Tokenomics Red Flags: 7 Warning Signs That Could Cost You Everything

Nov, 21 2025

Nov, 21 2025

Most people look at a crypto project and see one thing: the price chart. If it’s going up, they jump in. But what if the chart is lying? What if the real story is hidden in the numbers no one bothers to check - the tokenomics? Tokenomics isn’t just jargon. It’s the economic engine of any crypto project. And if that engine is broken, the whole thing will crash - no matter how many influencers shout about it.

Unlimited Supply? That’s Not a Feature, It’s a Flaw

Imagine a currency that keeps printing more money every single day. No cap. No limit. That’s Dogecoin. And while it’s still around, its value per coin has been steadily diluted for over a decade. Why? Because there’s no end to how many can be created. Every new coin entering circulation makes the ones you own worth slightly less. Projects with unlimited or extremely large total supplies - think trillions of tokens - are playing a dangerous game. They’re betting that hype will outpace inflation. It rarely works. Ethereum avoided this trap by introducing EIP-1559, which burns a portion of every transaction fee. That means fewer ETH in circulation over time, not more. That’s a deflationary pressure - the opposite of what unlimited supply does. If a project’s whitepaper says “no max supply” or “infinite tokens,” treat it like a car with no brakes. You might go fast for a while, but you won’t stop when you need to.Team Gets 20% - and It’s All Vested in 6 Months

Who owns the tokens? That’s the real question. Too many projects hand out huge chunks to founders, early investors, or venture funds - and then let them cash out in just a few months. That’s a dump waiting to happen. Look at the vesting schedule. If the team holds 15% or more and it unlocks all at once after 6 months, expect a price crash. Why? Because those people didn’t build the project to make it successful - they built it to exit. Real teams lock up their tokens for 2+ years. They stagger unlocks: 10% every quarter, not 50% in month seven. A fair schedule shows commitment. A rushed one shows greed. You can check this on CoinGecko or CoinMarketCap. Look under “Token Distribution.” If it says “Team: 20% - unlocked in 180 days,” run.No Real Use? Then It’s Just a Gambling Chip

A token isn’t money unless it does something. If the only reason to hold it is to sell it later, you’re not investing - you’re gambling. And casinos always win in the long run. Ask: What does this token actually do? Can you pay fees with it? Can you vote on upgrades? Can you earn rewards by locking it up? If the answer is “no” or “maybe someday,” that’s a red flag. Aave uses its AAVE token for governance and as a safety buffer in its lending protocol. GMX uses GMX to earn trading fees from its decentralized exchange. These aren’t just hype tokens - they’re functional parts of working systems. If the whitepaper spends more time talking about “community growth” than actual utility, you’re being sold a dream, not a product.

