Hydax Exchange Review 2025: Fees, Security, and Alternatives

Mar, 12 2025

Mar, 12 2025

Hydax Exchange Comparison Tool

Fee Structure

Spot Fee: 0.20%

Contract Fee: 0.02%/0.06% (maker/taker)

Asset Support

Over 100 cryptocurrencies including Bitcoin and Ethereum

Security Measures

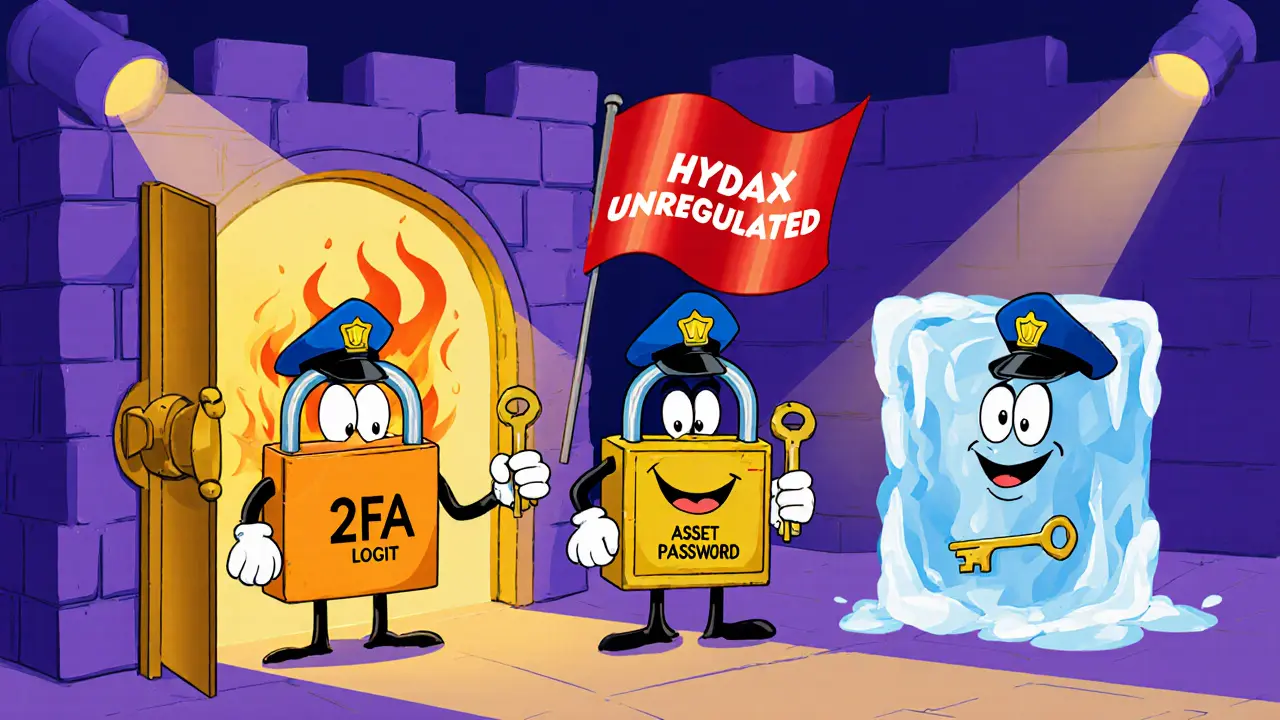

2FA, separate passwords, hot-cold wallet split

Unregulated

Withdrawal Fees

No proprietary fees – only blockchain network costs

Regulated Alternatives

Consider these regulated exchanges for enhanced protection:

- Kraken – U.S.-registered with robust compliance

- Binance US – American arm of global Binance network

- Coinbase – Publicly traded with strong regulatory stance

Comparison Table

| Feature | Hydax | Kraken | Binance US | Coinbase |

|---|---|---|---|---|

| Spot Fee | 0.20% | 0.16% (0.00% for VIP) | 0.10% (0.02% for VIP) | 0.00% (0.50% for card payments) |

| Contract Fee | 0.02%/0.06% | 0.00% (0.00% for VIP) | 0.02% (0.01% for VIP) | N/A |

| Assets Supported | 100+ | 300+ | 300+ | 300+ |

| Regulation | Unregulated | U.S. Regulated | U.S. Regulated | U.S. Regulated |

| Security | 2FA, Hot-Cold | 2FA, Insurance | 2FA, Insurance | 2FA, Insurance |

Recommendation

Hydax offers competitive fees and a solid asset selection, but lacks regulatory oversight. For traders prioritizing security and regulation, consider Kraken, Binance US, or Coinbase.

