CPUfinex Crypto Exchange Review: Legitimate Platform or Scam?

Feb, 21 2025

Feb, 21 2025

Crypto Exchange Verification Tool

Key Indicators of Legitimate Exchanges:

Regulatory License

Must be licensed by recognized financial authorities.

Proof-of-Reserves

Regular third-party audits confirming fund safety.

Transparency

Public data on trading volumes, fees, and team info.

When you stumble upon a new crypto exchange named CPUfinex is a platform that repeatedly appears in online searches alongside legitimate services, but its credibility is highly questionable. This review breaks down the red flags, compares it with a trusted alternative, and shows you how to verify any exchange before risking your funds.

What is CPUfinex and why it matters

Despite the catchy name, there is no record of CPUfinex in major industry databases such as CoinGecko, TradingFinder, or Coinspeaker. Legitimate exchanges are required to publish verifiable data - trading volume, security audits, team information - and none of those exist for CPUfinex. Its absence from the top‑100 exchange ranking, which includes platforms handling as little as $43million in daily volume, signals that the platform likely does not operate at a legitimate scale.

Red flags that mark CPUfinex as a potential scam

- Non‑existent regulatory listings - no license or registration with any financial authority.

- Lack of transparent Crypto Legal data - the database flags the "CPU" naming pattern as a common spoof.

- No proof‑of‑reserves or third‑party audits, unlike the 95% cold‑wallet holdings confirmed by exchanges such as CoinEx.

- Unrealistic promises of high returns, a classic lure documented in numerous crypto‑fraud reports.

- Fake or nonexistent customer support - users report unanswered tickets and dead‑end contact forms.

These warning signs align perfectly with the fraud‑scam characteristics outlined by the UK Financial Conduct Authority’s October2025 alert, which specifically warned about “CPU‑based exchange names” used in coordinated scam networks.

