DeFiChain (DFI) Airdrop Guide: How It Works, Who Qualifies, and What to Expect

Oct, 22 2025

Oct, 22 2025

DeFiChain Airdrop Calculator

Calculate Your DFI Rewards

Based on the historic Bitcoin-holder airdrop (September 2020): 500 DFI per 1 BTC (max 50,000 DFI)

When DeFiChain rolls out an DeFiChain airdrop, the crypto community lights up with questions: Who can claim? How much will I get? What do I need to do after the drop? This guide cuts through the hype and walks you through every active DeFiChain airdrop program, the historic Bitcoin‑holder giveaway, and the practical steps to claim safely.

DeFiChain is a blockchain built exclusively for decentralized finance services. It runs a native DFI token, the utility coin that powers staking, liquidity mining, and governance on the network. Since its launch, DeFiChain has used airdrops as a primary growth lever, targeting Bitcoin holders, new DeFi users, and social‑media participants.

Why DeFiChain Uses Airdrops

Unlike many projects that fling free tokens at anyone with a Twitter account, DeFiChain designs each airdrop to solve a specific problem:

- Bitcoin‑holder airdrop (2020): Leverage Bitcoin’s massive user base to kick‑start DeFi adoption.

- Cake DeFi partnership: Bring users who are ready to stake or lend, turning a free token into a long‑term revenue stream.

- CoinMarketCap campaign: Boost community visibility across Reddit, Telegram, and Twitter.

Each program balances ease of entry with a commitment level that filters out pure speculators.

Historical Bitcoin‑Holder Airdrop (Sept 2020)

The first big splash came on September 9, 2020, at Bitcoin block #647,500 (≈22:00 UTC). DeFiChain announced a fixed 500‑to‑1 ratio: for every BTC you held, you earned 500 DFI. There was no minimum BTC balance, but a cap of 100 BTC per address limited the maximum reward to 50,000 DFI.

Eligibility criteria:

- Hold Bitcoin in a private wallet that supports message signing (e.g., Electrum, Ledger).

- Submit a signed message proving ownership before the end of 2020.

The process required you to export a public address, sign a unique string with your private key, and paste the signature on DeFiChain’s claim portal. While technically demanding, it ensured that only real Bitcoin custodians received DFI.

