Pact Crypto Exchange Review: Features, Fees, and Security

May, 24 2025

May, 24 2025

Pact DEX Fee Calculator

Estimate Your Transaction Fees

Pact uses Algorand's ultra-low base fees with optional pool fees. Enter your trade details below to calculate total costs.

Estimated Transaction Cost

About Pact's Fee Structure

Pact leverages Algorand's low-cost infrastructure. Base transaction fees are approximately $0.001. Pool fees range from 0.1% to 0.3%, with special StableSwap pools offering lower fees (0.05%) for stable pairs.

Pact is a decentralized exchange built on the Algorand blockchain that aims to be the "home of liquidity on Algorand." It launched in 2021 as one of the first AMMs on Algorand and has since partnered with twelve ecosystem players, including Hivemind and Borderless Capital. This review breaks down how the platform works, its costs, security posture, and where it stacks up against rivals.

Key Takeaways

- Pact offers near‑instant swaps with transaction fees around $0.001 thanks to Algorand’s fast consensus.

- Security is reinforced by audits from Kudelski Security and a bug‑bounty partnership with Immunefi.

- The mobile‑first interface is praised for usability, but educational resources for new liquidity providers are limited.

- Liquidity depth lags behind Algorand‑centric rival Tinyman, though Pact’s StableSwap and multiple fee‑tier models help reduce slippage on stable pairs.

- Suitable for traders who want low‑cost ALGO‑based swaps and are comfortable staying within the Algorand ecosystem.

Platform Overview

Pact operates as a non‑custodial DEX: user funds stay in smart contracts on the Algorand chain, and the platform never holds private keys. Anyone can create a market for any Algorand Standard Asset (ASA), including popular stablecoins like USDC and USDT, wrapped assets, or the native ALGO token.

The core user flow mirrors typical AMM designs: you add liquidity to a pool, receive pool tokens, and earn a share of transaction fees. Pact distinguishes itself with two fee mechanisms:

- Multiple Fee Tiers - Pools can select a fee rate that matches their volatility profile.

- StableSwap - An optimized curve for stablecoin pairs that minimizes slippage and impermanent loss.

Technical Foundations and Performance

Algorand’s block time of roughly 4.3 seconds and capacity of up to 10,000TPS enable the "nearly instant settlements" that Pact advertises. The exchange leverages Algorand’s atomic swap feature, allowing two parties to exchange assets in a single, indivisible transaction. This reduces the risk of partial execution and keeps price impact low.

Because Pact is web‑based, there are no heavy system requirements-just a compatible Algorand wallet and an internet connection. The platform runs smoothly on both smartphones and desktop browsers, fulfilling its mobile‑first promise.