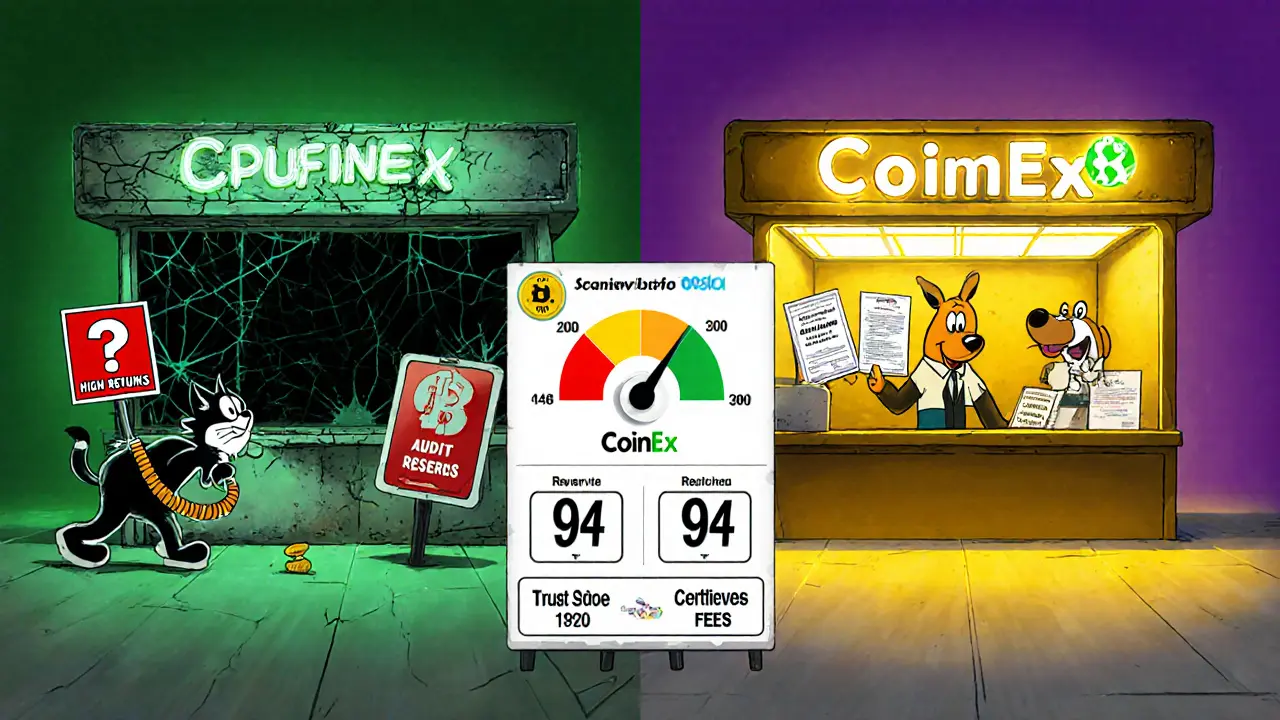

CPUfinex vs. CoinEx: A side‑by‑side comparison

| Metric | CPUfinex | CoinEx |

|---|---|---|

| Trust Score (CoinGecko) | - (not listed) | 94 |

| Verified Reserves | None disclosed | $1.2billion (independent audit) |

| Base Trading Fee | Unclear / unverified | 0.2000% (0.1500% with CET token) |

| KYC Requirement | None (or fake KYC) | Basic for spot, mandatory for advanced features |

| 24‑hr Volume | - (no data) | $1.1billion |

The table makes it clear: while CoinEx provides verifiable metrics and a solid security track record, CPUfinex offers nothing beyond a name that imitates a reputable platform.

How to verify a crypto exchange before you deposit

- Check major ranking sites - CoinGecko, CoinMarketCap, and TradingFinder list only exchanges that meet volume and compliance thresholds.

- Search the exchange’s name in Crypto Legal’s fraud database. Matching naming patterns (e.g., "CPU…ex") often indicate a spoof.

- Look for proof‑of‑reserves. Legitimate platforms publish audit reports or on‑chain proof that assets are held securely.

- Verify regulatory status - a registered entity will display license numbers and jurisdiction details on its website.

- Test customer support - send a query and gauge response time. Scams typically use generic contact forms that never reply.

Following these steps dramatically reduces the risk of falling for fraudulent exchanges.

Safe alternatives to CPUfinex

If you’re searching for a reliable place to trade, consider these established options:

- CoinEx - boasts a 94 trust score, over 1,200 crypto pairs, and a transparent fee structure.

- Binance - the world’s largest exchange by volume, with robust KYC, insurance funds, and a proven security history.

- Pionex - offers automated trading bots, tiered verification, and a clear fee schedule (0.05% maker/taker).

- Koinly‑recommended no‑KYC platforms - such as Kraken, which still enforce basic identity checks for large withdrawals.

All of these platforms are listed on CoinGecko and have verifiable audit trails, making them far safer choices than any “CPU‑based” clone.

What to do if you’ve already interacted with CPUfinex

First, stop any further deposits. Document every transaction - screenshots, email threads, wallet addresses - and report the incident to your local financial regulator. If you’re based in NewZealand, contact the Financial Markets Authority (FMA). Internationally, you can file a complaint with the UK FCA’s fraud portal or the US FTC’s online complaint system.

While recovery of funds from a scam exchange is unlikely, filing a report helps authorities track the operation and may prevent others from being victimised.

Frequently Asked Questions

Is CPUfinex a real cryptocurrency exchange?

No. CPUfinex does not appear in any reputable exchange directory, lacks verifiable reserves, and matches known scam naming patterns identified by Crypto Legal.

What are the main red flags of a fake exchange?

Missing regulatory license, no proof‑of‑reserves, unrealistic profit promises, unresponsive customer support, and absence from major ranking sites are the top warning signs.

How does CoinEx verify its reserves?

CoinEx publishes quarterly audit reports conducted by independent firms, showing that over 95% of user funds are kept in cold wallets and are regularly verified on‑chain.

Can I recover money sent to a scam exchange?

Recovery is rare, but you should report the incident to your local regulator and provide all transaction evidence. Law enforcement may be able to trace the wallets.

What steps should I take to verify any new exchange?

Check reputable ranking sites, look for audit reports, verify regulatory licensing, search the name in fraud databases, and test customer support before depositing any funds.

Siddharth Murugesan

February 21, 2025 AT 16:33This article is just another clickbait piece, full of hype and nothing but lies. The author doesn't even know basic crypto terms. I cant beleve they waste my time with garbage.

Hanna Regehr

February 25, 2025 AT 03:53While it’s easy to dismiss, the points raised about red flags are valuable. It’s always wise to cross‑check an exchange on multiple reputable sites before depositing. A balanced view helps newcomers avoid costly mistakes.

hrishchika Kumar

February 28, 2025 AT 15:13Reading through this, I felt a wave of relief knowing the community is vigilant. The colorful comparison with CoinEx paints a clear picture, and the step‑by‑step verification guide is a true lifesaver for anyone diving into crypto.