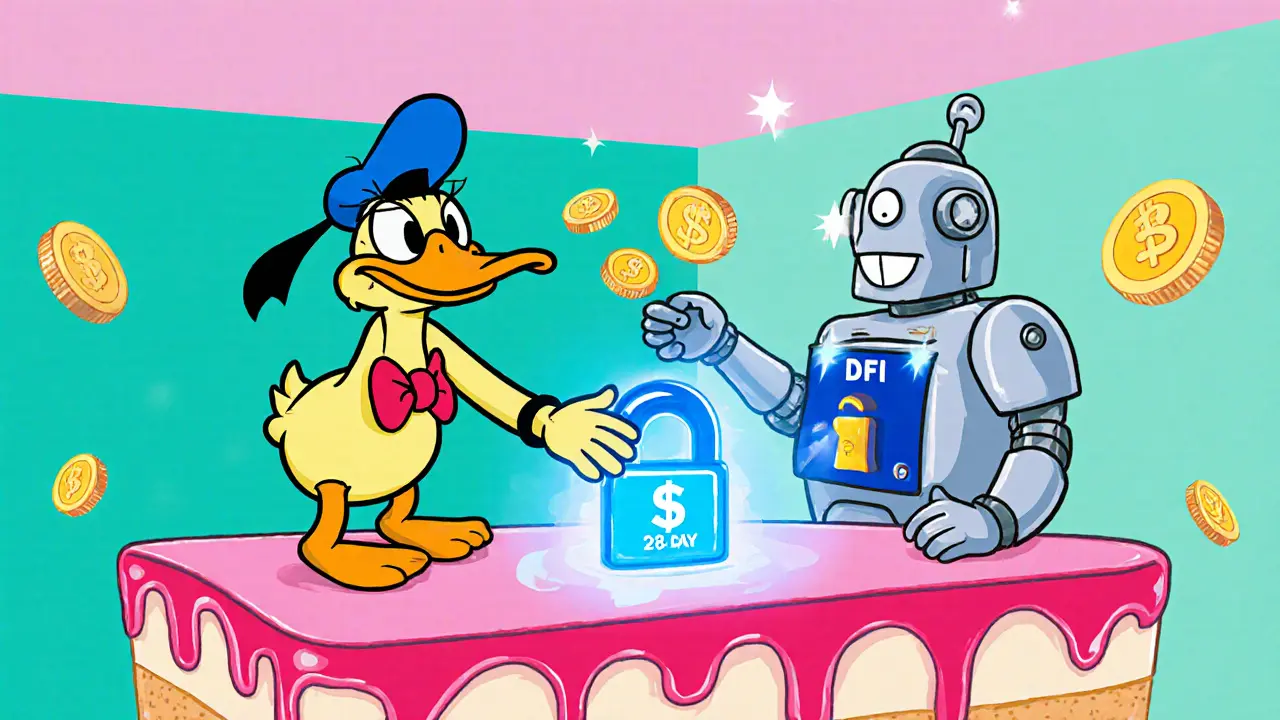

Current Cake DeFi Partnership Airdrop

DeFiChain now works with Cake DeFi, a crypto‑banking platform, to reward new users with $30 worth of DFI. The steps are straightforward but involve a modest financial commitment:

- Create a Cake DeFi account and verify your email.

- Complete KYC (Know Your Customer) verification - a standard ID check.

- Deposit at least $50 of any supported token (BTC, ETH, USDT, etc.) into a staking, lending, or liquidity‑mining freezer.

- Leave the deposit locked for a minimum of 28 days.

Once the lock‑up period ends, the $30 DFI reward is automatically enrolled in Cake DeFi’s “Confectionery” program, which pays a 34.5 % APY for 180 days. There’s also a referral bonus: bring a friend who completes the same steps, and you earn an extra $10 worth of DFI.

CoinMarketCap Social‑Media Airdrop

CoinMarketCap, the leading crypto data site, runs a community‑driven DeFiChain airdrop. The total pool is 58,383 DFI, split among 1,590 winners (up to 36.72 DFI each). To qualify, you must:

- Have an active CoinMarketCap account.

- Add DeFiChain to your watchlist.

- Follow DeFiChain on Twitter.

- Join the DeFiChain Reddit community.

- Join the official DeFiChain Telegram group.

The tasks are low‑tech; the main effort is managing multiple social accounts. Rewards are distributed directly to your CoinMarketCap wallet and can be transferred to any DFI address.

Side‑by‑Side Comparison

| Program | Eligibility | Reward Size | Primary Requirement | Lock‑up / APY |

|---|---|---|---|---|

| Bitcoin‑holder (2020) | Hold BTC in a private signing wallet | 500 DFI per 1 BTC (max 50,000 DFI) | Signed message before 31 Dec 2020 | None (one‑time claim) |

| Cake DeFi partnership | New Cake DeFi user + KYC | $30 worth of DFI (≈ 200 DFI) | $50 deposit, 28‑day lock | 34.5 % APY for 180 days |

| CoinMarketCap social | Active CMC account | Up to 36.72 DFI per winner | Complete 5 social tasks | None (immediate transfer) |

How to Claim Safely

Whether you’re dealing with a cryptographic signature or a simple social‑media task, security basics apply:

- Never share your private keys. DeFiChain’s claim page only asks for a signed message, not the raw key.

- Use hardware wallets (Ledger, Trezor) for signing whenever possible.

- Double‑check URLs. Official claim portals live on the defichain.com domain.

- Keep screenshots of your submission in case you need to follow up.

If something feels off-like a request for a password or a private key-step away and verify through official channels.

Common Pitfalls and How to Avoid Them

Even seasoned crypto fans stumble. Here are the top three mistakes and quick fixes:

- Using an exchange wallet for the Bitcoin‑holder airdrop. Exchanges cannot produce the required signed message. Move a small amount of BTC to a personal wallet first.

- Missing the claim deadline. The 2020 drop closed on Dec 31 2020. Future programs usually announce a hard cutoff-mark it on your calendar.

- Skipping KYC on Cake DeFi. Without verification, the $30 reward never appears. Keep a photo ID handy to speed the process.

What to Do After Receiving DFI

Getting your free DFI is just the start. DeFiChain offers several ways to put the tokens to work:

- Stake DFI: Earn up to 10 % annual rewards while supporting network security.

- Provide liquidity: Pair DFI with BTC or USD‑stablecoins on the DEX and capture swap fees.

- Participate in governance: Vote on proposals that shape protocol upgrades.

All three options are accessible via the DeFiChain wallet or the Cake DeFi dashboard. For newcomers, staking is the simplest way to generate passive income.

