MakiSwap (MAKI) Explained: What the Crypto Coin Is and How It Works

Oct, 16 2025

Oct, 16 2025

MakiSwap Revenue Calculator

How the Fee Structure Works

MakiSwap charges a 0.2% swap fee, which is distributed as follows:

- 0.05% to Liquidity Providers

- 0.10% to Protocol Treasury

- 0.05% to MAKI token holders (revenue sharing)

Note: With current trading volume near $0.00, potential MAKI earnings are effectively zero.

Potential MAKI token earnings: $0.00

Based on 0.05% of total trading volume distributed to MAKI holders

Current market price: $0.003 per MAKI

When you hear MakiSwap described as a decentralized exchange and automated market maker on the Huobi Eco Chain (HECO), you might wonder what makes it different from other DeFi platforms. The short answer: it’s a niche AMM that launched in 2021, uses the native MAKI token for fees and governance, and today sits on the fringes of the crypto market.

What is MakiSwap?

MakiSwap is an Automated Market Maker (AMM) and Decentralized Exchange (DEX) built exclusively on the Huobi Eco Chain. The platform lets anyone create liquidity pools, trade tokens without an order book, and earn a share of the 0.2% fee collected on each swap.

How the AMM model works on MakiSwap

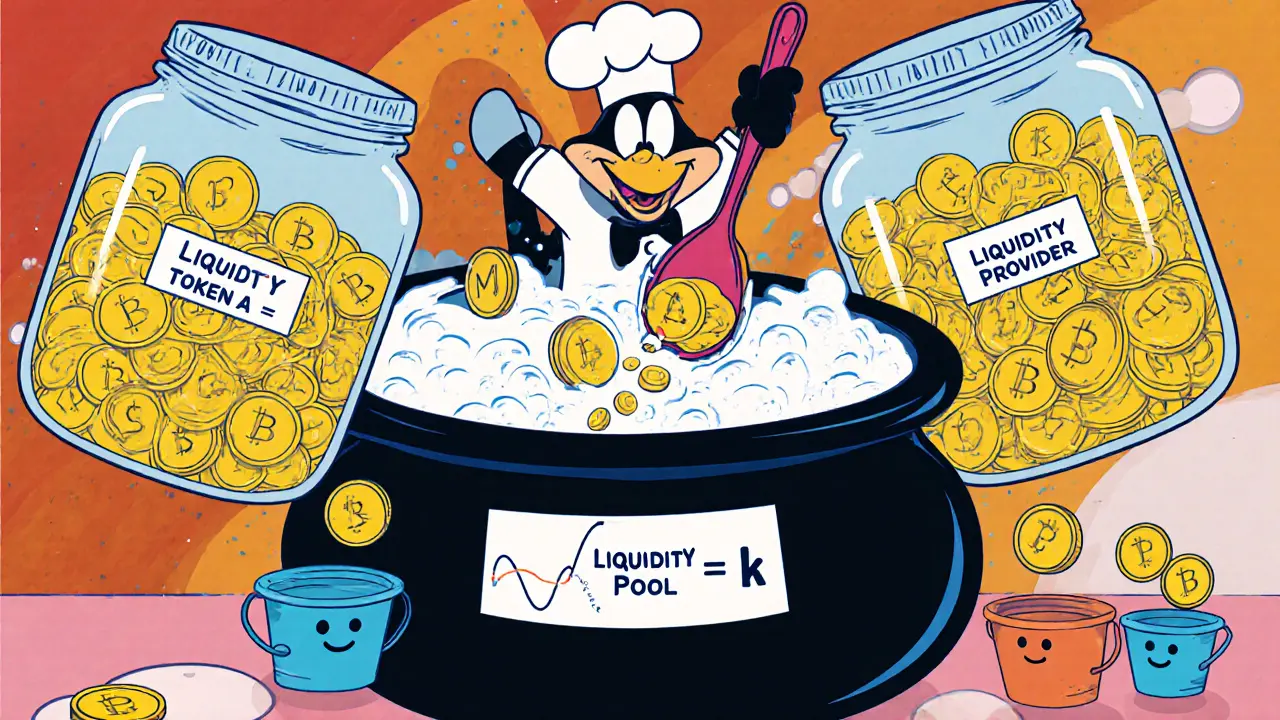

Instead of matching buyers and sellers, an AMM uses a mathematical formula-usually a constant‑product curve (x·y = k)-to set prices. When you add tokens to a pool, you become a Liquidity Provider (LP). In return, you receive LP tokens that represent your share of the pool and you collect a slice of the trading fees proportional to that share. MakiSwap follows the standard 0.2% fee split: a portion goes to LPs, another portion is funneled to MAKI token holders through a revenue‑sharing mechanism.

The MAKI token: utility and tokenomics

The native MAKI token serves three core purposes:

- Fee rebate: Holding MAKI reduces the effective swap fee you pay.

- Revenue sharing: A slice of the 0.2% fee is redistributed to token holders, creating a passive income stream.

- Governance: MAKI holders can vote on protocol upgrades, fee adjustments, and new pool listings through the platform’s Community Governance system.

The token has a fixed supply of 1billion MAKI. Reported circulation varies-some sources list about 96.5million, others around 69million-reflecting the lack of up‑to‑date reporting. The current market cap hovers near US$200K, a steep drop from its early‑stage valuations.

Technical specs and fee structure

