How El Salvador Uses Bitcoin for Its National Economy - And Why It’s Struggling

Nov, 12 2025

Nov, 12 2025

Remittance Cost Calculator

Send Money to El Salvador

Cost Comparison

Key Context

As reported in the article, traditional remittance services charge up to 20% in fees. Bitcoin transactions typically cost around 0.5% (actual rates vary based on network conditions). However, Bitcoin's volatility means the value received may fluctuate significantly between sending and receiving.

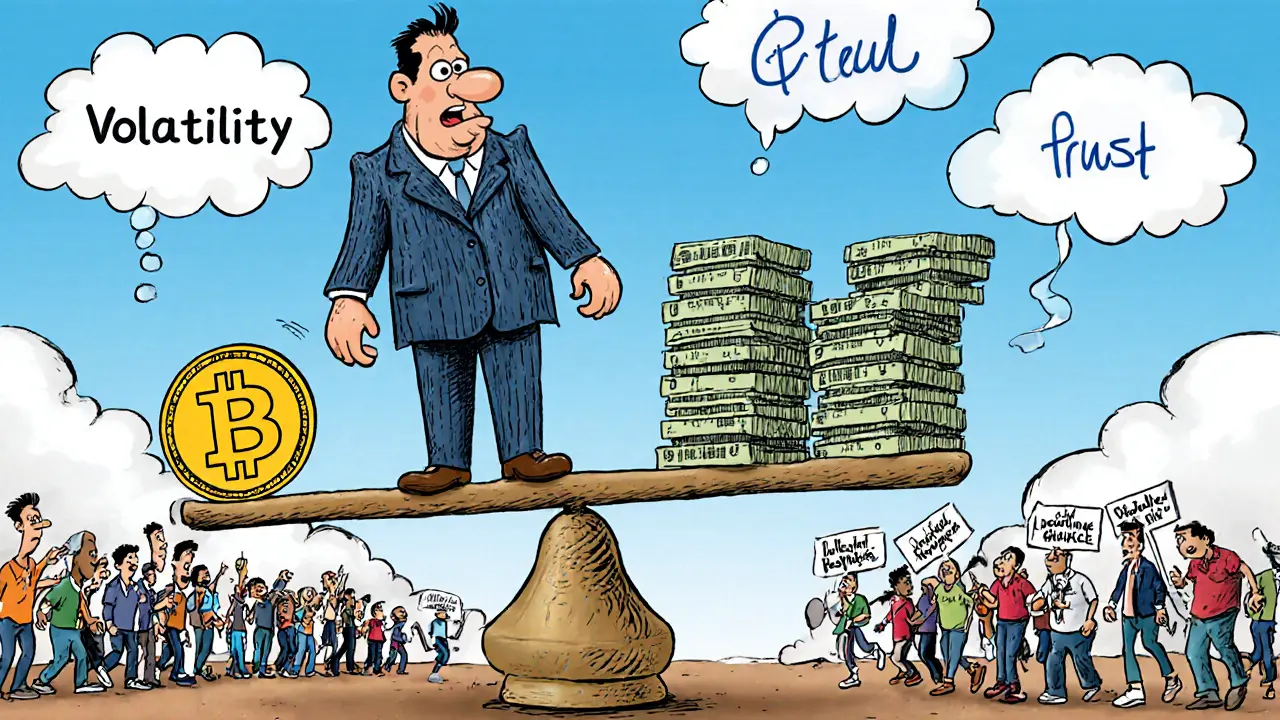

On September 7, 2021, El Salvador did something no other country had ever done: it made Bitcoin legal tender alongside the U.S. dollar. The move, pushed by President Nayib Bukele, was meant to shake up a stagnant economy. Remittances - money sent home by Salvadorans living abroad - make up over 20% of the country’s GDP. Sending that money through Western Union or banks cost up to 20% in fees. Bitcoin, the government said, would cut those costs to near zero. It would bring banking to the 70% of adults without bank accounts. It would attract investors looking for the next big thing. It would be a revolution.

But three years later, the revolution hasn’t taken root. Bitcoin is still legal. The government still holds over 5,000 BTC. The app, Chivo, is still on phones. But most Salvadorans aren’t using it for daily life. They’re not paying for groceries, bus rides, or electricity in Bitcoin. They’re not paying taxes in Bitcoin. They’re not even holding onto the free Bitcoin they got when the app launched.

