Inactive Crypto Exchange: Spot Ghost Platforms and Avoid Scams

When you hear about a crypto exchange with no reviews, no license, and no trading volume, you’re likely looking at an inactive crypto exchange, a platform that appears online but has no real users, support, or liquidity. Also known as a ghost exchange, it’s often a front for scams, exit ramps, or abandoned projects. These aren’t just poorly run platforms—they’re digital traps designed to steal deposits or lure you into fake airdrops and fake trading pairs.

Many unverified crypto exchange, platforms that operate without regulatory oversight or public transparency like AIA Exchange and ko.one show up in search results with flashy websites but zero history. They don’t list their team, don’t publish audit reports, and vanish from CoinMarketCap and CoinGecko. Some even copy the design of legit exchanges like Kraken or Binance to look real. But if you check their Twitter, Telegram, or support emails, you’ll find silence—or worse, bots. These platforms rely on one thing: your trust.

And it’s not just exchanges. The same pattern shows up in fake crypto platform, tokens or projects that claim to be active but have $0 market cap, no trading, and no team like MMS or STARGATEAI. They promise big returns, then disappear after the hype. The real danger? You’re not just losing money—you’re wasting time on fake airdrops, fake KYC forms, and fake wallet connections that can drain your actual crypto.

What makes these platforms dangerous isn’t just their lack of activity—it’s how well they mimic the real thing. They use real-looking URLs, copy-paste whitepapers, and even fake customer testimonials. But if you dig deeper, the signs are clear: no recent transactions, no liquidity pools, no GitHub commits, no community engagement. Real exchanges like Coinbase or OKX update daily. Ghost exchanges stay frozen in time.

You don’t need to be a pro to spot these traps. Start by checking if the exchange is listed on any major crypto data sites. Look for user reviews on independent forums—not the ones on their own site. Search for the exchange name + "scam" or "shut down." If nothing comes up except the project’s own marketing, that’s your warning. And never deposit funds into a platform that doesn’t answer questions within 24 hours.

Below, you’ll find real case studies of exchanges that went dark, tokens that never launched, and airdrops that were never real. Each post breaks down exactly what went wrong, who got burned, and how you can protect yourself next time. No fluff. No guesses. Just facts from the ground.

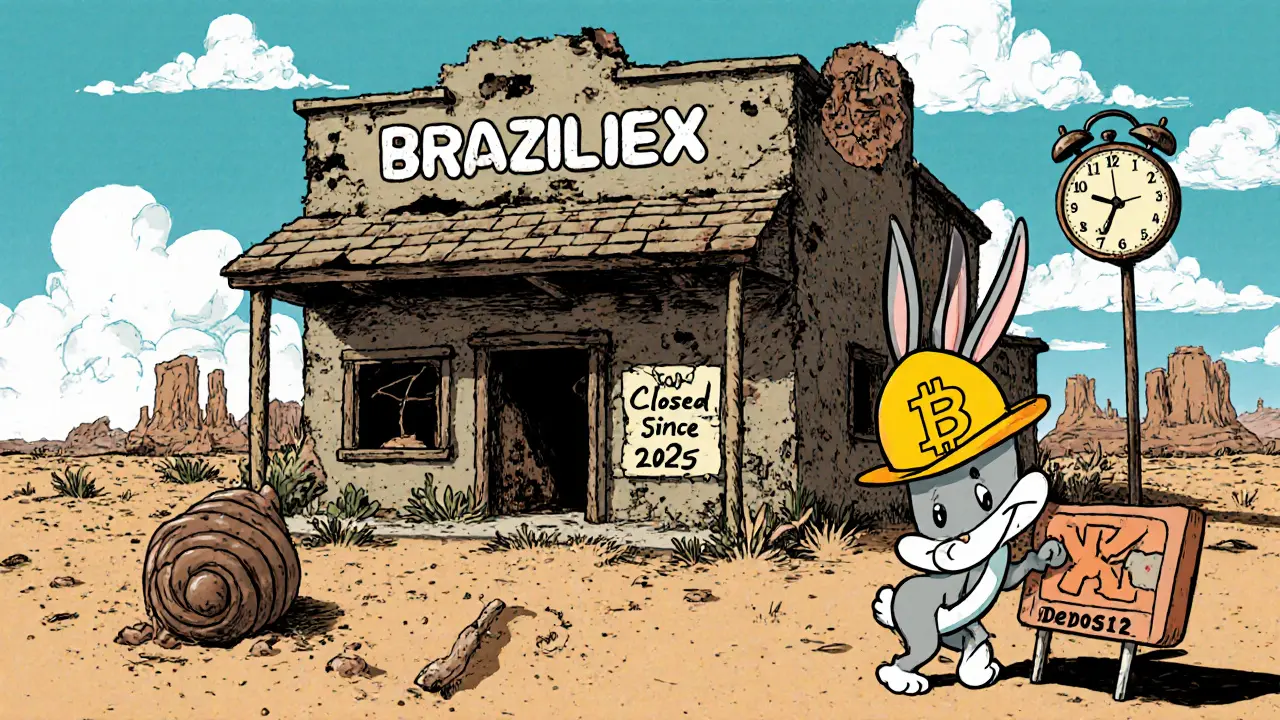

Braziliex Crypto Exchange Review: Why It's Inactive and What to Use Instead

Braziliex crypto exchange is inactive as of 2025. Learn why it failed, what red flags to watch for, and which Brazilian exchanges actually work today for BRL trading with Pix, low fees, and real support.