DoveSwap v3 Review: Is This Polygon zkEVM DEX Worth Your Trade?

Jan, 28 2025

Jan, 28 2025

DoveSwap v3 Risk Assessment Calculator

Assess DoveSwap v3 Risk Level

Enter your estimated trade amount and experience level to determine the risk associated with using DoveSwap v3.

Risk Assessment Result

Quick Takeaways

- DoveSwap v3 runs on Polygon zkEVM, offering cheap gas but extremely low trading volume.

- It uses a concentrated‑liquidity AMM similar to Uniswap V3, but only 5 trading pairs are live.

- No security audit has been published, making the protocol high‑risk for anything beyond tiny test trades.

- Average spread sits at ~0.65%; slippage spikes quickly once you move past $20‑$30 trades.

- For most users, established DEXs like Uniswap or PancakeSwap are safer and deeper.

Below is a DoveSwap v3 review that walks you through the platform’s tech, how to get started, what the numbers look like, and whether it makes sense for you.

What is DoveSwap v3?

DoveSwap v3 is a decentralized exchange (DEX) built on the Polygon zkEVM blockchain that implements a concentrated‑liquidity automated market maker (AMM). Launched in 2023, the protocol aims to cut transaction costs by leveraging zero‑knowledge rollups and allowing liquidity providers (LPs) to allocate capital within custom price ranges. The core pricing formula remains the classic constant product model (x*y=k), ensuring every trade preserves the pool’s invariant.

Where does it live? Polygon zkEVM

Polygon zkEVM is a layer‑2 solution that offers Ethereum‑compatible smart contracts while validating transactions with zero‑knowledge proofs. This means you pay gas in MATIC the native token of the Polygon network used to pay transaction fees, and you benefit from sub‑$0.01 fees on most swaps.

How to start using DoveSwap v3

1. Set up a Web3 wallet that supports Polygon zkEVM - MetaMask is the most common choice.

MetaMask a browser extension wallet that lets you connect to any EVM‑compatible network works, but you need to add the zkEVM network manually (RPC URL, chain ID 1101, etc.).

2. Load some MATIC into the wallet for gas.

3. Go to the DoveSwap v3 UI (the URL is listed on the project’s GitHub and Twitter). Click “Connect Wallet”, approve the connection, and you’ll see the five available trading pairs.

