Ethereum Sidechain: What It Is, Why It Matters, and What You Need to Know

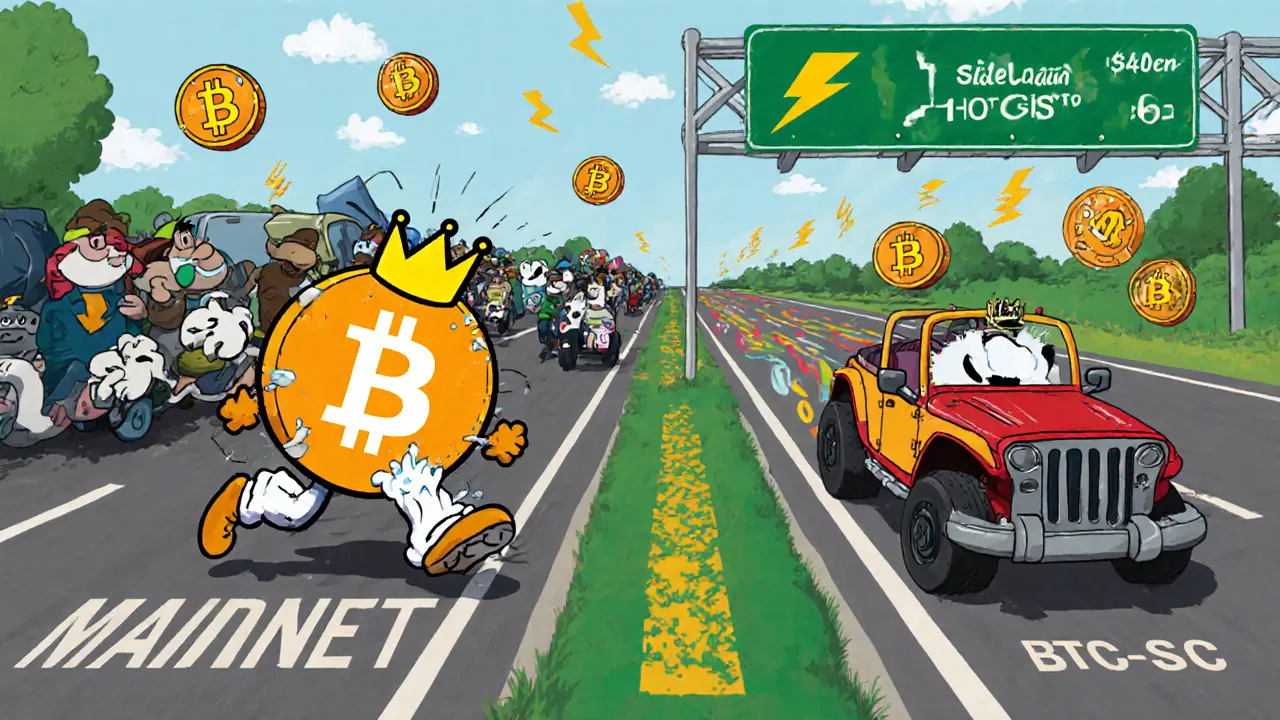

When you hear Ethereum sidechain, a separate blockchain connected to Ethereum that handles transactions off the main network to reduce congestion and fees. Also known as layer 2 solution, it’s not a replacement for Ethereum—it’s a helper that lets users move faster and cheaper without sacrificing security. Think of it like adding extra lanes to a highway that’s always backed up. The main road (Ethereum) still controls the rules and final settlement, but the side lanes (sidechains) take the daily traffic so you don’t sit in gridlock.

Sidechains aren’t just theory—they’re used by real projects. Chains like Polygon, Arbitrum, and Optimism aren’t just buzzwords; they’re where millions of trades, NFTs, and DeFi swaps happen every day. These networks pull data back to Ethereum for security but run their own block production, giving users low fees and fast confirmations. That’s why most new DeFi apps don’t launch on Ethereum mainnet anymore—they pick a sidechain that fits their needs. And if you’re trading, staking, or using a dApp today, you’re probably already on one without realizing it.

But not all sidechains are built the same. Some use fraud proofs, others use zero-knowledge tech. Some are permissioned, others fully open. That’s why you’ll see posts here about Arbitrum Nova, a lightweight sidechain optimized for low-cost transactions and high throughput, or SynFutures v2, a decentralized futures exchange built on Base, a sidechain powered by Coinbase. These aren’t random examples—they’re practical cases showing how sidechains enable real functionality. You’ll also find posts that warn you about fake chains or poorly secured bridges, because not every sidechain is trustworthy.

What makes this topic so messy is that people mix up sidechains with rollups, plasma chains, and state channels. They’re all scaling tools, but they work differently. A sidechain has its own validators and consensus. Rollups bundle transactions and post proofs back to Ethereum. The difference matters when you’re moving money or choosing where to deploy your assets. That’s why the posts here cover everything from how to bridge ETH to a sidechain, to why some chains crash when liquidity dries up, like what happened with Real USD (USDR) when its real estate collateral couldn’t be sold fast enough.

And here’s the truth: if you’re still doing everything on Ethereum mainnet in 2025, you’re paying too much and waiting too long. Sidechains aren’t optional anymore—they’re the default. Whether you’re an Indian trader using UPI to buy crypto, a Brazilian looking for Pix-compatible exchanges, or someone trying to avoid Iran’s banking restrictions, sidechains are what make it possible to trade without waiting hours or paying $50 in gas. The tools are here. The networks are live. The question isn’t if you should use one—it’s which one works best for your use case.

Below, you’ll find real reviews, deep dives, and scam warnings about the platforms and tokens built on these sidechains. No fluff. No hype. Just what’s actually working—and what’s not—in the Ethereum sidechain world today.

What Are Sidechains in Cryptocurrency? A Simple Guide to Scalable Blockchain Networks

Sidechains are independent blockchains connected to mainnets like Bitcoin or Ethereum via a two-way peg. They enable faster, cheaper transactions and smart contracts without compromising mainchain security.