Fees, Liquidity, and Trading Costs

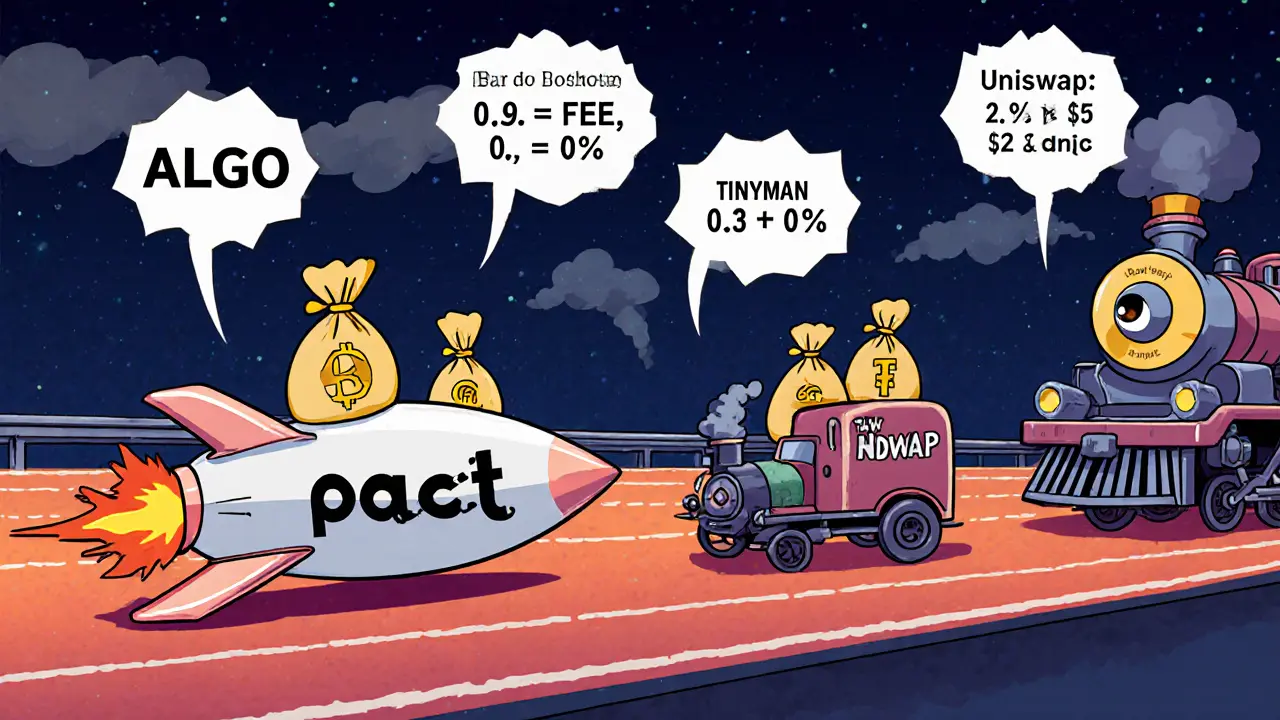

Transaction fees on Algorand average $0.001, so swapping on Pact is dramatically cheaper than on Ethereum‑based DEXs like Uniswap, where fees often exceed $2 per trade. Pact adds a pool‑level fee that varies between 0.1% and 0.3% depending on the chosen tier. For stablecoin pairs using StableSwap, fees can drop to as low as 0.05%.

Liquidity depth is a mixed bag. While Pact’s pools are deep for high‑volume pairs such as ALGO/USDC, they are shallower for niche ASAs. AlgoRank’s October2023 report gave Pact a 4.2/5 rating, noting “room for improvement in liquidity depth across less popular token pairs.” By comparison, Tinyman still holds about 65% of Algorand DEX volume, leaving Pact with roughly 15‑20% of the market share among Algorand‑based DEXs.

Security Architecture

Security is a headline feature. Pact’s smart contracts were audited by Kudelski Security, a reputable firm in blockchain auditing. The platform also participates in Immunefi’s bug‑bounty program, which has not publicly disclosed any critical exploits as of October2023. Because the exchange is non‑custodial, users retain full control of their assets at all times, a point emphasized in Ulam Labs’ case study.

While no major incidents have been reported, users should still be aware of typical AMM risks such as impermanent loss and smart‑contract bugs. Pact’s documentation offers a basic overview, but power users might want to cross‑reference independent audit reports for deeper assurance.

Wallet Compatibility and User Experience

Pact integrates with the major Algorand wallets: Pera, My Algo, Fireblocks, AlgoSigner, and Defly. Connecting a wallet is a one‑click process; after authentication, the dashboard displays available pools, your liquidity positions, and real‑time price charts.

The interface is deliberately simple: large buttons, clean typography, and a responsive layout that feels native on iOS and Android. Reddit users frequently commend the “clean mobile interface,” though some note a lack of tutorials for first‑time liquidity providers.

Pros and Cons

- Pros

- Ultra‑low transaction fees thanks to Algorand.

- Mobile‑first design makes on‑the‑go trading easy.

- Strong security backing with audits and bug‑bounty coverage.

- Multiple fee tiers and StableSwap cater to both volatile and stable pairs.

- Cons

- Liquidity depth trails behind Tinyman, especially for niche ASAs.

- No cross‑chain bridges; you’re locked into the Algorand ecosystem.

- Educational resources for new liquidity providers are sparse.

- Community size is modest compared to larger DeFi ecosystems.

