CPUfinex Crypto Exchange Review - Spot the Scam and Choose Safer Alternatives

Feb, 21 2025

Feb, 21 2025

Exchange Legitimacy Checker

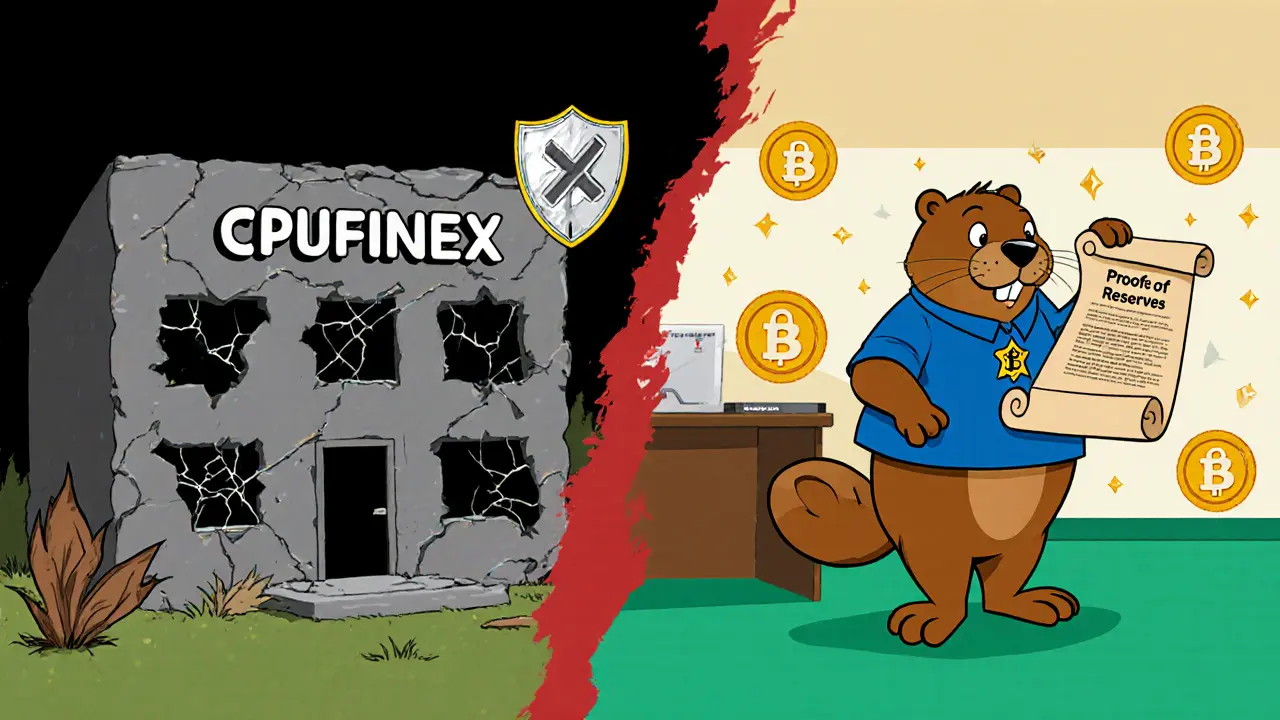

You’ve probably seen a platform called CPUfinex appearing in quick internet searches as a cryptocurrency exchange and wondered whether it’s worth trying. The short answer: the name shows up nowhere in reputable databases, and all signs point to a copy‑cat scam designed to steal unsuspecting traders. This review breaks down why CPUfinex fails every trust test, compares it with a legitimate alternative, and gives you a clear checklist to avoid similar traps.

Key Takeaways

- CPUfinex does not exist in any major exchange ranking, regulatory listing, or audit report.

- The naming pattern mirrors known frauds that mimic established brands like CoinEx.

- Legitimate exchanges provide verifiable proof‑of‑reserves, transparent fees, and regulated KYC processes.

- Use the checklist below before depositing any funds on a new platform.

- Consider CoinEx or other vetted exchanges as safe options.

Why CPUfinex Fails the Legitimacy Test

Every reputable exchange appears on at least one of these reference sites: CoinGecko a leading crypto data aggregator that ranks exchanges by volume, security, and compliance, TradingFinder a research portal that publishes detailed exchange reviews, and the UK Financial Conduct Authority the regulator that issues alerts on fraudulent platforms. CPUfinex is absent from all three, while CoinEx, Binance, and Bybit are listed with full profiles.

Scam‑tracking outfit Crypto Legal a database that catalogs fraudulent crypto entities has logged over 380 copy‑cat exchanges using the "*ex" suffix (e.g., 24bitexup.com). Their 2025 report specifically warns that “CPU‑based exchange names are a red flag.” CPUfinex matches this pattern exactly.

Comparing CPUfinex with a Trusted Exchange

| Attribute | CPUfinex | CoinEx |

|---|---|---|

| Legitimacy | Not listed on any recognized exchange directory | Listed on CoinGecko, TradingFinder, FCA alerts (as a compliant platform) |

| Regulatory Status | No disclosed jurisdiction or licensing | Registered in the Seychelles, complies with AML/KYC policies |

| KYC Requirement | None advertised (often a lure for scammers) | Tiered KYC - basic trading without verification, advanced features require ID |

| Proof of Reserves | No audit or public proof | Third‑party audit confirming $1.2billion in reserves |

| 24‑hour Volume (Oct2025) | - (no data) | $1.4billion |

| Base Trading Fee | Unclear, often advertised as “0%” | 0.2000% (discounts with CET token) |

| Security Measures | No public info - likely basic hosting | 256‑bit SSL, multi‑signature cold wallets (95% of assets) |

Notice how every critical metric for trust is missing or vague for CPUfinex, while CoinEx supplies concrete numbers, audit reports, and a transparent fee schedule.

