How Alipay and WeChat Pay Enforce China's Crypto Ban in 2025

Dec, 2 2025

Dec, 2 2025

China doesn’t just ban cryptocurrency-it makes sure you can’t even pay for it. Since 2021, the government has outlawed all crypto trading, mining, and payments. But the real power behind that ban isn’t in laws on paper. It’s in your phone. Alipay and WeChat Pay are the enforcers. They’re not just payment apps-they’re financial gatekeepers, controlled by the state to shut down crypto at the point of use.

How the Ban Actually Works

If you try to send money to a crypto exchange through Alipay or WeChat Pay, the transaction gets blocked before it even leaves your phone. No warning. No explanation. Just a red error message: "Transaction declined due to regulatory restrictions." This isn’t a glitch. It’s intentional. Both platforms use real-time monitoring systems that scan every payment for signs of crypto activity. They look for known exchange wallet addresses, OTC trading keywords, mining pool URLs, and even suspicious patterns like repeated small payments to the same recipient. If the system flags it, the payment dies. Your account might get flagged for review. In serious cases, your identity could be reported to the People’s Bank of China.These systems don’t just block payments. They track behavior. If you’ve sent money to a crypto site once, and then suddenly start sending small amounts to random individuals, the system starts watching you closer. That’s not paranoia-it’s how the state keeps control.

Who’s Behind the Enforcement?

You might think this is just Ant Group and Tencent making business decisions. It’s not. They’re following orders from a web of Chinese regulators: the People’s Bank of China, the National Administration of Financial Regulation, the Cyberspace Administration, and even the Ministry of Public Security. These agencies don’t just give guidelines-they demand compliance. And they audit.State-owned banks are part of the same system. When you link your bank account to Alipay or WeChat Pay, you’re not just connecting to a payment app. You’re connecting to a state-controlled financial pipeline. If crypto activity is detected anywhere in that pipeline, the entire chain locks down. No bank, no payment app, no crypto.

