DYORSwap Crypto Exchange Review - Is This Niche DEX Worth Your Money?

Oct, 20 2025

Oct, 20 2025

DYORSwap Fee Calculator

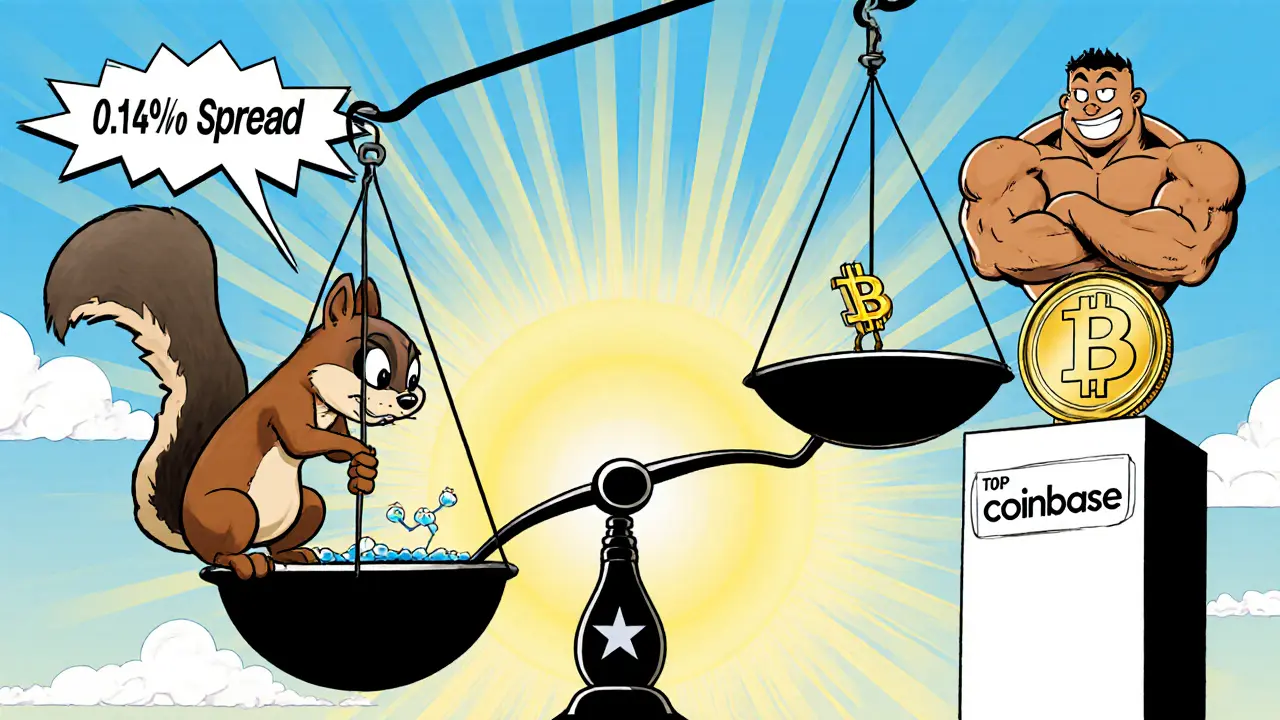

DYORSwap claims "no fees," but the 0.614% bid-ask spread acts as a hidden cost. Calculate how much this spread will cost you on your trade compared to major exchanges.

Fee Breakdown

Your trade: $0.00

DYORSwap hidden fee (0.614% spread): $0.00

Total cost: $0.00

Compared to typical exchange (0.1% fee):

Hidden fee: $0.00

Total cost: $0.00

Important: DYORSwap's 0.614% spread is significantly higher than typical exchanges (0.1% or less). For $1,000 trades, this means losing $6.14 to hidden fees.

When you hear the name DYORSwap is a decentralized cryptocurrency exchange that markets itself around the ‘Do Your Own Research’ mantra, you might wonder whether it’s a hidden gem or just another experimental platform. The short answer? It’s a very niche DEX with just two listed tokens, limited liquidity, and almost no documented features. Below we break down everything you need to know-fees, liquidity, security, and how it stacks up against the heavy‑hitters like Kraken and Coinbase-so you can decide if it deserves a spot in your portfolio.

