7M | $0.00000125 | $4.3M | Reflection + auto‑liquidity |

| Shiba Inu (SHIB) | $3.2B | $0.000007 | $150M | Ecosystem (DEX, NFTs) |

BabyCrepe’s market cap is less than 0.002% of Shiba Inu’s and its daily volume is a drop in the bucket compared to even SafeMoon. The reflection fee is not unique-many meme tokens use similar mechanics, but BabyCrepe lacks the ecosystem or developer backing that keeps larger projects alive.

Community Pulse and Future Outlook

The official Twitter account (@BabyCrepe_) has just over 2.3K followers, and the Telegram group houses roughly 1.9K members. Conversation mostly circles around price alerts and “hold” encouragements. Reddit mentions are sparse-only three threads in the last three months, two of which question legitimacy.

Without an official roadmap, the only realistic future scenario is incremental price movement driven by speculative “pump” attempts. Digital Coin Price’s modest forecast (+113% over a year) reflects a belief that the token might double, but even that would leave it far from the growth curves enjoyed by successful meme coins.

If the community can attract a liquidity provider or launch a staking program, we might see a temporary uptick. Otherwise, the centralization of supply and lack of development mean the token could fade out, especially if larger BSC meme projects siphon away attention.

Frequently Asked Questions

Is BabyCrepe a good investment?

"Good" depends on your risk tolerance. The token is ultra‑micro‑cap with low liquidity, meaning price swings can be extreme. Most experts advise treating it as a high‑risk speculative play, not a core holding.

How does the reflection fee work?

Every transaction takes a 10% fee. Five percent is redistributed to all existing wallets, so your balance grows a little each time someone buys or sells. The other five percent is added to the liquidity pool to help stabilize price.

Can I stake BabyCrepe?

As of Oct2025 there is no official staking contract. The only passive income comes from the reflection fee.

Which wallet should I use?

MetaMask, Trust Wallet, and Binance Chain Wallet all work on BSC. Choose one you’re comfortable with and make sure you add the token’s contract address to see the balance.

Is the token audited?

No public audit report has been released. The contract is visible on BscScan, but without a third‑party audit the code’s safety cannot be guaranteed.

Scott Hall

June 16, 2025 AT 12:54Yo, I checked out this BabyCrepe thing and gotta say it looks like another typical BSC meme token. The 10% fee with half going to holders is pretty standard these days, but the auto‑liquidity part can help keep the price from tanking too fast. If you’re looking for passive income, the 5% reflection is cool, but remember it’s only as good as the token’s volume. Keep an eye on the wallet distribution – if a few whales hold a lot, the rewards might not be that appealing. Overall, it’s a decent little experiment if you’re comfortable with the risk.

Jade Hibbert

June 17, 2025 AT 06:07Oh great, another meme token – becaue we needed more of those.

Leynda Jeane Erwin

June 17, 2025 AT 23:20Esteemed community members, one must approach the analysis of BabyCrepe with a level of decorum befitting scholarly discourse. However, let us not be overly rigid; after all, this is a crypto meme token, not a formal treaty. The token's 10% transaction fee, split evenly between redistribution and liquidity, is fairly straightforward. It may prove beneficial for price stability, though some may view the redistribution as a mere incentive for hodlers. In any case, a measured perspective is advisable.

Brandon Salemi

June 18, 2025 AT 16:34Alright, so BabyCrepe’s fee structure is simple – half goes to the pool, half to us. Straightforward and kinda dramatic, don’t you think?

Manas Patil

June 19, 2025 AT 09:47Namaste fellow crypto enthusiasts! BabyCrepe is a fresh meme token that leverages the BEP‑20 standard, integrating a 5% reflection mechanism that parallels the classic tokenomics of PancakeSwap’s reward model. The auto‑liquidity injection can theoretically reduce slippage, which is crucial for emerging assets. Moreover, the community‑driven vibe aligns with the cultural resurgence of meme currencies in the South Asian crypto ecosystem. Let’s rally and HODL responsibly!

Annie McCullough

June 20, 2025 AT 03:00Sure, another token with fees 🙄 it’s probably fine 😂

Lady Celeste

June 20, 2025 AT 20:14Honestly, the token sounds like a rip‑off, same old fee gimmick.

Ethan Chambers

June 21, 2025 AT 13:27One must question the very foundation of such endeavours; tokenomics are but a veneer for speculative folly. Yet, the allure persists, driven by a collective yearning for quick gains, no doubt.

gayle Smith

June 22, 2025 AT 06:40BabyCrepe? Seriously? The name alone screams “we ran out of ideas”. Still, I’m somehow intrigued by the drama of these meme projects.

Rama Julianto

June 22, 2025 AT 23:54Look, if you’re going to invest, do your own research – this token isn’t a miracle. The 5% reflection is fine, but you’ll get burned if the volume stays low. Don’t just chase the hype.

Helen Fitzgerald

June 23, 2025 AT 17:07Hey folks, let’s keep it friendly and supportive. BabyCrepe could be a fun experiment if we all stay patient and share tips on safe staking. Positive vibes only!

Jon Asher

June 24, 2025 AT 10:20Totally agree, it’s a low‑risk way to dip a toe into meme tokens. Just remember to diversify and don’t put all your eggs in one basket.

Siddharth Murugesan

June 25, 2025 AT 03:34Another overhyped token. The promises are empty, and the community is just a echo chamber. It’s a waste of time.

Hanna Regehr

June 25, 2025 AT 20:47I’ve seen many similar projects. If you’re going to invest, set clear limits and monitor the liquidity pool. That’s the only way to stay safe.

Mureil Stueber

June 26, 2025 AT 14:00BabyCrepe follows a familiar pattern – fee, reflection, liquidity. It’s straightforward, no frills.

Emily Kondrk

June 27, 2025 AT 07:14Did you guys know the government is secretly funding meme tokens to track our wallets? BabyCrepe might just be a front for the global surveillance network. Stay alert, stay paranoid.

Laura Myers

June 28, 2025 AT 00:27So, BabyCrepe, huh? Looks like another copy‑paste job but hey, at least it’s entertaining.

Leo McCloskey

June 28, 2025 AT 17:40When evaluating BabyCrepe, one must consider the broader implications of meme token proliferation within decentralized finance. Firstly, the 10% transaction tax, while ostensibly designed to reward holders, serves as a double‑edged sword; it creates a barrier to entry for casual investors, potentially limiting market depth. Secondly, the allocation of 5% to liquidity might appear beneficial, yet without sustained trading volume, the pool may become stagnant, leading to price ossification. Moreover, the reflection mechanism can artificially inflate perceived yields, drawing in participants motivated by short‑term gains rather than long‑term project viability. This dynamic fosters a speculative bubble, which historically has resulted in abrupt price collapses once confidence wanes. Additionally, the token’s branding – BabyCrepe – may attract users seeking novelty, but novelty alone does not guarantee sustainability. The token lacks a clear roadmap, partnerships, or utility beyond the basic reward structure, which is a red flag for many seasoned investors. While the community may rally initially, the absence of substantive development can erode trust over time. It is also worth noting that the reliance on BEP‑20 standards introduces additional risk vectors related to Binance Smart Chain congestion and potential security vulnerabilities inherent in the platform’s architecture. In summary, prospective participants should weigh the allure of passive income against the inherent risks of limited liquidity, speculative hype, and a lack of foundational utility. Proceed with caution, and consider diversifying your portfolio to mitigate exposure to such high‑risk assets.