EarthMeta (EMT) Crypto Coin Explained - Features, Tokenomics, and Risks

Feb, 22 2025

Feb, 22 2025

EarthMeta (EMT) Token Analyzer

Token Metrics

Risk Assessment

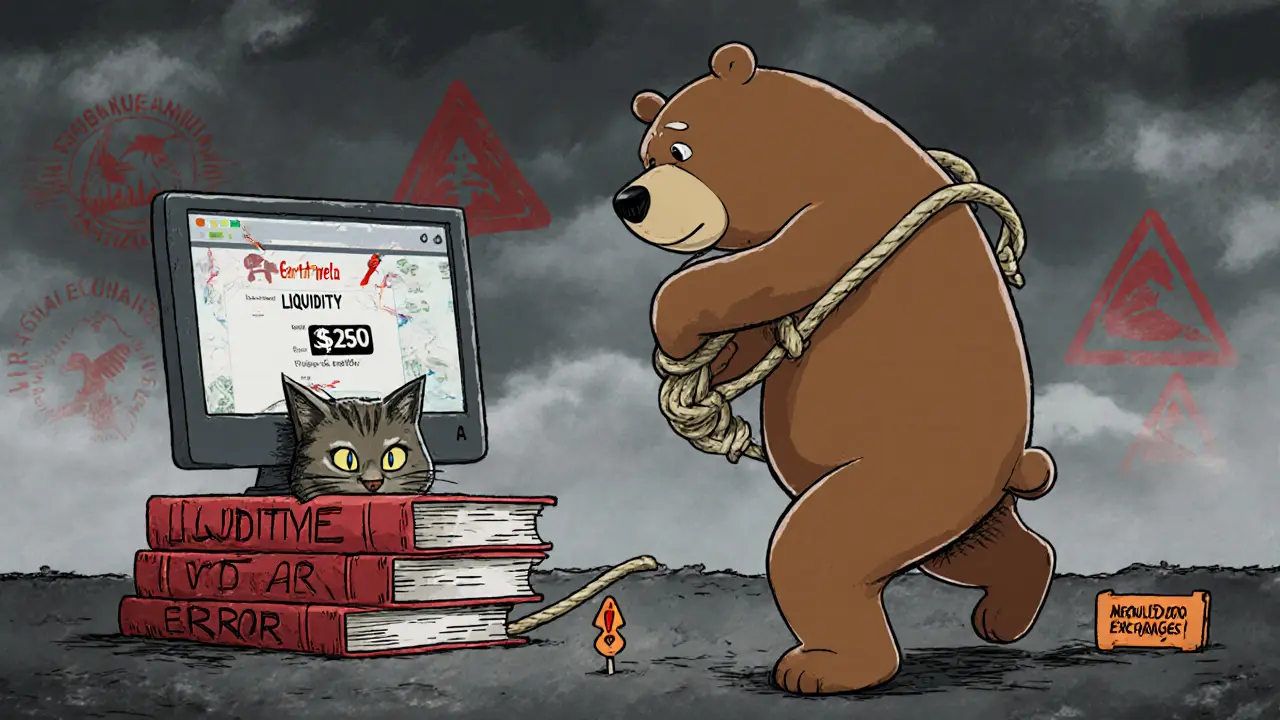

- Extremely low liquidity

- Non-functional website

- Limited exchange listings

- No public audits

- Regulatory uncertainty

Comparison with Major Metaverse Tokens

| Feature | EarthMeta (EMT) | Decentraland (MANA) | The Sandbox (SAND) |

|---|---|---|---|

| Blockchain | Polygon (ERC-20) | Ethereum (ERC-20) | Ethereum (ERC-20) |

| Core Focus | Geospatial digital twin | Open-world VR | Game creation & assets |

| Land Model | Real coordinates | Virtual plots | Virtual plots |

| Market Cap | $15M | $1.1B | $850M |

| 24h Volume | $4.3K | $32M | $21M |

| Exchange Presence | 2 minor exchanges | Major exchanges | Major exchanges |

Investment Risk Calculator

Projected Outcome

Quick Takeaways

- EarthMeta (EMT) is an ERC‑20 utility token on Polygon that powers a digital‑twin metaverse of real‑world locations.