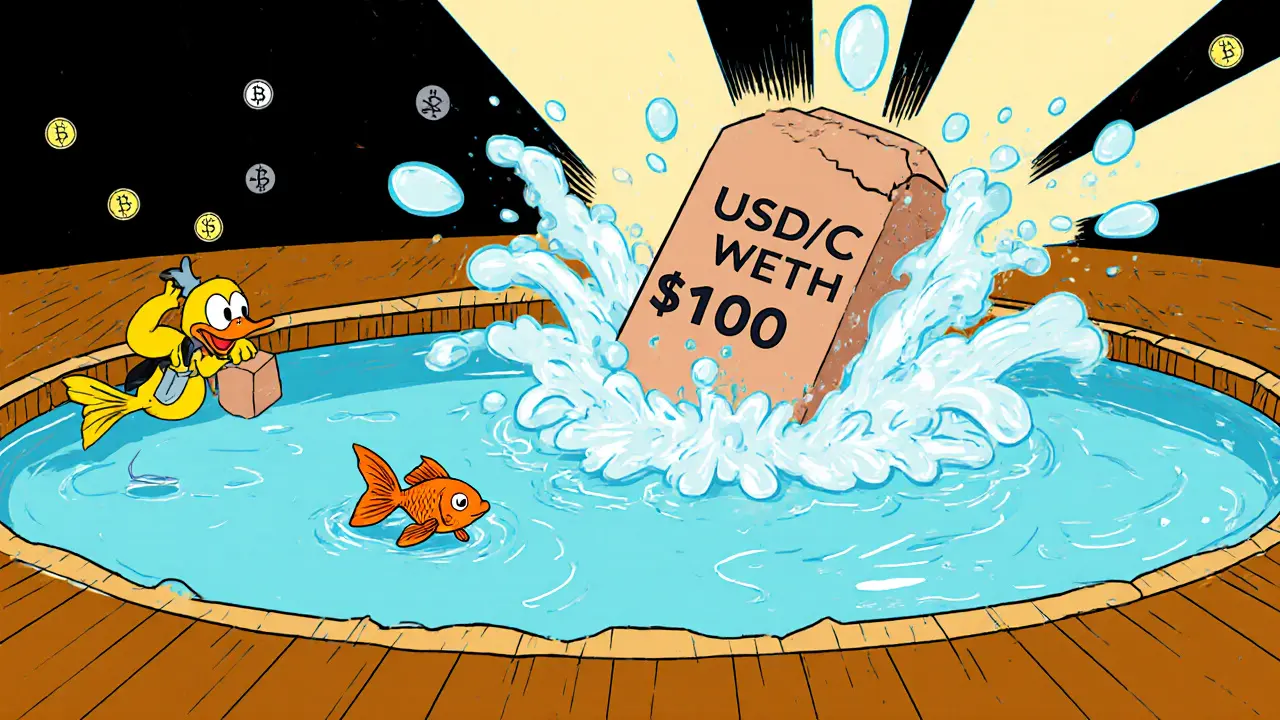

4. To trade, select a pair (e.g., USDC/WETH), enter the amount, and confirm the swap. The UI shows a price impact estimate; given the shallow depth, expect higher impact beyond very small trades.

5. If you want to provide liquidity, click “Add Liquidity”, deposit equal USD value of both tokens, and you’ll receive an LP token that represents your share.

Liquidity snapshot - are the numbers realistic?

According to CoinGecko data from October102025, DoveSwap v3 lists only four coins and five trading pairs. The most active pair, USDC/WETH a stablecoin‑to‑wrapped‑Ether pool, generated $540.07 of 24‑hour volume, accounting for roughly 66.8% of the platform’s total activity. The overall 24‑hour volume sits between $808 and $2,711 across sources, a fraction of a cent compared to Uniswap’s billions‑day flow.

The average bid‑ask spread is 0.648%, which looks decent on paper but hides the fact that tiny order books cause slippage to rise sharply after $30‑$50 trades. A quick test on the UI shows a $100 swap against USDC/WETH would move the price by over 10%-clearly unsuitable for meaningful trades.

Security posture - what’s missing?

One of the biggest red flags is the lack of any published security audit. Neither CertiK, Trail of Bits, nor any other reputable firm has examined the smart‑contract code, according to public repositories. In the DeFi world, unaudited contracts are considered high‑risk, especially after high‑profile exploits in 2022‑2024 that targeted similar AMM designs.

The protocol’s contracts are non‑upgradeable, which means if a vulnerability is discovered, the team would need to launch an entirely new version rather than patching the existing one. This adds operational friction and further discourages trust‑seeking users.

Pros and Cons - a balanced view

| Pros | Cons |

|---|---|

| Very low gas fees thanks to Polygon zkEVM | Extremely low liquidity - high slippage for modest trades |

| Concentrated liquidity model can be capital‑efficient for LPs | No security audit; unaudited smart contracts |

| Simple UI mirrors Uniswap V3, easy for experienced traders | Only 5 trading pairs, limited token selection |

| Fully decentralized - no custodial risk | Minimal community support; no active social channels |

| Zero‑knowledge rollup offers fast finality | No native token for fee discounts or governance |

How does DoveSwap v3 stack up against the big players?

| Feature | DoveSwap v3 | Uniswap (Ethereum) | PancakeSwap (BNB Chain) |

|---|---|---|---|

| Underlying chain | Polygon zkEVM | Ethereum L1 | BNB Smart Chain |

| 24h volume (approx.) | $1k - $3k | $4B+ | $2B+ |

| Liquidity depth (USDC‑pair) | $150 - $200 | $2B+ | $800M+ |

| Gas cost per swap | ≈$0.005 (MATIC) | ≈$2.00 (ETH) | ≈$0.03 (BNB) |

| Concentrated liquidity | Yes (V3‑style) | Yes (V3) | No (standard AMM) |

| Security audit | None | Multiple audits (CertiK, Slowmist) | Audited (PeckShield) |

| Native token | None | UNI | CAKE |

| Community size (Twitter followers) | ~2k | >1.2M | >1.5M |

Even though DoveSwap v3 wins on ultra‑cheap gas, the massive gaps in volume, liquidity, and security make it a niche experiment rather than a mainstream trading hub.