What Makes DYORSwap Different?

Most crypto traders look for exchanges that offer hundreds of assets, low maker‑taker fees, and robust security tools. DYORSwap flips that script. It only lists two cryptocurrencies and provides five trading pairs, which immediately puts it in the ultra‑niche category. The platform claims to be a pure decentralized exchange (DEX), meaning you trade directly from your wallet via smart contracts, without a custodial order book.

Key Metrics at a Glance

- Listed assets: 2

- Trading pairs: 5

- Average bid‑ask spread: 0.614%

- Volume percentile (CoinGecko): 48th

- Order‑book depth percentile: 26th

- Margin trading: Not offered

- Explicit trading fees: None disclosed (spread acts as hidden cost)

How the Fees Really Work

DYORSwap advertises “no fees,” but the reality is that the bid‑ask spread functions as a built‑in cost. A 0.614% spread is markedly higher than the sub‑0.1% spreads you’ll see on major centralized exchanges for liquid pairs. For a $1,000 trade, that difference translates into about $6.14 lost purely to price slippage-something to keep in mind if you’re a low‑volume trader.

Liquidity - The Real Deal

Liquidity is the lifeblood of any exchange. DYORSwap’s order‑book depth sits in the 26th percentile, meaning you’ll often encounter slippage even on modest trades. By contrast, Kraken’s order‑book depth regularly lands in the top 10 percentile, allowing large orders to execute with minimal price impact. If you plan to trade more than a few hundred dollars at a time, DYORSwap’s thin market could eat into your returns.

Security and Transparency

Security details are a major missing piece for DYORSwap. There’s no public audit report, no disclosed custody solution, and the underlying blockchain isn’t even specified-Ethereum, Solana, or a custom chain? Without a verifiable audit, you’re taking a gamble. In comparison, Kraken highlights cold‑storage, two‑factor authentication, and regular third‑party audits, while Coinbase publishes a detailed security whitepaper.

Given the rise in fraudulent platforms documented by Crypto Legal’s 2025 fraud database, the lack of transparent security measures makes DYORSwap a high‑risk choice.

Feature Set Compared to Industry Leaders

| Feature | DYORSwap | Kraken | Coinbase | Binance US |

|---|---|---|---|---|

| Assets listed | 2 | 350+ | 235 | 158 |

| Trading pairs | 5 | 5,000+ | 3,500+ | 3,000+ |

| Fee structure | No explicit fees; 0.614% spread | Maker 0.00‑0.16%, Taker 0.10‑0.26% | 0‑3.99% (varies by asset) | 0‑0.10% (maker/taker) |

| Liquidity depth | 26th percentile | Top 10 percentile | Top 15 percentile | Top 12 percentile |

| Margin / leverage | None | Up to 5x | None (margin on select assets via Coinbase Pro) | Up to 3x |

| Security audits | None published | Regular third‑party audits | Annual SOC‑2, ISO‑27001 | Annual security audit reports |

| Customer support | No visible channels | 24/7 live chat & email | Phone, chat, email | Live chat, email |

Who Might Actually Use DYORSwap?

Because the platform is so limited, the only realistic use case is for developers testing DEX integrations or hobbyists who want a sandbox with almost no competition. If you’re looking for a place to diversify a portfolio, execute large trades, or rely on proven security, other exchanges are far better choices.

Practical Steps to Get Started (If You Still Want to Try It)

- Set up a non‑custodial wallet compatible with the exchange’s blockchain (e.g., MetaMask if it runs on Ethereum).

- Connect the wallet to the DYORSwap interface-look for a “Connect Wallet” button.

- Deposit one of the two supported tokens. Since there’s no fiat on‑ramp, you’ll need to acquire the asset elsewhere first.

- Choose a trading pair, review the displayed price (watch that 0.614% spread), and confirm the transaction.

- Monitor the transaction on the blockchain explorer to ensure it was mined.

Because there’s no official support, you’ll have to troubleshoot any hiccups yourself-check community forums, GitHub issues, or the platform’s limited documentation if you can find any.