- Only about 1.44billion EMT are circulating out of a 2.1billion total supply.

- Liquidity is extremely low - roughly $4,250 24‑hour volume on the few exchanges that list it.

- Key utilities: buying NFT land parcels, staking for rewards, and participating in a dual‑governance system.

- Bearish outlook dominates analyst reports due to minimal adoption, exchange scarcity, and a non‑functional website.

When you see EarthMeta is a utility cryptocurrency built on the Polygon blockchain that powers a digital twin of Earth, letting users buy, trade, and manage virtual land parcels as NFTs, the term might sound like another hype project. In reality, it tries to blend real‑world geography with blockchain tech.

The EarthMeta token aims to create a decentralized version of Google Earth where every coordinate can become a tradable piece of digital property. Below we break down what the project promises, how it works, and why many investors stay cautious.

What is EarthMeta?

EarthMeta (ticker EMT is a utility token that fuels the platform’s marketplace, staking pools, and governance mechanisms). Launched in 2024, the token lives on the Polygon (MATIC) network, which offers cheaper gas fees than Ethereum’s mainnet. The team behind the project runs under the domain earthmeta.ai, but as of October2025 the site returns a 500 error, raising red flags about ongoing development.

How the Digital Twin Works

The core idea is simple: each real‑world location is mirrored as a unique non‑fungible token (NFT). These NFT land parcels are metadata‑rich tokens that encode latitude, longitude, and landmark information, allowing owners to display, trade, or develop virtual structures on the platform.

Because the NFTs sit on Polygon, transactions settle in seconds and cost pennies. Users need a Polygon‑compatible wallet-MetaMask configured for the Polygon network is the most common choice. Once the wallet is funded with EMT or MATIC, you can bid on or purchase a parcel directly from the marketplace (if the marketplace is operational).

Tokenomics and Utility

EMT’s supply numbers are clear: a hard cap of 2,100,000,000 tokens, with roughly 1,437,539,666.67 circulating as of September2025 (Market data reports a circulating supply that represents about 68% of the total). The token serves three main purposes:

- Marketplace currency - EMT is used to buy, sell, or rent NFT land parcels.

- Staking & farming - Holders can lock EMT in smart contracts to earn passive “tax rewards” generated from land‑management fees.

- Governance - A dual system featuring “Governors” and “Presidents” lets token holders vote on platform upgrades and reward distribution.

The governance token model is described as a dual governance system where elected roles receive a slice of transaction taxes, incentivizing active participation. However, no audit or third‑party verification of the governance smart contracts is publicly available.

Market Snapshot (October2025)

According to Liquidity Finder, EMT trades on only two exchanges-BitMart and XT-with a combined 24‑hour volume of about $4,250. The price hovered around $0.0105, giving the project a market cap of roughly $15million (Market cap is calculated by multiplying circulating supply by the current price).

Volatility stands at 8.85% over the past month, and technical indicators show a bearish trend: a 14‑day RSI of 16.86, price below both the 50‑day SMA ($0.010276) and the 200‑day SMA ($0.013212). Analyst Dmitriy Mironov labels EMT a “highly speculative micro‑cap token with limited utility beyond its immediate ecosystem.”

How EarthMeta Stacks Up Against Other Metaverse Tokens

| Feature | EarthMeta (EMT) | Decentraland (MANA) | The Sandbox (SAND) |

|---|---|---|---|

| Blockchain | Polygon (ERC‑20) | Ethereum (ERC‑20) | Ethereum (ERC‑20) |

| Core focus | Geospatial digital twin of Earth | Open‑world virtual reality | Game creation & asset marketplace |

| Land ownership model | NFT parcels tied to real coordinates | NFT parcels (no real‑world mapping) | NFT parcels (virtual plots) |

| Market cap (Sept2025) | ~$15M | ~$1.1B | ~$850M |

| 24‑hr volume | ~$4.3K | ~$32M | ~$21M |

| Exchange presence | 2 minor exchanges | Major exchanges (Binance, Coinbase) | Major exchanges (Binance, KuCoin) |

| Unique selling point | Exact‑location virtual land & tax rewards | Established creator economy | Play‑to‑earn game tools |

While EarthMeta’s niche is intriguing, the numbers make it clear why liquidity and community activity lag far behind the giants.