APY of 200%? That’s Not Yield - It’s a Pyramid

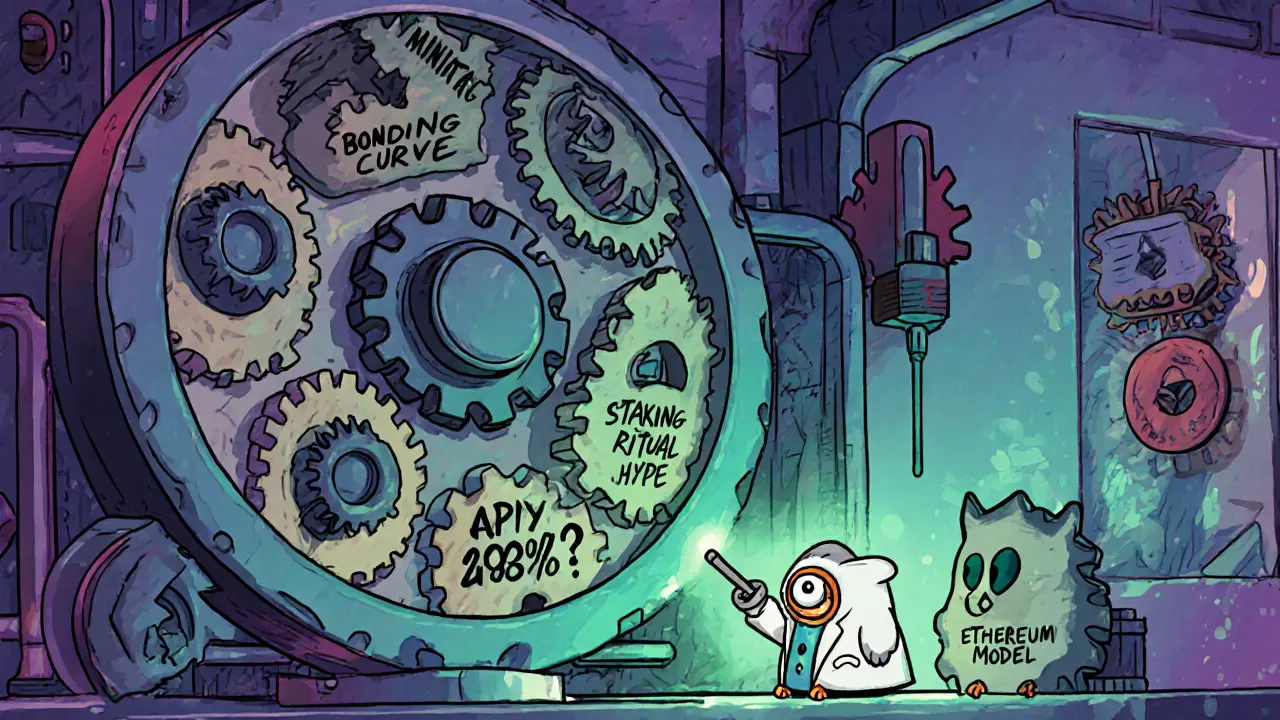

You see a DeFi protocol offering 180% annual returns. Sounds amazing, right? Until you realize: they’re paying you with new tokens they just created. That’s not revenue. That’s printing money to pay yourself. Real yield comes from real activity: trading fees, lending interest, subscription payments. If a project can’t explain where the money comes from to pay you - and it’s not from transaction volume or revenue - it’s a Ponzi. The first people get paid. The later ones lose everything when the new investors dry up. A sustainable APY in 2025 is under 10%. Anything above 50% without a clear, audited revenue model is a warning sign. Projects like Olympus DAO tried this and collapsed. Others, like Curve Finance, keep yields low but steady - because they earn real fees.Too Many Moving Parts? That’s Not Innovation - It’s Obfuscation

Some projects have five types of tokens, three staking pools, a bonding curve, a minting mechanism, and a burn ritual. It sounds smart. It’s not. It’s a distraction. Complex tokenomics often hides weak fundamentals. If you need a 10-page diagram to explain how your token works, you’ve probably over-engineered it. Real systems are simple. Bitcoin has one function: store value. Ethereum has one core use: pay for computation. Aave’s token is for governance and collateral. Clean. Clear. Understandable. If the project’s website feels like a sci-fi novel, walk away. Real innovation doesn’t need jargon to impress. It just works.No Transparency? That’s the Biggest Red Flag of All

Can you find the token contract on Etherscan? Is the total supply clearly listed? Is the burn address public? Can you see how many tokens have been burned this month? If the answers are “I don’t know” or “It’s on their website somewhere,” that’s a problem. Transparency isn’t optional. It’s the baseline. Projects like Uniswap and Chainlink publish all their token activity publicly. You can track every burn, every transfer, every vesting unlock. If a project won’t show you the numbers - or if their docs are vague, outdated, or written in marketing speak - they’re hiding something. And in crypto, hiding something usually means they’re about to run.

