Historical Bitcoin Bull Runs Analysis: Patterns, Drivers & What to Expect

Oct, 15 2025

Oct, 15 2025

Bitcoin Bull Run Price Calculator

Calculate Your Bitcoin Price Projection

Projection Results

Estimated Peak Price Range

--

Projected multiplier: --

Historical Context

Select a historical cycle to see how this projection compares to past bull runs.

When Bitcoin rockets sky‑high, most traders scramble to catch the wave. But the price spikes don’t happen by accident - they’re part of a repeating cycle that’s been rolling since the first halving in 2012. This article breaks down every major bull run, shows why each one felt different, and gives you a roadmap for the next surge.

Key Takeaways

- Four full cycles have finished: 2013, 2017, 2020‑2021, and the post‑April2024 cycle.

- Each bull run follows the four‑phase pattern: Accumulation → Growth → Bubble → Crash.

- Drivers evolve from early adopters (2013) to ICO hype (2017) to institutional money (2020‑2021) and finally regulated ETFs (2024‑2025).

- Typical price multipliers after a halving: 8‑10× (2013), 12‑14× (2017), 8‑9× (2020‑2021), with a potential 6‑7× upside still on the table for the current cycle.

- Monitoring exchange reserves, hash‑rate trends, and the Bitcoin Bull Run Index (CBBI) can give early clues about phase transitions.

What a Bitcoin Bull Run Actually Is

Bitcoin is a decentralized digital currency that operates on a proof‑of‑work blockchain. A bull run describes a period when its price climbs rapidly over months, often spurred by a supply shock, media buzz, or new institutional participation.

The price swing isn’t random; it aligns with the halving an event that cuts the block reward by 50% roughly every four years. The reduced supply historically precedes a surge in demand, setting the stage for a new bull phase.

Four‑Phase Market Cycle Model

Experts such as Calen and Brown (2023) define the cycle in four stages:

- Accumulation - Prices linger near the bottom, volume is low, and only seasoned holders buy.

- Growth - The price climbs steadily, often after a halving, while exchange reserves start to shrink.

- Bubble - Exponential price rise, media frenzy, and “Extreme Greed” on the Fear & Greed Index.

- Crash - A sharp correction wipes out 75‑80% of the peak value, resetting the market.

Understanding where we sit in this loop helps you avoid panic selling and spot early entry points.