Risks and Criticisms

Several red flags emerge from the data:

- Liquidity crunch - With only $4.2K moving daily, even small trades can cause large slippage.

- Exchange scarcity - Absence from Binance, Coinbase, or Kraken limits exposure to mainstream investors.

- Platform availability - The main site returns a 500 error, suggesting possible abandonment or severe technical issues.

- Regulatory uncertainty - The “tax rewards” feature could classify EMT as a security in jurisdictions like the US, raising compliance headaches.

- Audit silence - No public security audit or code repository is linked, making smart‑contract risk hard to assess.

All these factors feed into the bearish price forecasts. CoinCodex predicts a 25% drop by the end of 2025, and the Project Viability Index gives EarthMeta a 28/100 score, flagging critical risk.

Getting Started (If You Still Want to Try)

For the handful of adventurous users, here’s a quick checklist:

- Install MetaMask (or another Polygon‑compatible wallet) and add the Polygon network (RPC URL: https://polygon-rpc.com).

- Acquire MATIC to pay transaction fees, then swap some MATIC for EMT on BitMart (EMT/USDT pair).

- Visit the EarthMeta marketplace (if it’s back) and browse the map. Each parcel shows its geographic coordinates and price in EMT.

- If you buy a parcel, the NFT will appear in your wallet under the “ERC‑721” section. You can then stake the EMT you hold to earn the platform’s tax‑reward share.

- Participate in governance by locking EMT in the voting contract - remember the dual‑governance model distributes part of the land‑tax revenue to elected nodes.

Because support channels are nearly non‑existent, you’ll rely on community forums like Reddit’s r/CryptoMoonShots for informal help. Expect long response times and sparse documentation.

Bottom Line

EarthMeta tries to marry real‑world geography with blockchain‑based ownership, a concept that could be revolutionary if fully realized. In practice, the project suffers from tiny liquidity, a non‑functional website, and limited exchange reach. The token’s utility is tightly bound to a platform that many cannot even access. If you’re looking for a speculative micro‑cap with high upside, EMT fits the bill - but the upside comes with a very high risk of total loss.

Frequently Asked Questions

What blockchain does EarthMeta use?

EarthMeta is an ERC‑20 token that runs on the Polygon (MATIC) layer‑2 network, which offers low fees and fast confirmation times.

How can I buy EMT?

At the moment EMT is listed on BitMart and XT. You’ll need a Polygon‑compatible wallet, fund it with USDT or MATIC, then place a buy order on the EMT/USDT pair.

What is the purpose of the NFT land parcels?

Each parcel represents a specific location on Earth as a unique NFT. Owners can trade, develop virtual structures, or earn passive tax rewards from activity on their land.

Is EarthMeta safe to invest in?

Safety is questionable. The platform’s website is down, liquidity is low, and there’s no public audit. Consider the high risk before allocating funds.

Can I earn staking rewards with EMT?

Yes, EMT can be locked in staking contracts to receive a portion of the tax rewards generated by land transactions. The exact APY varies and is not transparently published.

Ben Parker

February 22, 2025 AT 01:18Yo, if you think EMT is the next big thing, you’re dreaming 😂. The liquidity is basically a puddle, good luck 🙄.

Daron Stenvold

February 22, 2025 AT 09:38Observing the current landscape, one cannot ignore the stark reality that the EMT project teeters on the brink of obscurity.

Its market cap of merely fifteen million dollars pales in comparison to the multibillion‑dollar giants it aspires to rival.

The meager twenty‑four‑hour volume, hovering around four thousand dollars, signals an alarming lack of trader interest.

Liquidity, as any seasoned investor knows, is the lifeblood of a token; without it, even modest transactions become prohibitively costly.

Furthermore, the project's website returning a 500 error raises serious doubts about operational stability and developer commitment.

Regulatory uncertainty looms, especially given the ambiguous nature of the “tax rewards” mechanism that could be construed as a security offering.

