Low Fee Crypto Exchange: Find the Best Platforms Without Hidden Costs

When you trade crypto, every penny matters. A low fee crypto exchange, a platform that charges minimal costs for buying, selling, or transferring digital assets. Also known as cost-efficient crypto trading platform, it’s not just about saving a few dollars—it’s about keeping more of your gains when you trade regularly. Most beginners think all exchanges are the same, but the difference between a 0.1% fee and a 0.5% fee can cost you hundreds over time, especially if you’re active.

It’s not just about the trading fee. You also need to watch deposit and withdrawal costs. Some exchanges let you deposit fiat for free but charge $15 to pull your money out. Others have hidden fees for using certain payment methods or for holding certain tokens. A true low fee crypto exchange, a platform that charges minimal costs for buying, selling, or transferring digital assets. Also known as cost-efficient crypto trading platform, it’s not just about saving a few dollars—it’s about keeping more of your gains when you trade regularly. should have transparent pricing across all actions. You shouldn’t need to dig through 10 pages of fine print to find out what you’re really paying.

Many of the top decentralized exchange, a peer-to-peer platform for trading crypto without a central authority. Also known as DEX, it enables users to trade directly from their wallets. users care about fees because they’re often trading small-cap tokens with thin liquidity. On a DEX, you might pay less in trading fees but more in gas costs. That’s why some traders prefer centralized platforms like Bitget or VinDAX, which offer flat, predictable fees and lower network charges. Meanwhile, platforms like DogeSwap or Braziliex might look cheap on paper—but if they’re inactive or have poor liquidity, you end up paying more in slippage than in fees.

It’s not just about picking the cheapest exchange. It’s about picking the right one for your style. If you’re copying trades, you need low fees and solid execution—like Bitget offers. If you’re holding long-term, you care more about withdrawal fees and security. If you’re trading meme coins, you might tolerate higher slippage on a small DEX, but you still don’t want to pay $50 in gas to trade $200 worth of tokens.

And don’t get tricked by fake low-fee claims. Some exchanges advertise 0% fees but make it up in hidden spreads or by locking your funds. Others list tokens with zero volume so they can charge high fees on the few trades that happen. That’s why reviews matter. Real user experience—like what traders say about AIA Exchange or Braziliex—tells you more than any marketing page.

What you’ll find here aren’t just lists. You’ll see real breakdowns of exchanges that actually deliver low fees, what they charge for withdrawals, how their copy trading tools affect costs, and which platforms are worth your time in 2025. We cover everything from BNC airdrop eligibility on KuCoin to why USDR’s instability makes fee structure even more critical. No fluff. No sponsored posts. Just what you need to know before you click trade.

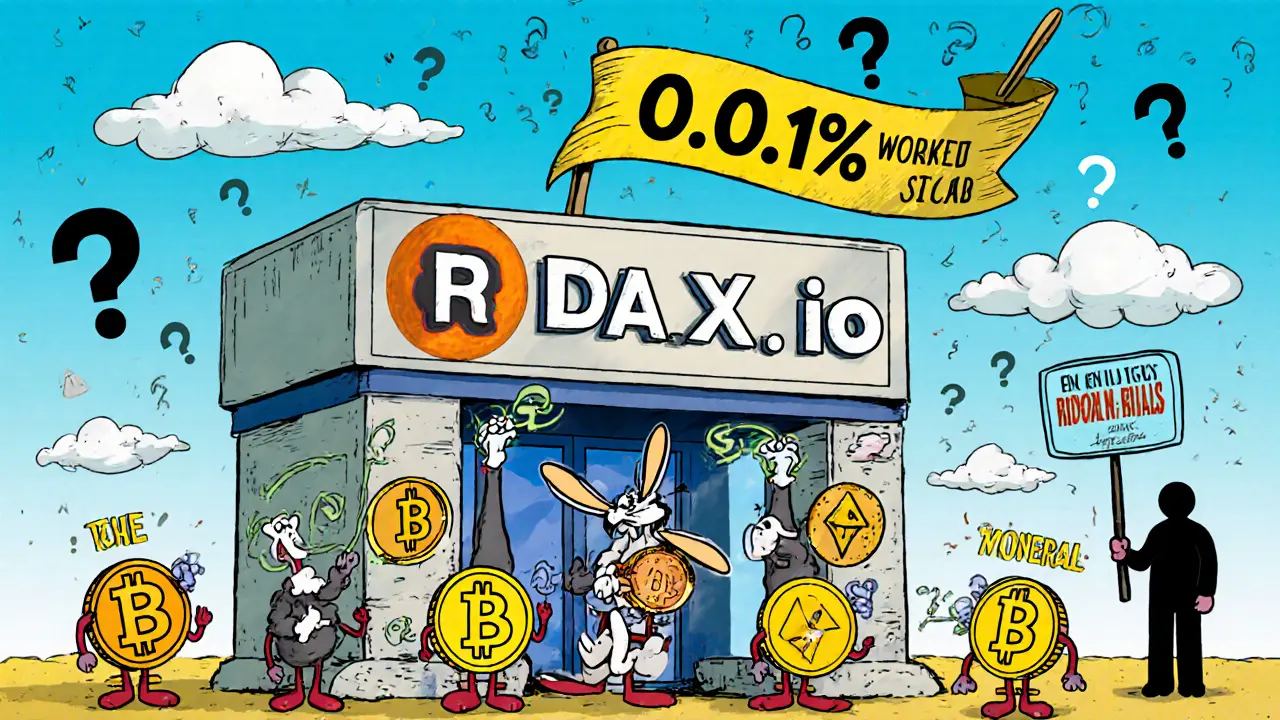

RDAX.io Crypto Exchange Review: Low Fees, No Fiat, and Major Red Flags

RDAX.io offers unusually low crypto trading fees and free withdrawals, but lacks transparency, regulatory status, and user trust signals. With no fiat on-ramp, no security disclosures, and no presence on major crypto platforms, it raises serious red flags for users.