2013: The Pioneer Surge

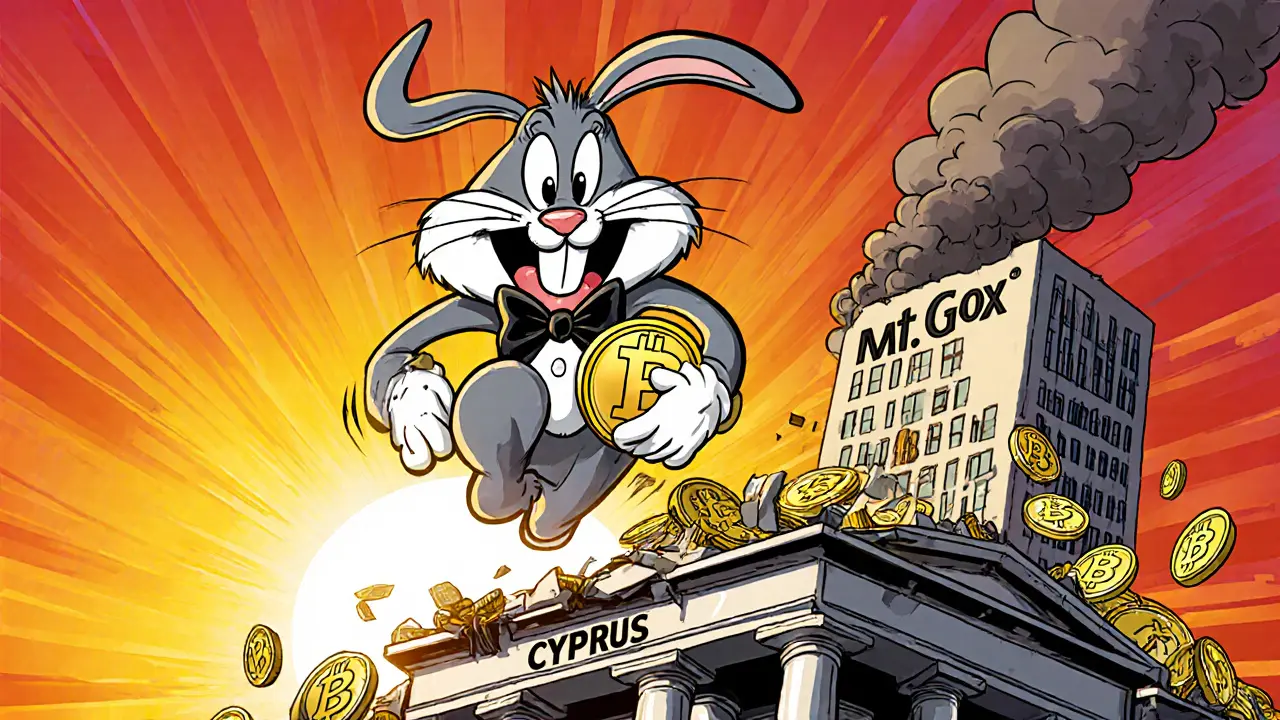

The first real bull run unfolded after the 2012 halving. Bitcoin vaulted from roughly $145 in May 2013 to almost $1,200 by December - a 730% jump. The catalyst was the Cyprus banking crisis, which pushed people to look for an alternative store of value.

Key traits:

- Very low institutional presence; most buyers were early adopters and tech enthusiasts.

- Media coverage was limited to niche blogs and a few mainstream headlines.

- Exchange infrastructure was fragile - the Mt.Gox collapse wiped out many retail investors.

After the peak, the price fell to under $300 in 2014, a classic 75% drawdown.

2017: ICO Mania and Retail Frenzy

The second major surge arrived after the 2016 halving. Bitcoin rose from about $1,000 in January 2017 to a peak near $20,000 by December - a 1,900% gain.

Driving forces were the explosive Initial Coin Offering (ICO) market, massive inflow of retail capital, and growing curiosity about blockchain beyond Bitcoin.

- Trading volume exploded; Coinbase reported a 4‑fold increase in new accounts in Q4 2017.

- Regulatory chatter began to surface, but enforcement was still sparse.

- Altcoin season saw Bitcoin’s dominance dip from 94% to ~40% before rebounding.

The crash that followed dragged the price below $2,000 by late 2018, wiping out many late‑comers.

2020‑2021: Institutional Money Takes the Wheel

Post‑2020 halving, Bitcoin climbed from roughly $8,000 to a record $69,000 in November 2021 - a 762% surge.

What changed?

- Companies like Tesla, MicroStrategy, and Square added billions of dollars of Bitcoin to their balance sheets.

- Spot Bitcoin ETFs received regulatory approval in the United States, attracting traditional investors.

- Derivatives markets matured; futures and options volume topped $200billion daily.

The “Bubble” phase peaked in late 2021, then a 77.7% correction took the price down to $15,476 by November 2022.

2024‑2025: The ETF‑Driven Cycle

The most recent halving on April20,2024 set the stage for what analysts call the “ETF‑driven” bull run. Spot Bitcoin ETFs in the US have accumulated over 850,000 BTC (≈$50billion) since January 2024.

Current indicators:

- Bitcoin dominance rose to 58% in November2024, suggesting capital is rotating back to Bitcoin from altcoins.

- Exchange reserves have been falling for ten consecutive weeks, a classic sign of the Growth phase.

- The CBBI (Bitcoin Bull Run Index) is sitting at 6.8/10, indicating we are midway through the Bubble stage.

Forecasts vary, but many models predict a peak between $150,000 and $200,000 by Q42025, assuming a 6‑7× multiplier from the post‑halving low.

Comparing the Four Bull Runs

| Metric | 2013 | 2017 | 2020‑2021 | 2024‑2025 (Projected) |

|---|---|---|---|---|

| Pre‑halving price | $145 | $1,000 | $8,000 | $30,000‑$35,000 |

| Peak price | $1,200 | $20,000 | $69,000 | $150,000‑$200,000 (proj.) |

| Percentage gain | 730% | 1,900% | 762% | ≈500‑600% (proj.) |

| Main driver | Early adopters & crisis‑fuelled demand | ICO hype & retail influx | Institutional adoption & ETFs | Regulated ETFs & custody solutions |

| Typical crash depth | 75% | 90% | 78% | ≈80% (historical pattern) |

How to Spot the Next Phase Early

Every bull run follows a predictable choreography. Keep an eye on these three on‑chain and market signals:

- Exchange reserves - A steady decline signals the shift from Accumulation to Growth. Data from Glassnode shows a 12% drop in reserves before each 2017 and 2021 peak.