Audits, the cornerstone of trust in the decentralized arena, are conspicuously absent from EMT's public disclosures.

While the concept of mapping real‑world coordinates to NFTs is innovative, innovation alone cannot sustain a currency lacking community adoption.

Potential investors should weigh the opportunity cost of allocating capital to EMT against more established metaverse tokens with robust ecosystems.

The dual‑governance model, though theoretically intriguing, suffers from opacity, leaving token holders in the dark regarding decision‑making processes.

Historical price action reflects a bearish trend, with the token trading below its 50‑day and 200‑day simple moving averages.

Technical indicators, such as an RSI languishing in the mid‑teens, further underscore oversold conditions that may not reverse without substantive catalyst.

In essence, the token's promise is eclipsed by a cascade of red flags: scant liquidity, limited exchange listings, non‑functional web presence, and a void of third‑party verification.

Prospective participants must therefore approach EMT with a heightened sense of caution, recognizing the high probability of capital erosion.

Only those with a tolerance for extreme risk and speculation should consider a modest exposure, fully aware that total loss remains a tangible possibility.

Leo McCloskey

February 22, 2025 AT 17:58From a macro‑macro‑economic perspective, EMT exhibits a profoundly suboptimal liquidity profile; the 24h volume, a mere $4.3K, is statistically negligible, rendering price discovery virtually impossible, and the token's utility, ostensibly tethered to geospatial NFTs, appears to be a speculative veneer masking systemic deficiencies; consequently, the risk‑reward calculus skews heavily towards adverse outcomes, particularly in the absence of verifiable audits, which are, frankly, a non‑negotiable prerequisite for any credible blockchain venture.

Jacob Moore

February 23, 2025 AT 02:18Hey folks, if you’re thinking about dipping a toe into EMT, here’s a quick cheat‑sheet: first, set up a Polygon‑compatible wallet like MetaMask and add the Polygon RPC.

Next, grab a bit of MATIC for gas, then swap some of it for EMT on BitMart’s EMT/USDT pair.

Once you have EMT, you can explore the marketplace (when it’s back online) and snag a parcel that corresponds to real‑world coordinates.

Don’t forget you can also stake your EMT to earn a slice of the platform’s tax‑reward pool – just make sure you lock it for the required period.

If you run into any hiccups, the r/CryptoMoonShots community can be a decent fallback for informal guidance.

Carol Fisher

February 23, 2025 AT 10:38Patriotic investors should steer clear of foreign‑run scams like EMT 🇺🇸💥. America deserves projects with real backing, not shaky tokens that vanish overnight 🚀.

Melanie Birt

February 23, 2025 AT 18:58Alright, let’s break this down step by step :) First, the token lives on Polygon, so gas fees are minimal – that’s a plus.

Second, the only exchanges listing EMT are BitMart and XT, which means you’ll face slippage on even tiny trades.

Third, the site’s downtime is a red flag; without a functional UI you’re essentially blind‑folded.

Finally, if you decide to stake, double‑check the contract address to avoid phishing scams. Stay safe and only allocate funds you can afford to lose.

Jade Hibbert

February 24, 2025 AT 03:18yeah cuz buying a token with $4K volume is sooo stable.

Leynda Jeane Erwin

February 24, 2025 AT 11:38While the technical specifications of EMT appear robust on paper, one must also consider the real‑world implications of a non‑functional platform – a juxtaposition that, frankly, undermines any claim to seriousness. That said, the allure of owning a slice of the planet’s digital twin remains tempting for the adventurous.

Brandon Salemi

February 24, 2025 AT 19:58EMT promises a novel spin on digital land, but the numbers scream caution.

Siddharth Murugesan

February 25, 2025 AT 04:18this token is a total waste of time i cant beleive peopl still think its legit theres no future here

Hanna Regehr

February 25, 2025 AT 12:38If you’re looking for a quick entry point, remember that staking rewards are currently opaque, so treat any projected APY with skepticism. However, the underlying concept of geospatial NFTs could gain traction if the team revives the platform.

hrishchika Kumar

February 25, 2025 AT 20:58From a cultural perspective, the idea of mapping Earth’s geography onto blockchain is truly fascinating 🌍. It bridges technology and heritage, offering new ways for communities to celebrate their local landmarks in the digital realm. Let’s hope the developers find a way to restore the site so the vision can flourish.