Because MakiSwap lives on HECO, it benefits from the chain’s EVM compatibility while offering lower gas costs than Ethereum. Transactions typically settle in seconds and cost a fraction of a cent. The fee model is simple: every swap incurs a 0.2% charge. Of that, 0.05% is sent to LPs, 0.1% to the protocol treasury, and the remaining 0.05% is distributed to MAKI holders. This revenue‑sharing was marketed as a way to align incentives, but the near‑zero trading volume makes the payouts practically negligible.

Current market activity (or lack thereof)

As of October2025, MakiSwap shows almost no on‑chain activity. Data aggregators report zero active trading pairs and a 24‑hour volume of $0.00. The token price trades around $0.003, a fraction of its 2021 launch price of $0.02-$0.075. Social channels-Telegram, Twitter, Medium-are silent, and the official website receives minimal traffic (Alexa rank >1million). In plain terms, the DEX is effectively dormant; you can still add liquidity or execute a swap, but you’ll likely move the price dramatically because there’s no depth.

Why the platform is considered a “zombie” protocol

Several factors contributed to MakiSwap’s decline:

- Limited ecosystem: HECO’s popularity waned as Binance Smart Chain, Polygon, and Avalanche attracted more developers.

- Competition: Established AMMs like PancakeSwap and SushiSwap offered deeper liquidity, cross‑chain bridges, and stronger community support.

- Liquidity vacuum: With virtually no active pools, users cannot trade without suffering massive slippage, driving them away.

- Governance fatigue: The community‑driven voting model never gained traction, leaving decisions to a small core team that appears inactive.

All these signals point to a project that failed to achieve the network effects necessary for a DEX to survive.

How (or if) you can interact with MakiSwap today

If you still want to experiment, here’s a quick rundown:

- Install a Web3‑compatible wallet (MetaMask, Trust Wallet) and add the HECO network (RPC URL: https://http-mainnet.hecochain.com).

- Obtain some HECO‑based gas token (HT) to cover transaction fees.

- Visit the official MakiSwap UI (use the exact URL from a trusted source to avoid phishing).

- Connect your wallet, select a token pair (if any exist), and proceed.

- Expect high slippage or outright transaction failure due to missing liquidity.

- To become a liquidity provider, you would need to deposit equal values of two tokens into a pool. With no pools listed, you’d have to create a new one, which again suffers from zero counterpart trades.

Bottom line: the platform technically works, but the economic incentives are practically nil.