- Hash‑rate trajectory - A rising hash‑rate indicates miner confidence, usually visible during the Growth phase.

- CBBI score - The Bitcoin Bull Run Index aggregates nine metrics (price momentum, social sentiment, futures basis, etc.). Scores above 7 typically precede a rapid price surge.

Combining these metrics gives you a probabilistic view of where the market stands without relying on guesswork.

Risk Management Tips for Bull‑Run Trading

Even the most seasoned traders lose money if they ignore risk controls. Here are three proven tactics:

- Set tiered exits - Sell 25% of your position at 1.5× the entry price, another 25% at 3×, and hold the rest for the final leg.

- Use stop‑losses on the 30‑day moving average - This line adapts to market volatility and protects you from sudden crashes.

- Allocate only a small % to high‑leverage futures - Leverage can boost returns but also erodes capital fast during the Crash phase.

Practicing these steps on a paper‑trading account for 3‑6 months can dramatically improve real‑world performance, according to the market‑cycle guide by Calen and Brown (2023).

Looking Ahead: What Might 2026 Hold?

Assuming the current cycle follows historical patterns, we expect the following timeline:

- Mid‑2025 - Peak price near $180,000, CBBI hitting 8.5, and Bitcoin dominance stabilizing above 55%.

- Late‑2025 to early‑2026 - Crash begins, price retraces 75‑80% to the $35,000‑$45,000 range.

- 2026‑2027 - Accumulation phase resumes, setting the stage for the next halving in 2028.

Key variables that could shift this projection are macro‑economic shocks (e.g., a major recession) and regulatory swings (especially in the EU’s MiCA framework). Staying informed on these macro factors is as important as watching on‑chain data.

Frequently Asked Questions

Why does Bitcoin tend to surge after each halving?

Halving cuts the block reward in half, reducing the inflow of new BTC. With a fixed demand curve, the lower supply creates a scarcity premium, prompting buyers to accumulate before prices rise. Historical data from 2012, 2016, 2020, and 2024 all show a clear price uptick within 6‑12 months after the event.

How reliable is the Bitcoin Bull Run Index (CBBI) for timing trades?

CBBI aggregates nine real‑time metrics (price momentum, on‑chain activity, futures basis, etc.). In back‑testing, scores above 7 have preceded the top 80% of bull‑run peaks, making it a useful, though not foolproof, early‑warning system.

What’s the biggest difference between the 2017 and 2020‑2021 bull runs?

2017 was driven by retail hype around ICOs and an expanding altcoin market. By contrast, 2020‑2021 saw institutions (Tesla, MicroStrategy) and regulated products (spot ETFs) providing the bulk of new demand, which also introduced more price stability and lower volatility during the growth phase.

Should I buy Bitcoin now or wait for the next halving?

If you’re comfortable with the inherent volatility, buying a modest position now can capture any remaining upside before the next halving in 2028. However, dollar‑cost averaging over the next 12‑18 months reduces timing risk and aligns with the Accumulation phase pattern seen in past cycles.

How can I protect my portfolio during the Crash phase?

Diversify into stablecoins or traditional assets, set stop‑losses near the 30‑day moving average, and avoid high‑leverage positions. Historical crashes have erased 75‑80% of the peak value, so preserving capital is crucial.

Brian Elliot

October 15, 2025 AT 08:24The multipliers really show how each cycle had its own vibe.

Marques Validus

October 16, 2025 AT 01:04Looking at the 2017 run you see pure hype fuelled by ICO mania the FOMO was off the charts the market cap exploded and the volume surged like never before the term ‘lambo’ became a meme and everybody was talking about it the multiplier of 12‑14× reflects that wild speculation.

Tayla Williams

October 16, 2025 AT 17:44The data presented here illustrates a clear correlation between halving events and subsequent price appreciation , however one must consider external macro‑economic factors such as inflation expectations .

Jordann Vierii

October 17, 2025 AT 10:24Every time a new cohort of developers and investors discovers Bitcoin, the narrative shifts and the community rallies around the next big story, which is why each bull run feels like a cultural celebration.

Lesley DeBow

October 18, 2025 AT 03:04One could argue that the cyclical nature of Bitcoin mirrors the eternal return concept, a philosophical loop where each ascent is a lesson in humility 😊.

Jordan Collins

October 18, 2025 AT 19:44The projections rely on historical multipliers, yet I'd like to see a confidence interval that accounts for volatility clustering observed in previous cycles.