Emily Kondrk

February 26, 2025 AT 05:18Everything about EMT smells like a hidden agenda – the tax‑reward scheme could be a covert way to funnel capital to insiders, and the silent audits suggest they’re covering something. Stay vigilant, because the deeper you dig, the stranger it gets.

Laura Myers

February 26, 2025 AT 13:38Wow, another “groundbreaking” token that forgets to actually launch a working site. Classic drama, right? I guess we’ll see if the hype can survive the reality check.

Anjali Govind

February 26, 2025 AT 21:58The community vibe around EMT feels like a sunrise over an empty field – full of potential but currently barren. When the platform stabilizes, local artists could really use this canvas to showcase regional culture.

Ted Lucas

February 27, 2025 AT 06:18Guys, the tokenomics are simple: high supply, low cap, and a niche use‑case. If you can stomach the volatility, there’s a speculative upside – just remember to diversify 🙂.

ചഞ്ചൽ അനസൂയ

February 27, 2025 AT 14:38Think of EMT as a philosophical experiment: can we map reality onto the blockchain without losing its essence? It’s a question worth pondering, even if the current implementation feels clunky.

Manas Patil

February 27, 2025 AT 22:58Encouraging developers to embrace local heritage through digital twins could spark a wave of creativity across emerging markets. EMT’s concept, though flawed, points toward a brighter, more inclusive metaverse.

Annie McCullough

February 28, 2025 AT 07:18Sure EMT could be the next big thing :) but honestly it feels overrated.

Lady Celeste

February 28, 2025 AT 15:38Another overhyped project that will probably implode. Keep your eyes open.

Ethan Chambers

February 28, 2025 AT 23:58While the masses chase hype, the discerning few recognize EMT’s fundamental flaws – a classic case of style over substance.

gayle Smith

March 1, 2025 AT 08:18EMT tries to be avant‑garde, but without a functional marketplace it’s just jargon without juice.

mark noopa

March 1, 2025 AT 16:38Ah, the eternal dance between illusion and reality, where tokens like EMT pirouette on the edge of absurdity 😅.

We begin with a lofty promise: to digitize every coordinate on Earth, turning latitude and longitude into tradable assets.

Yet the first step falters when the web portal vanishes into a 500 error, leaving investors stranded in a digital no‑man’s land.

Liquidity, that essential lifeblood of any financial organism, is reduced to a trickle of $4.3K per day – anemic by any standard.

Such thin volume ensures that even a modest purchase will gouge the market price, creating a feedback loop of dwindling confidence.

Compounding the issue, the token resides on Polygon, a layer‑2 solution praised for low fees but often shadowed by a perception of being a “second‑tier” network.

For the uninitiated, this may seem irrelevant, but seasoned traders know that layer‑2 assets sometimes suffer from reduced visibility on major aggregators.

The governance model, advertised as “dual‑governance”, promises shared authority yet hides its mechanics behind opaque smart contracts.

Without public audits, one must wonder: are we entrusting our capital to a codebase that could harbor undisclosed vulnerabilities?

Regulatory ambiguity adds another layer of unease – the tax‑reward mechanism could be re‑characterized as a security, inviting scrutiny from agencies that have already cracked down on similar schemes.

Historically, tokens with comparable market caps and volume profiles have either surged dramatically due to speculative frenzy or collapsed beneath the weight of their own impracticality.

In EMT’s case, the odds tip toward the latter, given the scarcity of exchange listings and the absence of a vibrant community.

Nevertheless, a sliver of optimism persists among niche collectors who envision a future where virtual and physical geographies converge.

If that vision materializes, early adopters could reap outsized rewards – a classic high‑risk, high‑reward scenario.

Investors must therefore calibrate their exposure meticulously, perhaps allocating only a token’s worth of capital they are prepared to lose.

In sum, EMT stands at the crossroads of innovation and speculation; the path it ultimately takes will be dictated by developer perseverance, regulatory direction, and market appetite for experimental digital real‑estate.