Future Outlook for DeFiChain Airdrops

DeFiChain’s roadmap hints at more partnership drops, especially with platforms that emphasize staking yields. The current 34.5 % APY on Cake DeFi’s Confectionery program is likely to stay competitive, so expect similar incentive structures in upcoming campaigns. Keep an eye on official announcements and the DeFiChain Telegram channel for the latest opportunities.

Do I need to own Bitcoin to claim any DeFiChain airdrop?

Only the historic 2020 airdrop required Bitcoin holdings. The current Cake DeFi and CoinMarketCap programs accept any eligible user, regardless of BTC ownership.

Can I claim the airdrop using a mobile wallet?

Yes, as long as the mobile wallet supports message signing (e.g., Trust Wallet for Bitcoin) and can connect to the DeFiChain claim portal.

What happens to the DFI after the 180‑day APY period?

After 180 days the locked reward converts to a regular DFI balance in your Cake DeFi account. You can then withdraw, stake, or trade it freely.

Is there a tax implication for receiving a DeFiChain airdrop?

In most jurisdictions, airdropped tokens are treated as taxable income at their fair market value on the day you receive them. Check your local regulations or consult a tax professional.

How can I verify that an airdrop announcement is legit?

Always cross‑check the announcement on DeFiChain’s official blog, Twitter, or Discord. Phishing sites often copy the design but use a slightly different URL.

By understanding each program’s rules, preparing the right wallet or account, and following the safety steps above, you can turn a free token drop into a lasting source of DeFi income.

Ryan Steck

October 22, 2025 AT 08:26Dont trust any of this DFI airdrop hype – it's a front for the deep‑state crypto cabal to siphon your keys.

James Williams, III

October 25, 2025 AT 03:06DeFiChain’s airdrop architecture is built around on‑chain proof‑of‑ownership checks that leverage signed messages rather than custodial exchange balances, which mitigates double‑spend vectors.

The historic 2020 Bitcoin‑holder drop required a UTXO‑compatible wallet capable of ECDSA signing, such as Electrum or Ledger, to generate a verifiable signature.

By anchoring the claim to a block height (647,500) the protocol ensures a deterministic snapshot, preventing retroactive manipulation.

Current partnership drops like the Cake DeFi incentive use KYC‑linked off‑chain verification, tying the on‑ramp to AML compliance while still distributing native DFI on‑chain.

The CoinMarketCap social campaign abstracts away cryptographic steps entirely, instead weighting eligibility on multi‑platform engagement metrics stored off‑chain and later reconciled via a Merkle proof.

When preparing to claim, always verify the URL ends with defichain.com and that the TLS certificate is valid to avoid phishing clones.

For hardware wallet users, employ the “sign message” feature directly in the device UI to keep private keys isolated from the host OS.

If you’re using a mobile wallet, ensure it supports BIP‑322 style message signing to remain compatible with the claim portal’s verification routine.

After a successful claim, the DFI tokens land in the address you supplied; you can then choose to stake, provide liquidity, or hold for governance voting power.

Staking DFI on the native wallet yields up to ~10 % APR, with rewards compounding each epoch and contributing to network security via masternode collateral.

Liquidity mining on the DEX enables you to pair DFI with BTC or USDT, earning swap fees proportional to your share of the pool, albeit with impermanent loss risk.

Governance participation requires a minimum locked balance, and proposals are weighted by the amount of DFI you have delegated to the voting contract.

For the Cake DeFi program, the $30 reward is auto‑enrolled into a 34.5 % APY “Confectionery” lock‑up, which matures after 180 days before converting to liquid DFI.

Referral bonuses are additive, so inviting a friend effectively multiplies your APY exposure without additional capital outlay.

Tax considerations dictate that each airdrop is treated as ordinary income at fair market value on receipt, with subsequent capital gains taxed on disposition.

In summary, the safest path is to use a hardware wallet for signature‑based drops, double‑check URLs, keep screenshots of submissions, and allocate received DFI into staking or liquidity pools aligned with your risk tolerance.

Patrick Day

October 27, 2025 AT 20:46Sounds like they wanna track every move – even the signature thing could be a backdoor for the unknown cabal.

Jenna Em

October 30, 2025 AT 15:26Every airdrop is a mirror reflecting our collective trust in decentralized systems.

If we hand over signatures without scrutiny, we may be selling pieces of our autonomy to unseen hands.

Yet the promise of free DFI also beckons us toward a more inclusive financial future.

Balance curiosity with caution, and let reason guide your claim.

Prerna Sahrawat

November 2, 2025 AT 10:06The very notion of an airdrop, in its ostentatious largesse, belies a profound commentary on the sociopolitical scaffolding of modern cryptoeconomics.