Who’s Behind It? Look at the Team, Not the Hype

A great token model means nothing if the team has no track record. Are the founders anonymous? Do they have past projects that failed? Are they active on Twitter, or just posting memes? The best projects have teams with real experience - people who’ve built things before. You can find their LinkedIn profiles. You can see if they’ve contributed to open-source code. You can check if they’ve been involved in other crypto projects that survived. If the team is anonymous, or if their LinkedIn says “Crypto Enthusiast” with no real history - that’s a red flag. No one builds a billion-dollar protocol in a basement with no credentials. If they could, they’d have done it already.What to Do Instead

You don’t need to be an economist to spot bad tokenomics. Here’s a simple checklist:- Is there a clear max supply? (Avoid unlimited)

- Are team tokens locked for 2+ years? (Avoid 6-month unlocks)

- Does the token have a real use? (Not just “governance” - what does that mean?)

- Is the APY under 50% and backed by real revenue?

- Can you verify the token contract and burns on a blockchain explorer?

- Can you find real names and past work behind the team?

Why This Matters More Than Ever in 2025

The crypto market isn’t what it was in 2021. Back then, you could buy anything and make money. Now, regulators are watching. Institutions are asking questions. And investors are smarter. Projects with bad tokenomics are getting shut down. The CFTC and other agencies are targeting those with guaranteed returns, no physical address, and no clear utility. You don’t want to be holding a token that gets flagged as a security - or worse, a scam. The winners in 2025 won’t be the ones with the flashiest websites. They’ll be the ones with clean, simple, transparent token models. The ones that earn value, not just hype. Don’t chase pumps. Chase structure. Because in crypto, the projects that last aren’t the ones that rise the fastest. They’re the ones built on solid ground.What is the biggest tokenomics red flag?

The biggest red flag is an unlimited or extremely large token supply with no burn mechanism. This creates constant inflation, diluting the value of every token you hold. Projects like Dogecoin suffer from this, while Ethereum’s EIP-1559 burn system helps maintain scarcity and long-term value.

Can a project with high APY still be legitimate?

Yes - but only if the APY is funded by real revenue, like trading fees or lending interest. If the project is paying you with newly minted tokens and can’t explain where the money comes from, it’s unsustainable. APYs over 50% without clear revenue are almost always traps.

How do I check a project’s vesting schedule?

Look on CoinGecko or CoinMarketCap under the token’s “Token Distribution” section. Then check the project’s official documentation or whitepaper for details. If team tokens unlock in under a year, especially in large chunks, it’s a warning sign.

Is a token without utility always a scam?

Not always - but it’s always risky. Tokens without real use cases rely entirely on speculation. History shows these projects collapse when hype fades. Even if it’s not a scam, it’s a poor investment. Look for tokens that are used to pay fees, vote on upgrades, or earn protocol revenue.

Why do some projects hide their team?

They’re hiding because they don’t want accountability. In crypto, anonymity can be legitimate for privacy reasons, but when paired with other red flags - like unlimited supply or no utility - it’s a major warning. Real teams have public profiles, past projects, and social presence. If you can’t find any, assume the worst.

Should I avoid all new projects?

No. But you should avoid new projects that lack transparency, have rushed vesting, or promise unrealistic returns. The best new projects are those that copy the proven models of Ethereum, Aave, or GMX - simple, transparent, and utility-driven. Don’t fear newness - fear secrecy.

Peter Mendola

November 22, 2025 AT 23:31Unlimited supply = monetary socialism. Dogecoin isn't a currency; it's a fiscal experiment in hyperinflation. EIP-1559 is the only sane countermeasure in crypto. No debate.

Terry Watson

November 23, 2025 AT 08:38Oh my GOD, this is SO TRUE!!! I mean, like, have you seen some of these projects?? They're just... just printing tokens like confetti at a toddler's birthday party!!! And then they wonder why the price crashes??!!! I'm literally shaking right now!!!