Red Flags to Spot a Fake Exchange

- Missing URL verification: Scam sites often use a domain that looks similar but differs by a few letters (e.g., cpu‑finex.com vs coinex.com).

- No verifiable team info: Legit platforms list founders, office locations, and contact details. CPUfinex offers only a generic contact form.

- Too‑good‑to‑be‑true returns: Promises of 10%+ daily profit are classic bait.

- Absence from major data aggregators: If CoinGecko, CoinMarketCap, or TradingFinder don’t have a page, proceed with caution.

- Unclear fee structure: Hidden withdrawal fees exceeding 50% are a common scam tactic.

How to Verify an Exchange Before You Trust It

- Search the exact URL on CoinGecko and check the exchange’s profile.

- Look for a publicly posted proof‑of‑reserves audit - preferably a PDF signed by a reputable accounting firm.

- Check the platform’s KYC policy. Any exchange that never asks for identity verification is suspicious.

- Read community feedback on Reddit’s r/CryptoScams and see if the name appears in recent warning threads.

- Confirm the exchange appears on a regulator’s alert list, such as the UK Financial Conduct Authority “crypto scam” page.

Safer Alternatives to Consider

If you’re looking for a reliable place to trade, the following platforms meet the criteria outlined above:

- CoinEx - proven track record, proof‑of‑reserves, and a transparent fee model.

- Binance - the world’s largest exchange, fully regulated in several jurisdictions.

- Koinly‑approved no‑KYC exchanges such as Pionex, which still publish audit reports and have clear security policies.

Quick Checklist Before Depositing Funds

- Is the exchange listed on CoinGecko or TradingFinder?

- Does the site publish a recent proof‑of‑reserves audit?

- Are the fees clearly outlined on a dedicated “Fees” page?

- Is the domain exactly what the official site uses (no extra hyphens or misspellings)?

- Has the platform been mentioned in a regulator’s warning list?

What to Do If You’ve Already Sent Money to CPUfinex

Unfortunately, recovery rates for copy‑cat exchanges are low, but you can still try a few steps:

- Document every transaction - screenshots, wallet addresses, timestamps.

- Report the incident to your local consumer protection agency and to the FCA’s crypto fraud line.

- If you used a credit card, contact your issuer immediately to request a chargeback.

- Post the details on r/CryptoScams so other users are warned.

- Consider filing a police report if the amount is significant.

Final Thoughts

Crypto trading is exciting, but the space is still riddled with copy‑cat platforms that prey on the unwary. CPUfinex review shows that the exchange fails every basic test of legitimacy - no listings, no audits, no clear team, and a name that directly mirrors known scams. Stick with exchanges that are openly vetted by CoinGecko, TradingFinder, or a regulator’s approved list. When in doubt, run the checklist, verify the URL, and never deposit more than you can afford to lose.

Frequently Asked Questions

Is CPUfinex a real cryptocurrency exchange?

No. The platform does not appear in any recognized exchange directory, regulator list, or audit report, and the naming pattern matches known scams.

How can I tell if an exchange is legitimate?

Check for listings on CoinGecko or TradingFinder, look for a publicly posted proof‑of‑reserves audit, verify the domain spelling, review KYC requirements, and see if regulators have issued any alerts.

What should I do if I’ve already sent crypto to CPUfinex?

Gather all transaction details, report the fraud to local consumer protection agencies and the UK FCA, contact your payment provider for a possible chargeback, and share the info on community watchdog forums.

Are there any safe alternatives to CPUfinex?

Yes. Exchanges like CoinEx, Binance, and regulated no‑KYC platforms such as Pionex meet industry standards for security, transparency, and compliance.

Why do scammers use names like CPUfinex?

They copy the look of popular exchanges (CoinEx, Binance) to trick users searching for trusted platforms. The slight spelling change often evades quick internet checks but still feels familiar.

Dick Lane

October 11, 2025 AT 11:06Just saved my wallet. Thanks for the heads up.

Norman Woo

October 12, 2025 AT 08:15Serena Dean

October 12, 2025 AT 12:40Also, always check the domain. CPUfinex.com vs CoinEx.com - that tiny dash is the difference between your life savings and a dumpster fire.

James Young

October 12, 2025 AT 19:02Chloe Jobson

October 13, 2025 AT 13:47Also, no KYC? That’s not ‘user-friendly’ - that’s a money laundering funnel. Always assume the worst until proven otherwise.

Andrew Morgan

October 13, 2025 AT 19:20These guys are pros. They even hire actors to post fake testimonials on YouTube. I swear I saw a guy in a suit talking about ‘how CPUfinex changed my life’ and he was wearing the same watch as the guy from the Binance ad last year. Creepy.

madhu belavadi

October 14, 2025 AT 02:26Michael Folorunsho

October 14, 2025 AT 03:38Roxanne Maxwell

October 14, 2025 AT 03:51Jonathan Tanguay

October 14, 2025 AT 07:14Ayanda Ndoni

October 14, 2025 AT 13:58Elliott Algarin

October 14, 2025 AT 17:18John Murphy

October 15, 2025 AT 02:57Zach Crandall

October 15, 2025 AT 20:16Akinyemi Akindele Winner

October 16, 2025 AT 05:04Patrick De Leon

October 16, 2025 AT 08:47MANGESH NEEL

October 16, 2025 AT 16:31Sean Huang

October 17, 2025 AT 06:57Ali Korkor

October 17, 2025 AT 17:45Natasha Nelson

October 17, 2025 AT 22:10