The reality is simpler: El Salvador didn’t fix its economy with Bitcoin. It added a layer of complexity to an already fragile system.

Why Bitcoin Was Chosen

El Salvador’s economy has been stuck for decades. Low growth. High debt. Heavy reliance on the U.S. dollar since 2001. When the pandemic hit, remittances dipped - and with them, household income. The government needed a way to get money to people faster and cheaper. Bitcoin looked like the answer.

The plan had three clear goals:

- Reduce the cost of remittances by cutting out middlemen.

- Bring financial services to the unbanked.

- Attract foreign capital by becoming the world’s first Bitcoin nation.

The government didn’t just announce it - they backed it. They set aside $150 million to buy Bitcoin and to fund the Chivo wallet app. They made it illegal for businesses to refuse Bitcoin as payment. They created a system where every Bitcoin payment could be instantly converted to U.S. dollars. And they gave every citizen $30 in Bitcoin just for downloading the app.

At first, it looked like a success. Over half the population downloaded Chivo. Social media buzzed. Crypto influencers hailed it as the future. But the real test wasn’t downloads - it was usage.

What Actually Happened

A study by the National Bureau of Economic Research surveyed 1,800 Salvadoran households. The results were stark. Only 15% of those who downloaded Chivo used it more than once. More than 60% never made a single transaction after spending their free $30. One in five still hadn’t touched their bonus Bitcoin.

Who was using it? Mostly young, educated, urban men who already had bank accounts. The people the program was meant to help - rural women, older adults, small vendors - barely touched it. Why? Because Bitcoin wasn’t easier. It was harder.

Setting up a wallet required a smartphone, a stable internet connection, and understanding terms like “private key” and “gas fee.” Many didn’t have smartphones. Others lived in areas with spotty signal. The app crashed constantly in its early days. Transactions failed. People lost money. Trust vanished.

And then there was the price. Bitcoin swung wildly. In late 2021, it hit $68,000. By early 2022, it dropped below $30,000. The government had bought Bitcoin at high prices. When it sold some to cover budget shortfalls, it took losses. Critics called it a fiscal gamble. The IMF called it reckless.

The IMF Intervention

In 2024, El Salvador needed a $1.4 billion loan to avoid defaulting on its debt. The IMF said yes - but only if the country scaled back its Bitcoin experiment.

The agreement didn’t ban Bitcoin. But it forced changes: no more public Bitcoin purchases, no more taxpayer-funded incentives, no more using Bitcoin in government accounting. The country had to treat Bitcoin like a speculative asset, not a currency. The government had to stop pretending it was a solution to inflation or financial inclusion.

This was a major retreat. The original vision - a Bitcoin-powered economy - was officially scaled back. The message from the IMF was clear: volatility, lack of regulation, and poor adoption make Bitcoin unsuitable as national money.

Who Lost and Who Gained

Who won? A small group of tech-savvy entrepreneurs, crypto investors, and foreign speculators who bought land or started businesses in El Salvador hoping for tax breaks or future Bitcoin gains. Some mining operations popped up near geothermal sites, but they were small and controversial due to energy use.

Who lost? Ordinary Salvadorans. The government spent $150 million on Bitcoin and the app - money that could have gone to roads, schools, or electricity grids. The promised cost savings on remittances never materialized for most people. Many still use Western Union. The unbanked remain unbanked.

Even the Chivo app, once a symbol of progress, became a symbol of disappointment. People used it to cash out their free Bitcoin - then deleted it.

Why It Failed

El Salvador didn’t fail because Bitcoin is bad. It failed because it treated Bitcoin like a magic tool, not a technology with limits.

Bitcoin isn’t designed for everyday payments. It’s slow. It’s expensive during spikes. It’s volatile. It doesn’t scale. Trying to make it a national currency ignored its core design. No central bank can control it. No government can stabilize it. No merchant can plan around it.

Also, the rollout ignored human behavior. You can’t force adoption with free money. People need trust, simplicity, and reliability. Bitcoin offered none of that to most Salvadorans.