How Pact Stacks Up Against Competitors

| Feature | Pact (Algorand) | Tinyman (Algorand) | Uniswap (Ethereum) |

|---|---|---|---|

| Base chain | Algorand | Algorand | Ethereum |

| Typical transaction fee | $0.001 + 0.1‑0.3% pool fee | $0.001 + 0.3‑0.5% pool fee | $2‑$5 + 0.3% pool fee |

| Liquidity depth (ALGO/USDC) | Medium | High | Very high (Ethereum-wide) |

| Mobile UX | Optimized | Standard web | Responsive but not mobile‑first |

| Security audits | Kudelski Security + Immunefi | CertiK | Consensys Diligence |

| Cross‑chain swaps | No | No | Yes (via bridges) |

Overall, Pact shines when low cost and mobile usability are top priorities. If you need deep liquidity for obscure tokens or cross‑chain capabilities, Tinyman or Uniswap may be better fits.

Community, Support, and Resources

Pact runs an active Discord server with over 8,000 members and provides email support. Average response times hover around 4‑6hours during business hours. Documentation covers basic trading, pool creation, and fee structures, but lacks deep dive guides on strategies like impermanent loss mitigation.

Social signals are generally positive: Reddit threads from October2023 highlight praise for the UI and low slippage on popular pairs, while criticism focuses on the scarcity of beginner tutorials.

Step‑by‑Step: Getting Started on Pact

- Install an Algorand‑compatible wallet (e.g., Pera or My Algo) on your device.

- Fund the wallet with ALGO to cover transaction fees.

- Navigate to pact.fi and click “Connect Wallet.”

- Select a trading pair from the dashboard - for beginners, ALGO/USDC is a safe start.

- Enter the amount you wish to swap or add as liquidity, review the fee tier, and confirm the transaction in your wallet.

- Monitor the trade in the “My Positions” tab; you’ll see pool tokens representing your share.

- If you provide liquidity, claim earned fees periodically via the “Harvest” button.

Typical onboarding time is 15‑30minutes, according to usability tests by Ulam Labs.

Final Verdict on the Pact crypto exchange

If you’re already using the Algorand ecosystem, Pact offers a compelling mix of low fees, fast settlement, and a clean mobile experience. Its security track record is solid, thanks to professional audits and a bug‑bounty program. The biggest trade‑off is limited liquidity for niche assets and no cross‑chain bridges, which may push power users toward Tinyman or larger Ethereum DEXs. For everyday swaps of ALGO, USDC, USDT, or other popular ASAs, Pact delivers a smooth, cost‑effective experience.

Frequently Asked Questions

Is Pact a custodial exchange?

No. Pact is non‑custodial; users keep control of their private keys and assets remain in Algorand smart contracts until they withdraw.

What wallets can I use with Pact?

Pact works with Pera, My Algo, Fireblocks, AlgoSigner, and Defly. Connecting a wallet is a one‑click process from the web UI.

How do Pact’s fees compare to Uniswap?

Pact’s on‑chain cost is roughly $0.001 per transaction plus a 0.1‑0.3% pool fee. Uniswap typically charges $2‑$5 in gas plus a flat 0.3% fee, making Pact much cheaper for small trades.

Is there a way to earn rewards by providing liquidity?

Yes. Liquidity providers receive a share of the pool’s transaction fees, and Pact’s Aeneas Liquidity Program offers additional token incentives for certain pools.

Can I trade assets that aren’t on Algorand?

No. Pact only supports Algorand Standard Assets (ASAs). For cross‑chain swaps you’d need a different DEX or a bridge solution.

Carol Fisher

May 24, 2025 AT 04:36America deserves a crypto exchange that puts security and transparency first, and Pact pretends to deliver exactly that 🇺🇸. The low Algorand fees are a nice touch, but we must ask whether a platform that relies on a single blockchain can truly safeguard our assets from foreign meddling. If you’re looking for a home‑grown solution, Pact looks promising, but keep a vigilant eye on its governance structures. 💪