Sunita Garasiya

November 24, 2025 AT 20:17So you're telling me the only thing separating a crypto project from a pyramid scheme is a vesting schedule? Wow. I guess that's why my uncle's 'blockchain-based kombucha' startup failed. He didn't lock his tokens long enough. 😏

Mike Stadelmayer

November 25, 2025 AT 03:55Been down this road before. Thought I found the next big thing. Turned out it was just a fancy PowerPoint with a token attached. Learned the hard way: if it sounds too good to be true, it's probably just a burn address with a marketing team.

Norm Waldon

November 25, 2025 AT 12:34Who the hell is letting these people get away with this? The U.S. government is asleep at the wheel. This is financial terrorism. Every single one of these projects should be shut down by the Treasury. I've reported 17 of them to the SEC. Nobody listens. But I WILL keep fighting. This is not just crypto-it's national security.

neil stevenson

November 25, 2025 AT 14:23bro this is so real 😭 i just lost my rent money on a token that said 'earn 500% APY by staking your soul'... i still don't know what that means but i clicked 'confirm' anyway... 🤡

Samantha bambi

November 27, 2025 AT 12:33It's wild how many people still don't understand that tokenomics isn't about hype-it's about incentives. If the team gets rich before the users, the system is designed to fail. It's basic economics. Why is this so hard to grasp?

Anthony Demarco

November 28, 2025 AT 23:07Lynn S

November 30, 2025 AT 11:29It is truly astounding that individuals continue to invest in projects with no discernible utility, unvested team allocations, and opaque tokenomics. This is not investing. It is gambling with the veneer of innovation. One must possess an alarming degree of cognitive dissonance to believe otherwise.

Jack Richter

December 1, 2025 AT 09:26meh. seen this before. same stuff. just different coin.

sky 168

December 3, 2025 AT 08:19Check the vesting. Check the burn. Check the team. If all three are clean, it’s worth a look. Everything else is noise.

Devon Bishop

December 5, 2025 AT 00:44man i just checked a project i invested in and the team got 25% with 6 month unlock... i thought i was smart... turns out i just got played. i feel so dumb. also i think i misspelled 'vesting' in my notes lol

sammy su

December 5, 2025 AT 15:01you dont need to be a genius to get this. if the team can cash out before you even start making money, its not a project, its a trap. just walk away. easy.

Khalil Nooh

December 7, 2025 AT 01:43The fundamental flaw in most crypto projects is not technological-it is moral. When incentives are misaligned, when the architects of the system are the first to exit, the entire structure becomes a house of cards. The market will eventually correct this. The question is: will you be holding the cards when it collapses?

Chris G

December 8, 2025 AT 12:15Jennifer Corley

December 8, 2025 AT 22:36Actually, unlimited supply can be a feature if the protocol is designed to incentivize long-term holding through staking rewards and network effects. You're oversimplifying. Not every inflationary token is doomed. Some are just ahead of their time.

Natalie Reichstein

December 10, 2025 AT 14:10People who invest in these projects are not victims-they are enablers. They willingly ignore red flags because they want to believe. They want to be rich without effort. This isn't crypto failure-it's human failure.

Kaitlyn Boone

December 11, 2025 AT 16:08i read this and then checked my portfolio... 3 of these are in there... i think i need to go for a walk. or maybe a nap. or both.

James Edwin

December 12, 2025 AT 02:30Real yield comes from real usage. That’s why I only hold ETH and AAVE. Everything else is noise. If you can’t explain how the token generates value in one sentence, it shouldn’t be in your wallet.

Kris Young

December 13, 2025 AT 22:37This is exactly why I always check CoinGecko’s token distribution before investing. Vesting schedules, burn addresses, team allocations-I treat them like a credit report. If the numbers don’t add up, I move on. Simple.

LaTanya Orr

December 14, 2025 AT 05:41It's interesting how much of this comes down to trust. In traditional finance, we have auditors, regulators, legal structures. In crypto, we have transparency-or the lack of it. Maybe the real red flag isn't the tokenomics, but our willingness to believe in anonymity.