Looking for a straight‑up take on Hydax Exchange? This review breaks down what the platform actually offers, how its fees stack up, whether its security measures hold water, and which regulated alternatives might give you a better balance of cost and safety.

Key Takeaways

- Hydax charges a flat 0.20% spot fee and a 0.02%/0.06% maker/taker fee for contracts - decent but not the lowest in the market.

- It supports over 100 cryptocurrencies, including the big names like Bitcoin the original decentralized digital currency and Ethereum a programmable blockchain powering DeFi and NFTs, but falls short of giants that list 300+ assets.

- Security relies on 2FA, separate login and asset passwords, and a hot‑cold wallet split, yet the exchange remains unregulated - a red flag for many traders.

- No proprietary withdrawal fees - you only pay the blockchain network cost, which can save a few dollars on each move.

- If regulatory protection and insurance matter to you, platforms like Kraken a U.S.-registered exchange with robust compliance, Binance US the American arm of the global Binance network, or Coinbase a publicly traded exchange known for its strong regulatory stance may be better fits.

Carol Fisher

March 12, 2025 AT 21:29Anyone who trusts an unregulated exchange like Hydax is practically handing over their hard‑earned dollars to wolves 🇺🇸🦅!

Melanie Birt

March 13, 2025 AT 06:17Hydax’s 0.20% spot fee is decent for casual traders, but the maker/taker split on contracts (0.02%/0.06%) can bite you on high‑frequency strategies. Its 2FA and hot‑cold wallet architecture are standard, yet the lack of insurance means you’re on your own if something goes wrong. For anyone looking to diversify beyond the big three regulated platforms, Hydax can serve as a low‑cost entry point. Just remember to keep the withdrawal addresses whitelisted and double‑check network fees before moving large sums :)

debby martha

March 13, 2025 AT 15:05i read the review and honestly it sounds like just another copy‑paste. 100+ coins? meh, most of ’em are junk. fees ain’t that bad but why even bother with an unregulated site?

Orlando Lucas

March 13, 2025 AT 23:53When we consider the nature of trust in digital markets, we realize that it is less a product of corporate promise and more a communal contract, forged by countless individual decisions. Hydax, with its unregulated status, places the onus of vigilance squarely on the user, demanding a depth of understanding that many newcomers lack. The fee structure, while transparent, masks the hidden costs of potential security breaches that are not covered by any insurance scheme. A 0.20% spot fee may seem modest, yet if a hack were to occur, the financial loss could dwarf that saving many times over. Moreover, the hot‑cold wallet split, although a common safeguard, is only as strong as the operational discipline of the exchange’s staff. In contrast, regulated platforms like Kraken and Coinbase embed custodial insurance that provides a safety net, albeit at a higher fee. This trade‑off is not simply about price; it reflects a philosophical choice between autonomy and collective protection. Users must weigh whether they value the freedom of operating outside the jurisdictional bounds, or the reassurance that comes from regulatory oversight. The presence of 2FA and separate passwords is a baseline security measure, but it does not address systemic vulnerabilities such as insider threats. As the crypto ecosystem matures, we may see a convergence where unregulated entities adopt self‑imposed standards akin to those enforced by law. Until then, the onus remains on the individual to conduct due diligence, diversify exposure, and perhaps allocate only a portion of their portfolio to riskier venues. If you view your crypto holdings as a long‑term store of value, the volatility of an unregulated exchange may be an unacceptable gamble. Conversely, for speculative traders who thrive on low fees and rapid execution, Hydax could be a viable tool in a broader strategy. Ultimately, the decision is a personal calculus, informed by one’s risk tolerance, technical competence, and philosophical stance on freedom versus security. Remember that every transaction leaves a digital footprint, and that footprint can be both a shield and a scar depending on the environment in which it is cast.