Comparison with a leading AMM

| Feature | MakiSwap | PancakeSwap |

|---|---|---|

| Underlying Chain | Huobi Eco Chain (HECO) | Binance Smart Chain (BSC) |

| Swap Fee | 0.2% (split among LPs, treasury, MAKI holders) | 0.25% (LP rewards + CAKE buy‑back) |

| Active Trading Pairs | 0 (effectively dormant) | Thousands, high liquidity |

| Governance Token | MAKI (revenue sharing) | CAKE (staking, lottery) |

| 24‑hr Volume (USD) | $0.00 | >$2B+ (as of 2025) |

The table makes it clear why most users gravitate toward PancakeSwap: massive liquidity, active community, and real trading volume. MakiSwap’s numbers are essentially zero.

Key takeaways

- MakiSwap is an AMM‑based DEX on HECO that launched in 2021.

- The native MAKI token handles fee rebates, revenue sharing, and governance.

- Technical advantages (low gas) are moot because the platform now has virtually no liquidity or trading activity.

- Compared with mainstream AMMs, MakiSwap offers no practical utility for traders or LPs.

- Most investors view it as a “zombie” protocol; entering now carries high risk with little upside.

Frequently Asked Questions

Is MakiSwap still operational?

The smart contracts are still on‑chain, so technically the platform works. However, there are zero active trading pairs and no liquidity, making it effectively unusable for most users.

How can I acquire MAKI tokens?

MAKI can be found on a few smaller DEX aggregators that still list the token, or on peer‑to‑peer markets. Because of low demand, prices may be volatile and spreads wide.

Does staking MAKI earn rewards?

Staking MAKI in the platform’s vault gives a share of the 0.05% fee that’s allocated to token holders. With the current lack of swaps, those rewards are effectively zero.

What are the risks of using MakiSwap?

Primary risks include total loss of capital due to illiquidity, price impact from tiny pools, and possible smart‑contract bugs that haven’t been audited recently. Regulatory risk is minimal but the token’s low market cap makes it vulnerable to pump‑and‑dump schemes.

Should I consider MAKI a long‑term investment?

Given the near‑zero activity, dwindling community, and lack of roadmap updates, most analysts treat MAKI as a high‑risk speculative token rather than a solid long‑term hold.

Michael Grima

October 16, 2025 AT 08:16MakiSwap? Just another ghost town.

Michael Bagryantsev

October 17, 2025 AT 03:42Even a dead pool can teach us something about market cycles; the key lesson is to steer clear of stagnant projects and channel your capital into ecosystems with real liquidity.

Maria Rita

October 17, 2025 AT 23:09Look, I get why you’re curious – the idea of a low‑gas DEX sounds appealing. But when there’s literally nothing to trade, the excitement fizzles fast. It’s like buying a ticket to a concert where the band never shows up. You might still learn a bit about contract interaction, but the financial upside is basically zero. So my advice is to treat MakiSwap as a sandbox experiment, not a serious investment vehicle.

Jordann Vierii

October 18, 2025 AT 18:36Exactly! Think of it as a cautionary tale for anyone chasing low‑fee platforms without checking the depth. If you ever decide to give it a spin, keep the stakes tiny and use it to practice reading token pairs – you’ll thank yourself when you face real liquidity.

Lesley DeBow

October 19, 2025 AT 14:02From a philosophical standpoint, MakiSwap embodies the paradox of abundance without utility. It was built on the promise of cheap transactions, yet the very cheapness became its Achilles’ heel because no one wanted to lock capital without confidence in counterparties. The tokenomics, featuring fee rebates and revenue sharing, sound elegant on paper; in practice, they collapse when the fee base evaporates. One could argue that the protocol serves as a living laboratory for the law of supply and demand – supply of liquidity dwarfs demand, leading to a self‑fulfilling prophecy of emptiness. Moreover, the governance model, which was supposed to democratize decision‑making, ended up being a hollow shell as voter participation dwindled to near‑zero. This presents a broader lesson for DeFi: incentives must be aligned not just theoretically but also empirically. Without active arbitrageurs or traders, fees become a myth, and token holders receive nothing but hope. The platform’s reliance on a single chain, HECO, also limited exposure to the larger cross‑chain ecosystem, further isolating it. In the end, MakiSwap is a reminder that technology alone cannot sustain a market; community engagement and network effects are the true lifeblood. So while the code may still compile, the economic engine is effectively stalled, turning the DEX into a monument to unfulfilled potential.