And the political context didn’t help. President Bukele’s administration has been criticized for weakening democratic checks. Critics saw the Bitcoin move not as economic policy - but as a power play to bypass traditional financial systems and centralize control.

What’s Left Now

Bitcoin is still legal tender. The government still holds Bitcoin. The Chivo app still exists. But it’s a shadow of the original plan.

Today, El Salvador’s Bitcoin experiment is more of a footnote than a foundation. It’s a cautionary tale for other countries thinking of copying it. The IMF won’t allow it. The people didn’t embrace it. The economy didn’t grow because of it.

What El Salvador did succeed in doing? It forced the world to pay attention. It showed that cryptocurrency can be more than a speculative asset - it can be a political statement. But it also showed that money, at its core, is about trust. And trust can’t be bought with free Bitcoin.

For now, the U.S. dollar still runs El Salvador’s economy. Bitcoin? It’s just a quiet, unused feature on a phone most people forgot about.

What This Means for Other Countries

Other nations - especially those with high remittance costs or weak banking systems - might look at El Salvador and think: “We should do that too.” But the lesson isn’t to adopt Bitcoin. It’s to ask harder questions.

Is the problem the cost of sending money? Then look at regulated digital wallets like Ripple or local mobile money systems like M-Pesa in Kenya. Is the problem financial inclusion? Then invest in low-cost banking infrastructure, not crypto apps. Is the problem distrust in government? Then fix governance, not currency.

Bitcoin isn’t the solution to economic weakness. It’s a distraction from it.

El Salvador didn’t become a financial pioneer. It became a case study - in ambition, in error, and in the limits of technology when it’s forced into a role it wasn’t built for.

Is Bitcoin still legal tender in El Salvador?

Yes, Bitcoin is still legal tender in El Salvador. The 2021 Bitcoin Law hasn’t been repealed. Businesses are still required by law to accept it as payment. But since the 2024 IMF agreement, the government no longer promotes it as a primary currency and has stopped buying more Bitcoin. Most people use it only to cash out their initial bonus or for occasional peer-to-peer transfers.

Did El Salvador’s Bitcoin plan help the economy grow?

No. Economic growth hasn’t improved since Bitcoin became legal tender. GDP growth remained below 2% annually, similar to pre-Bitcoin levels. Foreign investment didn’t surge as promised. The cost of living rose. The government took losses on its Bitcoin holdings. The IMF and World Bank have stated that the experiment added financial risk without delivering measurable economic benefits.

Why didn’t Salvadorans use Bitcoin for daily payments?

Most Salvadorans found Bitcoin too complicated, unreliable, and unnecessary. The Chivo app crashed often. Transactions were slow. Prices in Bitcoin changed daily, making it hard to budget. Many didn’t understand how it worked. And since the U.S. dollar was already widely accepted, there was no real incentive to switch - especially when the free Bitcoin ran out.

What happened to the $150 million the government spent on Bitcoin?

The government used that money to buy Bitcoin when prices were high - mostly between $30,000 and $60,000 per coin. As Bitcoin’s value dropped, the government sold some of its holdings to cover budget deficits, taking losses in the process. As of 2025, El Salvador still holds around 5,000 BTC, but its value is far below what was spent to acquire it. The money could have been used for infrastructure, education, or healthcare - areas that still need urgent investment.

Is El Salvador still working with the IMF on Bitcoin?

Yes. The 2024 $1.4 billion loan deal with the IMF required El Salvador to stop buying Bitcoin with public funds, stop using Bitcoin in government accounting, and stop offering financial incentives to use it. The country must now treat Bitcoin like any other volatile asset, not a currency. The IMF continues to monitor El Salvador’s fiscal policies closely, and further concessions could be required if economic conditions worsen.

Michael Heitzer

November 13, 2025 AT 10:35Bitcoin wasn't the problem - it was the delusion that technology alone can fix broken institutions. El Salvador didn't need a new currency. It needed better schools, reliable electricity, and a government that doesn't treat its people like beta testers. The IMF wasn't the villain here. The real villain was the cult of innovation that mistook hype for progress.

When you force a hammer into a role it wasn't built for - like using a chainsaw to cut butter - you don't get better butter. You just make a mess. Bitcoin is a decentralized ledger, not a fiscal policy tool. Trying to turn it into one is like trying to run a hospital on a crowdfunding app.