Red Flags to Watch Out For

- Lack of a verifiable launch date or team information.

- No published security audit or audit‑firm name.

- Absence from major exchange rankings (CoinGecko’s “Top 100 Exchanges”, Koinly’s best‑in‑class lists).

- Only two listed assets, which limits investment strategies.

- Higher-than‑average spread acting as a hidden fee.

Bottom Line: Is DYORSwap Worth Your Time?

If you value transparency, liquidity, and security-pretty much every trader does-DYORSwap falls short on all three fronts. It might be an interesting case study for developers or a curiosity for "crypto minimalists," but for everyday trading it offers no clear advantage over established platforms. In the fast‑moving 2025 landscape, where regulators are tightening and users expect robust protection, a DEX with two tokens and no audit simply isn’t a compelling option.

What assets can I trade on DYORSwap?

Only two cryptocurrencies are listed, giving you just five possible trading pairs. The exact tokens aren’t disclosed publicly, so you’ll need to check the platform’s UI for the current list.

Are there any hidden fees on DYORSwap?

The exchange claims zero explicit fees, but the average bid‑ask spread sits at 0.614%, effectively acting as a hidden cost on every trade.

How secure is DYORSwap compared to Kraken or Coinbase?

Security details are sparse-no public audit, no disclosed custody model, and the underlying blockchain isn’t confirmed. In contrast, Kraken and Coinbase publish extensive security whitepapers, third‑party audits, and cold‑storage practices.

Can I use margin or leverage on DYORSwap?

No. DYORSwap does not offer margin trading or leveraged positions, limiting it to spot trades only.

Is DYORSwap suitable for beginners?

Probably not. The platform lacks tutorials, customer support, and a clear fee schedule, making it harder for newcomers to navigate safely.

Jenna Em

October 20, 2025 AT 08:31Every new exchange feels like a secret society, promising freedom while whispering about hidden hands. The name DYORSwap itself sounds like a mantra to keep us obedient, doing our own research while they pull the strings behind the curtain. The fact that they only list two tokens makes the mystery even deeper; perhaps they want every trade to be traceable, or maybe it's a test platform for something larger. In any case, the lack of transparency feels less like openness and more like a veil.

Stephen Rees

October 25, 2025 AT 23:48It’s almost poetic, how the promise of "do your own research" becomes a silent command. If you stare at the numbers long enough, you see a pattern: thin liquidity, no audits, and a spread that silently siphons value. One could argue it’s a sandbox, but perhaps the sandbox is built to observe how naive users behave under the guise of autonomy.

Katheline Coleman

October 31, 2025 AT 14:04While the quantitative analysis presented in the review is thorough, I would like to emphasize the importance of regulatory compliance for any exchange handling user funds. The absence of a published audit report is a significant red flag that should not be overlooked. Furthermore, the limited asset offering constrains diversification strategies for investors seeking broader exposure.

Amy Kember

November 6, 2025 AT 05:20Indeed, the restricted token list hampers portfolio construction; users cannot achieve meaningful hedging without external platforms. Additionally, the thin order‑book depth implies higher slippage on even modest trade sizes, which erodes effective returns.

Evan Holmes

November 11, 2025 AT 20:37Looks like a gimmick.

Isabelle Filion

November 17, 2025 AT 11:53Ah, the ever‑enigmatic DYORSwap-presented as a beacon of decentralisation yet delivering the liquidity of a desert oasis. One must marvel at the audacity to market "no fees" while the spread siphons off unsuspecting traders. The platform's minimalist token roster could be praised for focus, but in practice it feels like an excuse to hide deeper shortcomings. Security? A noble claim without an audit is akin to shouting about a fortress while the walls are made of paper.

Erik Shear

November 23, 2025 AT 03:09I hear the sarcasm, but let’s keep the discourse constructive. Even if the platform is limited, it could serve developers experimenting with DEX integrations, provided they understand the risks. A balanced perspective acknowledges both the novelty and the glaring deficiencies.