Philip Smart

March 14, 2025 AT 08:41Look, you can philosophize all you want, but the bottom line is Hydax doesn’t have the insurance Kraken boasts, and that’s a deal‑breaker for most traders.

Nina Hall

March 14, 2025 AT 17:29Great rundown! 🌈 If you’re just starting out, Hydax can be a decent sandbox, but once you’re ready to scale, the regulated options give you peace of mind and a smoother ride.

Lena Vega

March 15, 2025 AT 02:17Hydax = low fees, high risk.

Sanjay Lago

March 15, 2025 AT 11:05For folks in India, the fee structure looks attractive, especially the zero proprietary withdrawal fees. Just make sure you’ve enabled both 2FA and the separate asset password; that double layer is your first line of defense. Also, keep an eye on network congestion – sometimes the blockchain costs can spike unexpectedly.

arnab nath

March 15, 2025 AT 19:53Don’t be fooled – those “defenses” are just a veil. Unregulated exchanges are breeding grounds for hidden backdoors, and the moment they get a subpoena, your assets vanish without a trace.

Nathan Van Myall

March 16, 2025 AT 04:41The review mentions over 100 assets, but many of those are low‑volume tokens with poor liquidity. If you plan to trade on volume, stick to the major pairs on Kraken or Coinbase to avoid slippage.

Manas Patil

March 16, 2025 AT 13:29From a fintech perspective, Hydax operates in a gray regulatory niche, leveraging a hybrid custody model that blends hot‑wallet liquidity with cold‑storage cold‑chain protocols. While this architecture can reduce latency for high‑frequency trades, the absence of a custodial insurance policy raises systemic risk, especially under market stress scenarios.

Annie McCullough

March 16, 2025 AT 22:17yeah but the jargon doesnt matter if the fees are lower and you can move coins fast lets face it

Lady Celeste

March 17, 2025 AT 07:05Another “review” trying to sound objective while ignoring the nightmare of losing funds on an unregulated platform.

Ethan Chambers

March 17, 2025 AT 15:53One must admit the melodrama is overblown; the market thrives on risk appetite, and a platform like Hydax simply caters to a niche segment that values cost efficiency over regulatory comfort.

gayle Smith

March 18, 2025 AT 00:41Sure, the drama is real, but the real issue is liquidity depth – without deep order books, even a modest trade can cause price impact, turning your ‘cheap’ fees into hidden costs.

mark noopa

March 18, 2025 AT 09:29When we dissect the anatomy of exchange choice, we encounter a tapestry woven from threads of cost, security, and human psychology 😊. Hydax presents itself as the frugal sibling, boasting a 0.20% spot fee that whispers sweet promises to the budget‑conscious trader. Yet, beneath that modest veneer lies an unregulated framework that flies under the radar of governmental oversight, a fact that should prick the conscience of any diligent investor. The dual‑password system and 2FA are akin to a lock on the front door while the back window remains ajar. In the world of crypto, where hacks are as common as coffee runs, such half‑measures can feel like a false sense of security. Comparatively, Kraken, Binance US, and Coinbase don’t just sell you a service; they package insurance, compliance, and a reputation built over years, albeit at a premium. This premium, however, can be rationalized as a hedge against the existential threat of fund loss. Moreover, the lack of proprietary withdrawal fees on Hydax is attractive, but network congestion fees can still nibble away at your profits, especially during peak market volatility. If you’re a day trader chasing micro‑gains, the low fee structure might justify the gamble, but if your strategy is long‑term preservation, the regulatory safety net becomes priceless. Regulators worldwide are tightening the net, which may soon render unregulated services less viable. Until that shift fully materializes, you’re essentially betting on regulatory inertia. The community sentiment often mirrors the exchange’s transparency; a silent platform can hide critical updates. Active monitoring of announcements and audit reports becomes essential for any serious user. Remember, every exchange is a contract between you and the code, and the code is only as trustworthy as the people who write and maintain it. So weigh your options, calibrate your risk tolerance, and don’t let the allure of cheap fees blind you to the larger picture 🌐.