The people didn't reject Bitcoin because they're backward. They rejected it because it was unreliable, confusing, and didn't solve their actual problems. Money isn't about tech. It's about trust. And trust takes decades to build - not 30 bucks and a buggy app.

Rebecca Saffle

November 14, 2025 AT 15:37Let’s be real - this was always a power grab disguised as economic reform. Bukele didn’t care about the unbanked. He cared about looking like a futuristic dictator while dodging accountability. The Chivo app? A surveillance tool with a blockchain veneer. And now the IMF is holding the bag because the government spent $150M on a crypto gamble instead of fixing roads or hiring teachers.

Don’t tell me about financial inclusion. I’ve seen the lines at Western Union. People aren’t refusing Bitcoin because they’re Luddites. They’re refusing it because they’ve been burned - and now they know the government’s word means less than a dropped transaction.

Ashley Mona

November 15, 2025 AT 09:35So many people miss the point: Bitcoin doesn’t solve poverty. It just adds another layer of risk to people who already live on the edge. Imagine being a single mom in rural El Salvador trying to pay for medicine, and your payment fails because the app crashed or the gas fee spiked. That’s not innovation. That’s cruelty wrapped in a whitepaper.

The real win would’ve been a low-cost mobile wallet tied to local banks - not a volatile crypto asset. But that’s boring. No one gets a TED Talk for fixing infrastructure. You get one for ‘revolutionizing money.’

Edward Phuakwatana

November 16, 2025 AT 00:27Y’all are missing the forest for the trees. Bitcoin’s failure here wasn’t technical - it was anthropological. Human beings don’t adopt new money because it’s ‘cool’ or ‘decentralized.’ They adopt it because it’s *easier*, *cheaper*, and *more reliable* than what they already use.

The U.S. dollar is stable. It’s understood. It’s everywhere. Bitcoin? A lottery ticket with a 12-step setup process. No wonder people cashed out their $30 and deleted the app.

Also, let’s not romanticize the ‘unbanked.’ Most of them don’t want crypto wallets. They want access to ATMs, affordable credit, and banks that don’t charge $5 to deposit a check. Tech can help - but only if it’s designed for humans, not crypto bros.

Noriko Yashiro

November 17, 2025 AT 17:05ok so like... i read this whole thing and i just wanna say... wow. this is so sad. like, imagine spending 150 million on something that just... makes people confused and then they delete the app. why not just give them cash? or fix the internet? or train people? instead of making them learn what a private key is??

also the government bought bitcoin at like $50k and now its 70k? so maybe they're fine? but nooo, they sold some at 30k. oof. that's just... yikes.

Adrian Bailey

November 17, 2025 AT 19:11Man, I feel bad for the people who actually tried to use Chivo. I’ve had apps crash on me before, but when your rent’s due and the app says ‘transaction failed’ and you don’t know if your money’s gone or just frozen? That’s not tech failure - that’s emotional trauma.

I’m not a crypto guy, but I get why people were excited. The idea of cutting out Western Union’s 20% fee? That’s life-changing money for families. But the rollout was a dumpster fire. No training. No support. No backup plan. Just ‘here’s an app, go wild.’

And now the government’s sitting on 5,000 BTC like it’s a trophy. Meanwhile, schools still don’t have textbooks. That’s not a revolution. That’s a performance art piece funded by taxpayer money.

Johanna Lesmayoux lamare

November 18, 2025 AT 22:48They didn’t fail because Bitcoin is bad. They failed because they didn’t listen.

dhirendra pratap singh

November 19, 2025 AT 04:27THIS IS WHY WE CAN’T HAVE NICE THINGS 😭

El Salvador thought they could outsmart the global financial system with a meme coin and a selfie stick. Meanwhile, the people are still paying $20 to send $100 home. The IMF was right. The government was wrong. And now the whole world is laughing.

Also, Bukele’s face on every Bitcoin ad? That’s not leadership. That’s a cult. 🤡

tom west

November 20, 2025 AT 13:13Let’s cut through the woke narrative. This wasn’t a failure of implementation - it was a failure of ideology. You cannot replace a sovereign currency with a speculative asset controlled by no one. That’s not innovation. That’s economic anarchy.