Benjamin Debrick

November 28, 2025 AT 18:26While I concur with the desire for a balanced view, it must be emphasized that the lack of verifiable security audits, coupled with an undefined underlying blockchain, elevates the systemic risk to an unacceptable threshold; investors, particularly those unfamiliar with the nuances of smart‑contract vulnerabilities, are effectively navigating a minefield without a map, thereby compromising the very principle of “do your own research” which, in this context, becomes an insurmountable obstacle.

Anna Kammerer

December 4, 2025 AT 09:42For newcomers, the steep learning curve can be daunting. It’s helpful to compare this DEX’s features side‑by‑side with more established platforms, noting that user support channels are essentially nonexistent, which further complicates onboarding.

Nikhil Chakravarthi Darapu

December 10, 2025 AT 00:58From a nationalistic standpoint, supporting home‑grown, transparent platforms should be a priority. Importing obscure services that lack oversight only fuels dependency on foreign tech stacks that may not align with our economic interests.

Lindsey Bird

December 15, 2025 AT 16:15Picture this: a trader, eyes glued to a flickering screen, hoping for a sliver of profit, only to watch the order‑book dissolve like mist. The exchange promises a sanctuary for the "crypto minimalist," yet offers the liquidity of a dried-up well. Each trade feels like stepping onto a rickety bridge, never knowing if it will hold. The spread, a silent predator, devours the modest gains of anyone daring to venture. Meanwhile, the platform's silence on audits becomes a deafening echo in the halls of trust. Users are left to navigate a maze without a map, hoping the walls aren’t moving. The allure of decentralisation, once a beacon, now resembles a mirage on the horizon. With only two tokens, diversification is a fantasy, not a reality. The hidden fees masquerade as market efficiency, while the reality is a thin market that erodes capital. Developers might find a sandbox, but for the average investor, it’s a costly lesson. The absence of customer support turns any hiccup into a midnight nightmare. The platform’s claim of "no fees" is a clever ruse, a magician’s trick that disappears when you look closely. In the grand theater of 2025’s crypto landscape, regulatory scrutiny is tightening, and platforms like this become targets for cautionary tales. Ultimately, the promise of freedom feels hollow without the scaffolding of security, liquidity, and transparency. The decision to engage should be weighed against the stark reality of risk, rather than the seductive glow of novelty.

john price

December 21, 2025 AT 07:31Yo, this DEX is a joke. Even a kid could see the trap, but here we are, diving in like it’s the next big thing. The spread’s a thief, the liquidity’s a ghost, and the security? Forget about it.

Patrick Day

December 26, 2025 AT 22:47Ever wonder why they never mention the code’s provenance? It’s almost as if they’re hiding the very backbone that powers the whole thing. Something smells off, and it’s not just the lack of tokens.

Tom Glynn

January 1, 2026 AT 14:04Totally get the skepticism 🤔. Still, if you’re a dev testing smart‑contract flows, a low‑traffic DEX can be useful – just keep your expectations realistic and your private keys safe. 💡

Johanna Hegewald

January 7, 2026 AT 05:20The core issue here is user education. If traders understand how spreads work and why liquidity matters, they can make informed choices, regardless of the platform.

Prerna Sahrawat

January 12, 2026 AT 20:36While I appreciate the call for education, let us not pretend that an exchange with a mere duo of assets can serve as a comprehensive learning environment. The paucity of trading pairs limits the exposure to diverse market dynamics, which is indispensable for a holistic grasp of decentralized finance. Moreover, the absence of a publicly audited codebase casts a pall over any instructional merit, as students may inadvertently internalize unsafe coding practices. In the grand hierarchy of educational tools, a minimalist DEX occupies a peripheral, perhaps even detrimental, niche, offering at best a shallow glimpse into the complexities that seasoned platforms encapsulate. Therefore, I would advise mentors to steer novices toward more robust ecosystems where risk management, liquidity provision, and security audits are integral components of the curriculum.

Molly van der Schee

January 18, 2026 AT 11:53From an optimism standpoint, any platform that encourages on‑chain trading adds to the overall decentralisation narrative. Even small players contribute to the ecosystem's diversity.

Mike Cristobal

January 24, 2026 AT 03:09👍 True, diversity is good, but diversity without safety is just chaos. 🎯