Why WeChat Pay Is the Harder Target

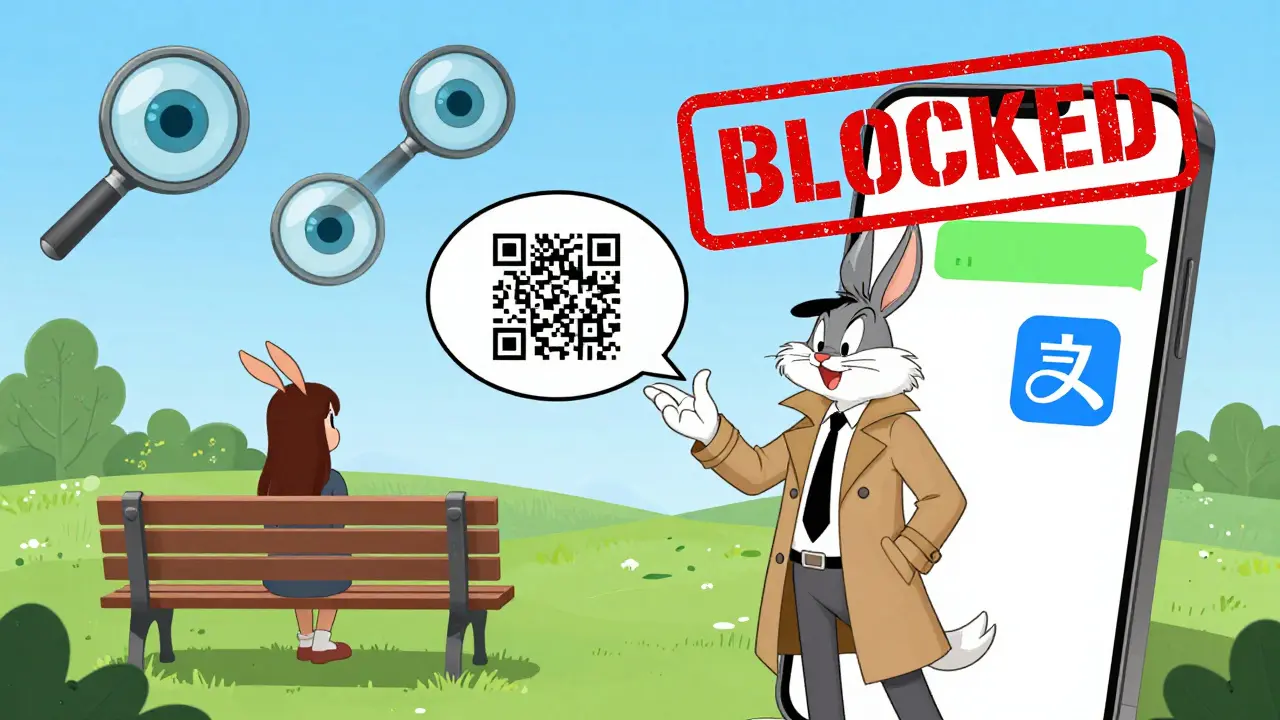

WeChat Pay has a secret weakness: it’s not just a payment tool. It’s a messaging app. And in China, where privacy is limited, WeChat’s encrypted chats are one of the few places people can still talk freely.Crypto traders have adapted. They don’t send money through WeChat Pay to buy Bitcoin. Instead, they use WeChat chat to coordinate. They share wallet addresses. They send QR codes for OTC trades. They arrange meetups in parks to exchange cash for crypto. The payment happens off-platform. The planning happens inside WeChat.

Law enforcement can’t read those messages. Tencent won’t hand over chat logs to foreign authorities. And even Chinese regulators can’t easily track what’s being said unless someone reports it. That’s why WeChat is now a gray zone-officially banned for crypto payments, but unofficially used to run crypto networks.

What You Can’t Do (And What You Can)

Here’s what’s blocked:- Buying Bitcoin, Ethereum, or any coin through Alipay or WeChat Pay

- Paying for mining equipment or cloud mining services

- Using crypto as payment in stores or online

- Transferring money to overseas exchanges like Binance or Coinbase

- Using stablecoins like USDT or USDC for transactions

Here’s what’s still possible-but risky:

- Buying crypto through OTC dealers who meet in person

- Using foreign payment apps like PayPal or Wise (if you have overseas accounts)

- Trading on decentralized exchanges via VPNs (though this can trigger account freezes)

- Participating in government-approved blockchain projects like the mBridge CBDC pilot

There’s no legal gray area. Even if you don’t use Alipay or WeChat Pay, if you’re caught trading crypto in China, you could face fines, asset seizure, or criminal charges. The Shanghai State-owned Assets Supervision and Administration Commission said in July 2025 that they’re watching digital assets closely-but they didn’t say they’d change the ban.

China’s Alternative: The e-CNY

While private crypto is banned, China is building its own digital currency: the e-CNY. It’s not blockchain. It’s not decentralized. It’s not anonymous. It’s a digital version of the yuan, controlled entirely by the People’s Bank of China.Alipay and WeChat Pay are now the main ways people use e-CNY. You can pay for groceries, bus rides, and even utility bills with it. But here’s the catch: every transaction is tracked. The government knows who you paid, how much, and when.

This isn’t a compromise. It’s a replacement. China doesn’t want you to own crypto. It wants you to use its version of money-where control, not freedom, is the point.

The Real Cost of the Ban

For most people, the ban works. They never think about crypto. They use Alipay to pay for food, WeChat Pay to send red envelopes. It’s convenient. It’s safe. They don’t miss what they never had.But for others, the cost is real. Entrepreneurs can’t access global crypto markets. Developers can’t build on open blockchains. Investors lose exposure to a growing asset class. Even ordinary users who want to store value outside the banking system have no legal option.

And yet, the ban isn’t failing-it’s evolving. As criminals use WeChat to coordinate crypto deals, regulators are upgrading their monitoring tools. They’re training AI to detect patterns in chat logs, payment timing, and location data. The goal isn’t just to block payments. It’s to predict and prevent crypto use before it happens.

What’s Next?

China’s crypto ban isn’t going away. Not in 2025. Not in 2026. The state sees private crypto as a threat to financial control, capital flow, and monetary sovereignty. Alipay and WeChat Pay aren’t just apps-they’re tools of economic policy.The future will be more surveillance, not less. More AI monitoring. More automated blocks. More pressure on Tencent to give up user data. And more people finding ways around it-through cash, offshore accounts, or peer-to-peer deals.