One must not merely skim the procedural veneer; the cryptographic rigors embedded within the Bitcoin‑holder distribution demand a disciplined adherence to asymmetric key protocols.

The audacity of stipulating a 500‑to‑1 ratio bespeaks a calculated orchestration designed to redistribute wealth from the entrenched Bitcoin aristocracy to the nascent DeFi proletariat.

Equally, the Cake DeFi partnership's requisite KYC veneer serves as both a regulatory appeasement and a subtle mechanism for data aggregation.

To navigate this labyrinthine dance, the aspirant must procure a hardware enclave, perform immaculate message signing, and subsequently marshal the resultant signature onto the official portal.

Any deviation – such as employing an exchange‑derived address – culminates in an inexorable denial of claim, a punitive reminder of the ecosystem's unforgiving exactitude.

Moreover, the social‑media airdrop, while ostensibly democratic, subtly incentivizes performative participation, an echo of attention economy dynamics.

Thus, the enlightened participant must wield both technical acumen and philosophical sagacity to harvest DFI without succumbing to the underlying machinations.

Joy Garcia

November 5, 2025 AT 04:46While you wax poetic about “machinations,” the reality is simple: if you don’t follow the steps, you get nothing – no one owes you free tokens for day‑dreaming.

mike ballard

November 7, 2025 AT 23:26DeFiChain's multi‑chain interoperability is a game‑changer 🌍 – it lets you bridge assets from Bitcoin, Ethereum, and even Binance Smart Chain into a unified liquidity pool, amplifying yield opportunities across ecosystems.

Molly van der Schee

November 10, 2025 AT 18:06It's easy to feel overwhelmed by the technical steps, but taking it one action at a time-sign the message, verify the URL, and then stake your DFI-can make the process feel manageable.

Mike Cristobal

November 13, 2025 AT 12:46Honestly, if you can't even handle a basic signature, you shouldn't be participating in any crypto project – it's basic responsibility 😊.

Erik Shear

November 16, 2025 AT 07:26The airdrop offers a low‑entry point for newcomers and can help spread awareness of DeFi concepts while keeping the community inclusive.

Benjamin Debrick

November 19, 2025 AT 02:06Indeed, the confluence of cryptographic proof‑of‑ownership mechanisms, KYC‑augmented incentive structures, and social‑media driven distribution channels represents a paradigmatic evolution in tokenomics; nevertheless, one must remain vigilant, for the allure of “free” assets often obscures the underlying regulatory and systemic complexities; thus, a discerning participant should engage with both technical rigor and strategic foresight.

Anna Kammerer

November 21, 2025 AT 20:46Sure, because sounding like a walking footnote is the best way to convince people to actually claim their tokens, right?

Mike GLENN

November 24, 2025 AT 15:26When I first encountered the DeFiChain airdrop, the jargon and steps felt intimidating, but breaking it down revealed a clear roadmap.

Start by confirming your wallet can sign messages – this is the cornerstone of the Bitcoin‑holder claim.

Next, follow the official portal link, paste the signature, and wait for on‑chain confirmation.

If you opt for the Cake DeFi program, remember the 28‑day lock‑up and the subsequent APY accrual, which can substantially boost your holdings.

The social media drop is simpler: just complete the listed tasks and your DFI will appear in your CMC wallet.

Each pathway has its own risk profile, so match the method to your comfort with technical steps and KYC requirements.

Finally, once you receive DFI, consider staking for steady rewards before moving into liquidity provision or governance participation.

Paul Barnes

November 27, 2025 AT 10:06Every airdrop is just a test to see who will hand over data without question.

John Lee

November 30, 2025 AT 04:46What excites me most about these drops is how they democratize access to DeFi tools, letting everyday users dip their toes into staking, liquidity mining, and governance without needing a hefty upfront investment.

Jireh Edemeka

December 2, 2025 AT 23:26Oh sure, because handing out tokens automatically solves every equity problem – sarcasm aside, it's still a neat way to get people involved.

del allen

December 5, 2025 AT 18:06i get that all the steps can seem like a lot, but just take it slow and double check each link – you won’t mess up if you keep a notebook of what you did.

Jon Miller

December 8, 2025 AT 12:46Guys, this airdrop is the hype we’ve been waiting for – grab it, share the news, and let’s watch our DFI stack grow together!

Nikhil Chakravarthi Darapu

December 11, 2025 AT 07:26Our community must seize these opportunities and showcase our technical superiority on the global stage.