Who might actually use DoveSwap v3?

- Developers testing concentrated‑liquidity logic on a zk‑rollup without paying Ethereum fees.

- Very small‑scale traders who want to move a few dollars and are comfortable with higher slippage.

- Anyone looking for a completely trustless swap with no native token governance-provided they accept the risk of unaudited code.

If you are a retail trader aiming for decent depth, or an institution needing large order execution, you’ll likely look elsewhere.

Future outlook - is DoveSwap v3 likely to improve?

Since its 2023 launch, there have been no visible roadmap updates, no new token launches, and the social media follower count remains stagnant. The broader Polygon zkEVM ecosystem is growing (≈$287M TVL), but other projects on the same chain have attracted more capital and audits. Without a clear upgrade path or an audit, the protocol’s odds of gaining traction appear low. Expect it to stay a low‑volume testing playground unless the team releases a major redesign or partners with an auditor.

Bottom line

DoveSwap v3 showcases what a zk‑rollup DEX can look like: cheap gas, concentrated liquidity, and a clean UI. In practice, the platform suffers from almost non‑existent liquidity, no security audit, and limited token choices. For hobbyists experimenting with tiny swaps or developers needing a sandbox on Polygon zkEVM, it can be useful. For anyone else, sticking with audited, deep‑liquidity DEXs is the safer bet.

Frequently Asked Questions

Is DoveSwap v3 safe to use?

Safety is a major concern because the protocol has never undergone a third‑party audit. While the smart contracts are non‑upgradeable, the lack of audit means any hidden vulnerability could be exploited. Use only test amounts and consider it high‑risk.

What wallets work with DoveSwap v3?

Any EVM‑compatible wallet that can connect to Polygon zkEVM works. MetaMask is the most common; you just need to add the zkEVM network manually. Other options include Trust Wallet and Coinbase Wallet after adding the custom RPC.

How does gas pricing on DoveSwap v3 compare to Uniswap?

Because DoveSwap runs on Polygon zkEVM, a typical swap costs a few thousandths of a dollar (≈$0.005 in MATIC). By contrast, a similar trade on Uniswap L1 today often costs $1‑$3 in ETH gas.

Can I earn fees as a liquidity provider?

Yes. LPs receive a share of swap fees proportional to their position in the pool. However, with such low volume, the fees collected per day are tiny-often less than a few cents.

Does DoveSwap have a native token?

No. The platform does not issue a governance or fee‑discount token, which means there are no additional incentives beyond the basic AMM fees.

Leo McCloskey

January 28, 2025 AT 03:48From a liquidity‑risk standpoint, the protocol exhibits anemic depth, sub‑optimal capital efficiency, and a non‑existent audit surface, thereby contravening best‑practice risk mitigation frameworks; consequently, any trade beyond micro‑scale is statistically predisposed to adverse slippage, impermanent loss, and systemic exposure.

Carol Fisher

January 28, 2025 AT 20:28🇺🇸 This DEX tries to brag about cheap gas, but America’s crypto pioneers know that safety comes first! 🚀💥 If you love our flag, stick to audited platforms – your wallet will thank you. 🙌

Melanie Birt

January 29, 2025 AT 13:08To get started, add the Polygon zkEVM RPC manually in MetaMask: network name "Polygon zkEVM", RPC URL https://zkevm-rpc.com, Chain ID 1101, Symbol MATIC, Explorer https://zkevm.explorer.io. Once added, switch to that network, fund with a few MATIC for gas, and you’ll see the five pairs on the UI. 😊 Make sure to approve the token allowance before swapping.

Siddharth Murugesan

January 30, 2025 AT 05:48i cant beleive people actually trust this shoddy thing. its like handing your cash to a street mager who never learnt the math. liquidity is nada, audit is none, so expect get scammed in a heartbeat.

Hanna Regehr

January 30, 2025 AT 22:28Hey folks, if you’re curious about experimenting, start with just a few dollars – think of it as a sandbox. The low fees are neat, but remember the risk, so keep the amount tiny and learn the ropes before you go bigger. You’ve got this!