But here’s the truth: if you’re in mainland China and you want to use crypto, you’re already operating outside the law. Alipay and WeChat Pay won’t help you. They’re built to stop you.

Can I still buy crypto using Alipay or WeChat Pay in China?

No. Any attempt to send money to a crypto exchange, OTC dealer, or wallet address through Alipay or WeChat Pay will be automatically blocked. The systems are designed to detect and reject these transactions in real time. If you try, your payment will fail, and your account may be flagged for review by financial regulators.

Why is WeChat Pay harder to enforce than Alipay for crypto bans?

WeChat Pay is tied to WeChat, China’s dominant encrypted messaging app. While Alipay is purely a payment platform, WeChat allows users to communicate privately. Criminals use WeChat chats to coordinate crypto trades-sharing wallet addresses, QR codes, and meeting locations-without ever using the payment function for the actual crypto exchange. This off-platform coordination is invisible to transaction monitors, making enforcement much harder.

Are there legal ways to use cryptocurrency in China?

No. All private cryptocurrency trading, mining, and payments are illegal under Chinese law as of 2025. Even holding crypto is not explicitly illegal, but any transaction involving it-buying, selling, exchanging-is prohibited. The only legal digital currency is the e-CNY, China’s government-controlled central bank digital currency, which is distributed through Alipay and WeChat Pay.

What happens if I’m caught trading crypto in China?

Consequences vary. First-time offenders might face account freezes or fines. Repeated or large-scale activity can lead to criminal charges under laws against illegal fundraising or unauthorized foreign exchange. Assets linked to crypto transactions can be seized. There have been cases where individuals were sentenced to prison for operating OTC crypto services.

Can I use a VPN to access crypto exchanges from China?

Technically, yes-but it’s risky. While a VPN lets you bypass internet blocks, your bank and payment apps still monitor your financial activity. If you link your Alipay or WeChat Pay account to an overseas exchange, even via VPN, the transaction may still be flagged. Your account could be frozen, and you could be reported to authorities. The risk isn’t just technical-it’s legal.

Is the e-CNY the same as Bitcoin or other cryptocurrencies?

No. The e-CNY is a digital version of the Chinese yuan, fully controlled by the People’s Bank of China. Unlike Bitcoin, it’s not decentralized, not anonymous, and not built on public blockchain. Every transaction is tracked by the government. It’s designed to replace cash, not compete with crypto. In fact, it’s part of China’s strategy to eliminate private digital currencies entirely.

Why doesn’t China just allow regulated crypto like Singapore or Hong Kong?

China’s priority isn’t innovation-it’s control. Singapore and Hong Kong allow crypto because they want to attract global finance. China wants to prevent capital flight, maintain monetary sovereignty, and avoid financial instability. Allowing private crypto-even under regulation-would mean giving up control over money flows. The state prefers a system where it owns the digital money, not the people.

Heather Hartman

December 2, 2025 AT 22:38Marsha Enright

December 4, 2025 AT 16:18Andrew Brady

December 5, 2025 AT 09:12Althea Gwen

December 7, 2025 AT 06:48Durgesh Mehta

December 8, 2025 AT 20:03Sarah Roberge

December 10, 2025 AT 04:49Jess Bothun-Berg

December 11, 2025 AT 14:07Rod Filoteo

December 12, 2025 AT 11:36Layla Hu

December 14, 2025 AT 07:29Nora Colombie

December 15, 2025 AT 21:05Mark Stoehr

December 17, 2025 AT 16:25Vidyut Arcot

December 18, 2025 AT 01:50Melinda Kiss

December 18, 2025 AT 12:52Nancy Sunshine

December 19, 2025 AT 18:25Alan Brandon Rivera León

December 19, 2025 AT 19:54Ankit Varshney

December 20, 2025 AT 22:39Ziv Kruger

December 22, 2025 AT 22:28Paul McNair

December 23, 2025 AT 23:58Mohamed Haybe

December 24, 2025 AT 01:16Sharmishtha Sohoni

December 24, 2025 AT 18:35Steve Savage

December 25, 2025 AT 22:13