The IMF didn’t ‘interfere.’ They prevented a full-blown collapse. El Salvador’s debt-to-GDP ratio was already unsustainable. Adding Bitcoin volatility on top was like putting a lit match next to a gas tank and calling it ‘financial freedom.’

And don’t even get me started on the ‘free Bitcoin’ stunt. That’s not inclusion - it’s welfare fraud with blockchain branding. People took the cash and ran. No surprise there. Human nature doesn’t change because you add a QR code.

Debraj Dutta

November 21, 2025 AT 23:44As someone from India, where UPI revolutionized payments overnight without any hype, I find this deeply frustrating. No one in India was told to download an app and get free crypto. Instead, the government partnered with banks, made interfaces simple, and ensured 24/7 uptime.

El Salvador didn’t need Bitcoin. It needed UPI. It needed collaboration. It needed patience.

Technology is not a magic wand. It’s a tool. And tools need skilled hands - not political theater.

Kristin LeGard

November 23, 2025 AT 20:09Oh please. Let’s not pretend this was about helping the poor. This was a vanity project for a dictator who wanted to be seen as the Elon Musk of Central America. The fact that the government bought Bitcoin at the peak? That’s not incompetence - that’s arrogance.

And now they’re still holding onto it like it’s a religious relic. Meanwhile, the people are still using cash. Because cash doesn’t crash. Cash doesn’t need a private key. Cash doesn’t ask you to trust a guy in a hoodie who says ‘it’s the future.’

Arthur Coddington

November 24, 2025 AT 02:46So… what’s the lesson here? That tech can’t fix bad governance? That’s it? That’s the big reveal?

I mean, I’m just sitting here wondering if we’re all just waiting for the next country to try this with Dogecoin. Maybe Nigeria will launch ‘DogePeso’ next. I can already see the TikTok trends: ‘I got 50 Dogecoins for downloading the app!!’

At this point, I’m not even mad. I’m just… bored.

Phil Bradley

November 25, 2025 AT 18:29It’s funny how we all act like this was some grand experiment. But really? It was just another Silicon Valley fantasy exported to a country that didn’t ask for it.

Imagine if instead of handing out Bitcoin, they’d handed out free solar chargers, or trained local women to run digital kiosks in markets. That would’ve been real innovation.

Instead, they gave people a tool they didn’t need, in a language they didn’t speak, for a problem they didn’t have.

And now the app’s just collecting dust. Like a gym membership from January.

Rachel Everson

November 26, 2025 AT 03:17For anyone who thinks this was a failure of Bitcoin - think again. It was a failure of empathy.

They didn’t ask people what they needed. They didn’t test it slowly. They didn’t offer help when it broke. They just threw a shiny object at the problem and said, ‘there, fixed.’

Financial inclusion isn’t about apps. It’s about dignity. It’s about making people feel safe with their money. Bitcoin didn’t do that. But a simple, reliable mobile payment system? That could’ve.

Still, I’m glad someone finally tried something bold. Even if it blew up. At least we learned something.

ty ty

November 27, 2025 AT 16:58Wow. So El Salvador spent $150 million to turn its citizens into crypto bros who don’t even know what a private key is. Congrats. You made the world’s first Bitcoin welfare program. Next up: mandatory NFT IDs for voting.

Also, ‘Bitcoin is legal tender’ - sure. Just like how my toaster is ‘legal food.’ Doesn’t mean I’m gonna eat it.

BRYAN CHAGUA

November 29, 2025 AT 00:33There’s a quiet dignity in the fact that Salvadorans didn’t fall for the hype. They saw the free Bitcoin, took it, and went back to their lives - using dollars, cash, and trust. That’s not ignorance. That’s wisdom.

Most revolutions are led by people who believe they’re changing the world. The best ones? They’re led by people who just want to pay for their bus ticket without losing half their money to fees - or app crashes.

El Salvador didn’t fail because it tried something new. It failed because it mistook spectacle for substance.

Suhail Kashmiri

November 29, 2025 AT 01:45Bro, this is why I hate when governments play with money like it's a video game. You don't get XP for making Bitcoin legal tender. You get a recession. And now the people are stuck with a useless app and a debt they didn't ask for.

Also, why is everyone still talking about this? It's over. Move on.