DeAnna Greenhaw

October 20, 2025 AT 09:29One must concede that the aesthetic of MakiSwap’s whitepaper belies a profound miscalculation in strategic foresight. Its tokenomics, while articulated with immaculate precision, suffer from a paucity of pragmatic validation. The absence of substantive market depth renders the proclaimed revenue‑sharing mechanism essentially ornamental. In summation, the protocol stands as an archetype of overengineered ambition devoid of requisite liquidity.

Luke L

October 21, 2025 AT 04:56While the critique is noted, it remains essential to recognize that the platform’s codebase is publicly auditable, offering a degree of transparency absent in many opaque projects.

Cynthia Chiang

October 22, 2025 AT 00:22yeah folks i think if u wanna try it just put a tiny amount of ht and maKI and see how the swap works, dont expect big gains tho.

Hari Chamlagai

October 22, 2025 AT 19:49Attempting to salvage value from a protocol that has zero volume is akin to polishing a tarnished relic; it will never shine for anyone but the collector. The reality is that MAKI token holders are trapped in a perpetual state of low‑return, and any future upside would require a massive, unlikely injection of capital.

Della Amalya

October 23, 2025 AT 15:16Let’s be honest: if you’re looking for a fresh start in DeFi, there are far better ecosystems with vibrant communities. MakiSwap’s silence tells a story louder than any marketing copy ever could.

Mandy Hawks

October 24, 2025 AT 10:42What we observe is the entropy of a once‑promising construct succumbing to market neglect; a quiet reminder of the fleeting nature of hype.

Scott G

October 25, 2025 AT 06:09It is with a measure of professional decorum that I advise prospective participants to allocate their resources toward platforms demonstrating robust, verifiable liquidity, thereby mitigating exposure to the systemic risks evident in dormant exchanges.

VEL MURUGAN

October 26, 2025 AT 01:36The data is unequivocal: transaction count approaches zero, and without active arbitrage, fee distribution collapses to insignificance. Consequently, any speculative position in MAKI should be treated as high‑risk and short‑term.

Russel Sayson

October 26, 2025 AT 20:02Listen up, crypto enthusiasts: the allure of a low‑fee DEX is intoxicating, but you must weigh that against the stark reality of zero depths. When you pour capital into a pool that has no counterparties, you’re essentially signing a contract with yourself – the price impact is catastrophic, and the slippage is off the charts. Even if you’re a dev experimenting, remember the gas you spend is real money, and the returns are mathematically nil under current conditions. The MAKI token’s revenue‑sharing claim becomes a theoretical curiosity when the fee base is $0.00. In short, if you’re hunting for genuine yield, redirect your gaze toward ecosystems where trade volume fuels sustainable incentives.

Jordan Collins

October 27, 2025 AT 15:29From a risk‑management perspective, the absence of active markets on MakiSwap removes any hedging possibilities, turning the protocol into a pure speculative venture without any protective mechanisms.

Andrew Mc Adam

October 28, 2025 AT 10:56the gists is that while its a neat tech demo, investing in a dead pool just adds noise to your portfolio and doesn't aport any tangible value.

Shrey Mishra

October 29, 2025 AT 06:22One must contemplate the emotional toll of watching a once‑promising project wither; the silence can be as deafening as any market crash.

Ken Lumberg

October 30, 2025 AT 01:49Ethically speaking, promoting a platform with negligible utility borders on irresponsibility; investors deserve transparency about the real prospects.