Melanie Birt

June 1, 2025 AT 07:36Here’s the quick rundown: Pact’s base fee is literally $0.001 per transaction, and the pool fees range from 0.05 % for stable‑swap pools up to 0.3 % for volatile pairs. You can plug in your trade amount in the calculator on the page to see the exact cost before you commit. 👍

mark noopa

June 9, 2025 AT 10:36When we stare into the abyss of decentralized finance, we inevitably confront the paradox of freedom versus security, a dialectic as old as the market itself. Pact, perched atop the Algorand network, claims to have solved this conundrum by offering ultra‑low fees while promising robust safeguards. Yet the very notion of “ultra‑low” fees evokes a deeper philosophical question: does the cost of a transaction truly reflect its intrinsic value, or is it merely a veneer for hidden risks? One must consider the underlying consensus mechanism, for Algorand’s pure proof‑of‑stake does mitigate some attack vectors, but it also centralizes power in the hands of a relatively small validator set. Moreover, the fee calculator on Pact’s site, while user‑friendly, abstracts away the dynamics of liquidity pools, making traders feel secure while the market silently rebalances against them. In practice, a 0.1 % pool fee may seem negligible, yet over repeated trades it compounds, eroding returns in ways that are not immediately obvious. The platform also touts “stable‑swap” pools with a 0.05 % fee, but stability is a relative term, dependent on how tightly the assets are pegged and how quickly the algorithm can respond to price shocks. If the peg fails, the lower fee does nothing to protect you from impermanent loss. Additionally, the user interface, while sleek, often masks the latency of order execution, which can be a silent killer for high‑frequency traders. The security model hinges on smart contracts that, like any code, are susceptible to bugs; a single exploit could drain funds before the community can react. From a regulatory perspective, operating in a jurisdiction‑agnostic environment raises concerns about compliance and recourse in case of disputes. Thus, while Pact’s fee structure is attractive on paper, one must weigh the invisible costs of potential vulnerabilities, governance opacity, and the ever‑present specter of market manipulation. The philosophical takeaway is that no exchange can guarantee absolute safety; every choice entails a trade‑off between cost, convenience, and risk. Ultimately, the prudent trader will treat Pact as a tool, not a panacea, and will diversify across platforms to hedge against systemic failures. Remember that the crypto world evolves rapidly, so today's low fee can become tomorrow's hidden trap. 🧐

Scott Hall

June 17, 2025 AT 13:36Looks like a solid low‑fee DEX, and the UI is pretty clean-good for newcomers.

Jade Hibbert

June 25, 2025 AT 16:36Oh great, another “clean” interface that hides the fees. 🙄

Leynda Jeane Erwin

July 3, 2025 AT 19:36Esteemed community members, I would like to draw your attention to the structural aspects of Pact’s fee architecture, which, in my humble opinion, merit a thorough examination. That said, the way the platform presents its calculator is pretty user‑friendly, so you don’t need a PhD to figure it out.

Brandon Salemi

July 11, 2025 AT 22:36Thanks for the breakdown-definitely helpful, but I’d love to see some real‑world trade examples. 🔥

Siddharth Murugesan

July 20, 2025 AT 01:36Pact looks like a shiny marketing gimmick; the low fees are only attractive until you realize the liquidity is shallow and slippage can wipe you out.

Hanna Regehr

July 28, 2025 AT 04:36While the pools may be smaller, the algorithmic pricing does attempt to minimize slippage, and many users report decent execution on modest trade sizes.

Ben Parker

August 5, 2025 AT 07:36Just tried the fee calculator and wow, those numbers are surprisingly low! 😲

Daron Stenvold

August 13, 2025 AT 10:36Indeed, the base fee of $0.001 is almost negligible, yet the pool fee still adds up over time, so keep an eye on cumulative costs.

Philip Smart

August 21, 2025 AT 13:36Honestly, I’ve seen better fee structures on other DEXs; Pact feels like a copy‑paste job.

Jacob Moore

August 29, 2025 AT 16:36Fair point, but the integration with Algorand does give it a speed edge that many competitors lack.

Manas Patil

September 6, 2025 AT 19:36From a DeFi infrastructure standpoint, Pact leverages Algorand’s Layer‑1 efficiency to achieve sub‑millisecond transaction finality, which is a notable advantage for high‑throughput arbitrage strategies.

Annie McCullough

September 14, 2025 AT 22:36Sure but low latency doesn’t fix the fact that the platform still lacks deep order book depth and real‑time risk analytics

Mureil Stueber

September 23, 2025 AT 01:36Overall, Pact offers an appealing fee model and decent speed, but users should consider liquidity depth and monitor pool fees to ensure it aligns with their trading strategy.