Ben Parker

January 31, 2025 AT 15:08🚀🚀🚀 Wow, looks like a fresh playground! If you need any help setting up the wallet, just ping me. 😎

Daron Stenvold

February 1, 2025 AT 07:48In light of the prevailing security concerns, it is prudent to allocate only a fractional portion of your portfolio to this platform, thereby preserving capital integrity while still gaining exposure to the innovative zkEVM environment. Should you decide to provide liquidity, monitor the pool metrics vigilantly.

Emily Kondrk

February 2, 2025 AT 00:28Ever wonder why the so‑called "decentralized" frontier is riddled with hidden backdoors? Some shadowy syndicates might be pulling strings on unaudited code, embedding malicious logic that only emerges under high‑volume stress. Stay alert, question the narrative, and consider the geopolitical implications of entrusting funds to an invisible protocol.

Laura Myers

February 2, 2025 AT 17:08Okay, drama alert: I walked into this DEX expecting fireworks and got a lukewarm sparkler. The UI is cute, but the depth is basically a puddle. If you want excitement, look elsewhere.

Jacob Moore

February 3, 2025 AT 09:48Friendly tip: keep your trades under $20 to stay in the low‑slippage zone. Anything larger will bite you with price impact. Also, double‑check the token addresses to avoid phishing traps.

Manas Patil

February 4, 2025 AT 02:28Namaste! From a cultural perspective, exploring Polygon zkEVM is like tasting a new spice – exciting but you need to start with a pinch. Test the waters with minimal exposure, then gradually increase as you gain confidence.

Annie McCullough

February 4, 2025 AT 19:08I think most people overhype this thing its just a tiny experiment with no real value

Lady Celeste

February 5, 2025 AT 11:48Liquidity is basically zero.

Ethan Chambers

February 6, 2025 AT 04:28Well, if you enjoy watching a hamster run on a wheel, this DEX might amuse you for a fleeting moment, but the underlying economics are as thin as air.

gayle Smith

February 6, 2025 AT 21:08Honestly, this platform feels like a backstage pass to a show that never actually performs. The hype is there, the substance? Not so much.

mark noopa

February 7, 2025 AT 13:48When one contemplates the epistemological underpinnings of decentralized exchange architecture, one must first acknowledge the ontological asymmetry between perceived security and actual vulnerability; the DoveSwap v3 construct epitomizes this dichotomy, masquerading as an avant‑garde solution whilst harboring the latent potential for catastrophic exploit. Moreover, the absence of a third‑party audit serves not merely as an oversight but as a tacit declaration of indifference to communal trust mechanisms, thereby amplifying the systemic risk profile. In practical terms, a trader deploying capital beyond a trivial quantum (> $25) may encounter slippage that escalates precipitously, a manifestation of the shallow order book depth-a quantitative reflection of market inefficiency. The concentrated‑liquidity model, though theoretically capital‑efficient, demands meticulous calibration of price ranges, a nuance often neglected by novice participants, culminating in impermanent loss scenarios. Concurrently, the zkEVM substrate confers sub‑cent gas fees, an alluring proposition that, while economically beneficial, does not offset the paramount concerns of code integrity. Participants should therefore adopt a risk‑averse posture, allocating only a negligible fraction of their portfolio, perhaps <1%, to experimentation, thereby preserving capital sanctity. Finally, the broader DeFi ecosystem illustrates a pattern: protocols that eschew rigorous security auditing invariably succumb to adversarial exploits, as evidenced by historical precedents ranging from the 2022 Poly Network breach to the 2023 Wormhole incident; thus, the prudent path lies in aligning with audited, liquidity‑rich platforms. 🌐🚀

Jade Hibbert

February 8, 2025 AT 06:28Sure, cheap gas sounds nice, but if the platform is a sinking ship, you’ll be the first to go overboard. 🙄

Leynda Jeane Erwin

February 8, 2025 AT 23:08Dear community, while I appreciate the innovative ambition behind the project, I must respectfully advise caution; please ensure thorough due diligence before allocating assets.

Brandon Salemi

February 9, 2025 AT 15:48Quick takeaway: if you’re just testing the UI, go ahead – otherwise, look elsewhere for depth.

hrishchika Kumar

February 10, 2025 AT 08:28Namaste, friends! 🌸 Think of this DEX as a tiny garden – lovely to visit, but you won’t harvest much unless you plant bigger seeds elsewhere. Keep your experiments light and stay curious!