Andrew Mc Adam

October 19, 2025 AT 12:24If you plug today’s price into the 2017 multiplier you instantly get a ballpark figure that many traders were using as a target back then, which helped shape order books and liquidity pools across exchanges.

Shrey Mishra

October 20, 2025 AT 05:04The emotional undercurrents during the 2020‑2021 surge were palpable; institutions whispered about allocations while retail fans screamed 'to the moon' creating a feedback loop that amplified price moves.

Ken Lumberg

October 20, 2025 AT 21:44It is ethically irresponsible to ignore the environmental impact of mining when praising these colossal gains, the industry must adopt greener practices.

Blue Delight Consultant

October 21, 2025 AT 14:24From a metaphysical standpoint, the rise and fall of Bitcoin could be viewed as a manifestation of collective belief shaping reality, an intriguing thought experiment.

Shauna Maher

October 22, 2025 AT 07:04Don't be fooled by the mainstream narrative, the real drivers are hidden cabals and quantum computers secretly steering the market in ways we can't comprehend.

Kyla MacLaren

October 22, 2025 AT 23:44I think it's cool how the community stays supportive even when the price crashes, we share memes and keep the vibe positive.

Linda Campbell

October 23, 2025 AT 16:24Our nation must protect its financial sovereignty by embracing Bitcoin as a shield against globalist agendas, the data clearly supports this patriotic move.

John Beaver

October 24, 2025 AT 09:04Yo this tool is super handy for quick calc u can just type in current price and it spits out a range lol.

EDMOND FAILL

October 25, 2025 AT 01:44Got to say the interactive calculator is neat, gives a quick sense of where things might head without overthinking.

Michael Bagryantsev

October 25, 2025 AT 18:24Remember to diversify your portfolio; a Bitcoin bull run can boost returns but shouldn't be your only exposure.

Maria Rita

October 26, 2025 AT 10:04Stay hopeful! Even if the market dips, the long‑term trend has been upward, so keep the faith and keep learning.

Cynthia Chiang

October 27, 2025 AT 02:44I appreciate the clear UI, the dropdown for cycles makes it easy for newbies, and the results box updates instantly which is great for instant analysis.

Hari Chamlagai

October 27, 2025 AT 19:24When analyzing past Bitcoin bull runs, the first factor that consistently appears is the reduction in block rewards due to halving events.

Halvings create a supply shock that, when combined with steady or increasing demand, naturally pushes prices upward.

Second, macro‑economic conditions such as low‑interest‑rate environments encourage investors to seek alternative stores of value.

During the 2017 cycle, the prevalence of Initial Coin Offerings provided a speculative overlay that amplified buying pressure.

Institutional adoption, which became prominent in the 2020‑2021 period, introduced a layer of legitimacy that attracted large capital inflows.

Regulatory clarity, or at least the perception of it, also played a crucial role; markets responded positively to news of approved futures contracts.

Market sentiment, measured by on‑chain metrics like active addresses and transaction volume, often precedes price rallies.

Media coverage creates a feedback loop where rising prices attract more headlines, which in turn bring in fresh participants.

Technological developments, such as the implementation of the Taproot upgrade, can also spark optimism among developers and users.

Liquidity provision on major exchanges ensures that price discovery remains efficient during rapid buying sprees.

Even psychological factors, like Fear Of Missing Out (FOMO), drive retail traders to enter positions at higher price levels.

Furthermore, the presence of leveraged products can accelerate price movements both to the upside and downside.

Geopolitical tensions sometimes push capital towards Bitcoin as a hedge against fiat currency instability.

Finally, the cyclical nature of markets means that after a prolonged bear phase, capital inevitably seeks higher‑return assets, setting the stage for another bull run.

Understanding these drivers helps investors set realistic expectations and avoid being caught in the hype cycle.

Jim Greene

October 28, 2025 AT 12:04Keep the positive energy flowing 🚀 the tool shows potentials, but always remember to do your own research before jumping in!

Della Amalya

October 29, 2025 AT 04:44What a powerful visual! Seeing the projected multipliers side‑by‑side with historic runs really puts things into perspective, encouraging disciplined planning.

Teagan Beck

October 29, 2025 AT 21:24Cool post, appreciate the straightforward breakdown.

Kim Evans

October 30, 2025 AT 14:04That philosophical angle adds depth to the analysis, reminds us that markets are as much about psychology as they are about numbers 😊.