Emily Kondrk

March 4, 2025 AT 02:33Don’t be fooled by the glossy UI – behind the scenes there’s a hidden network of actors pulling strings. Every "legitimate" claim is just a layer of obfuscation designed to keep the average user in the dark while they siphon funds.

Laura Myers

March 7, 2025 AT 13:53Wow, talk about drama! CPUfinex sounds like a plot twist straight out of a thriller, and the author’s detective work is nothing short of cinematic. I’m on the edge of my seat!

Carol Fisher

March 11, 2025 AT 01:13Patriotic investors deserve better than scams like this 🇺🇸💪. If you value your nation’s financial integrity, steer clear and support regulated platforms.

Melanie Birt

March 14, 2025 AT 12:33Great breakdown! 👍 If you’re still unsure, just remember: check for licensing, proof‑of‑reserves, and community reputation. Those three pillars keep your crypto safe.

Jade Hibbert

March 17, 2025 AT 23:53Sure, because trusting a nameless exchange is a brilliant idea.

Leynda Jeane Erwin

March 21, 2025 AT 11:13Dear user,

Thank you for sharing your perspective. It is appreciated.

Brandon Salemi

March 24, 2025 AT 22:33Short and sweet – avoid the hype, do your research.

Ben Parker

March 28, 2025 AT 09:53😂👍 Stay safe, folks! 🚀💰

Daron Stenvold

March 31, 2025 AT 22:13From a procedural standpoint, the article provides a commendable framework for due diligence. Its emphasis on regulatory verification aligns with best practices in financial compliance, and the juxtaposition with established exchanges adds necessary context.

Leo McCloskey

April 4, 2025 AT 09:33Honestly, this write‑up is… well, it’s a bit overblown; the jargon is heavy, the conclusions feel lazy-like they skimmed the data and threw in buzzwords without real depth.

Anjali Govind

April 7, 2025 AT 20:53Hey folks, just wanted to say the checklist at the end is super handy. I’ve saved it to my notes for the next time I’m scouting an exchange.

Orlando Lucas

April 11, 2025 AT 08:13When we consider the epistemic foundations of trust in digital financial ecosystems, we encounter a tapestry of interwoven assumptions, each demanding scrutiny. The first thread is the legitimacy of the entity: an exchange’s registration with a recognized authority forms the cornerstone of credibility. Without this, any subsequent claim of security becomes an illusion. Secondly, the concept of proof‑of‑reserves operates not merely as a technical metric but as a moral covenant between custodians and participants. Audited transparency assures users that their assets are not a phantom construct. Third, the psychological dimension of hype exerts a powerful pull; it can mask underlying deficiencies, leading investors to overlook critical red flags. By juxtaposing CPUfinex with CoinEx, the article illustrates how tangible metrics-trust scores, audited reserves, and volume data-serve as antidotes to speculative fervor. Moreover, the procedural checklist embodies a practical embodiment of due diligence, encouraging stakeholders to verify licensing, examine on‑chain data, and test support responsiveness. In an era where decentralized platforms proliferate, the onus lies with the community to elevate collective vigilance. Each verification step reduces asymmetry of information, narrowing the space where malicious actors can operate. Therefore, we must cultivate a habit of cross‑referencing multiple sources: CoinGecko, CoinMarketCap, and independent audit reports. This triangulation creates a resilient net of validation. Additionally, fostering open dialogue within forums and social channels disseminates experiential knowledge, further insulating participants from fraud. In conclusion, the synthesis of regulatory compliance, transparent reserves, and community corroboration forms a robust defense against scams. The article’s layered analysis not only warns of a specific threat but also equips readers with a timeless framework for evaluating future ventures. Let us adopt this mindset as a safeguard for the evolving digital economy.

Jacob Moore

April 14, 2025 AT 19:33Thanks for the deep dive, Orlando! 😄 I’ll definitely keep the checklist handy and double‑check any new platform before I fund it.

Manas Patil

April 18, 2025 AT 06:53Super insightful! The jargon-heavy analysis gave me new perspectives on how to vet an exchange. Keep the great content coming.

Annie McCullough

April 21, 2025 AT 18:13Well, maybe it's not that big a deal, but I guess some people love drama.

Lady Celeste

April 25, 2025 AT 05:33Another meme, another waste of time.

Rama Julianto

April 28, 2025 AT 16:53Listen up – this scamee is a total rip off. Stop wating on it pras as soon as you can.

Helen Fitzgerald

May 2, 2025 AT 04:13Hey everyone! This guide is super helpful – especially the part about checking customer support. Thanks for sharing!

Jon Asher

May 5, 2025 AT 15:33Nice! I’ll use this next time I look at a new exchange.