India’s 30% Crypto Tax Explained: Bitcoin Traders’ Full Guide

Mar, 14 2025

Mar, 14 2025

India Crypto Tax Calculator

Tax Calculation

Calculate your 30% tax on Bitcoin gains with India's current tax structure.

Tax Breakdown

Profit: ₹0

Taxable Amount: ₹0

30% Tax (Plus Surcharge & Cess): ₹0

TDS (1% on turnover > ₹50,000): ₹0

Total GST on Exchange Fees: ₹0

Effective Tax Rate: 0%

Important Notes

- Only the original purchase price is deductible; transaction fees are not.

- 1% TDS applies if your annual turnover exceeds ₹50,000.

- 18% GST applies to exchange fees (not on tax itself).

- Losses cannot be offset against gains from other cryptocurrencies.

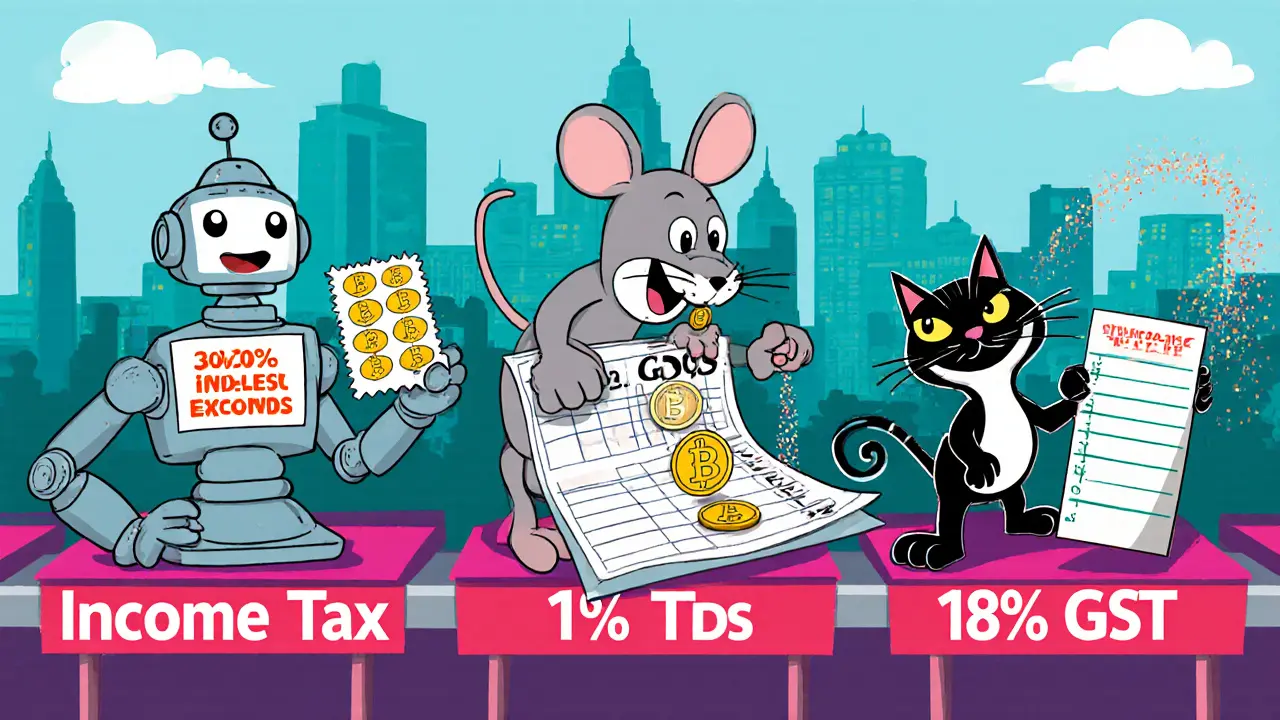

India’s 30% cryptocurrency tax is a flat levy that hits every gain from Bitcoin, Ethereum and other digital assets, regardless of how long you held them. Introduced on April12022 through Section115BBH of the Income Tax Act, the rule treats crypto gains like income in the highest tax slab (30% plus surcharge and 4% cess). For a typical Indian trader this means an effective rate of about 31.2% on every rupee of profit.

How the tax is calculated

The formula is brutally simple:

- Identify the total selling price of the Bitcoin you disposed of.

- Subtract the original purchase cost (the cost of acquisition).

- Multiply the difference by 30%.

Example: you bought 0.5BTC for ₹2,00,000 and sold it for ₹3,00,000. Profit = ₹1,00,000. Tax = ₹1,00,000×30% = ₹30,000 (plus surcharge/cess).

Key point: you cannot deduct transaction fees, wallet‑storage costs or any other expense. The tax law only allows the original purchase price as a deductible.

What you can’t do - loss offsetting

India’s tax code bars loss set‑off across assets. If you lose ₹30,000 on Bitcoin but make ₹30,000 on Ethereum, you still owe 30% of the Ethereum profit - ₹9,000 - because the loss cannot be used to reduce the gain. Likewise, there is no carry‑forward of losses to the next financial year.

Additional layers: TDS and GST

Since July2022, every crypto transfer that exceeds ₹50,000 a year triggers a 1% Tax Deducted at Source (TDS) under Section194S. The exchange deducts the 1% before crediting your account and deposits it with the tax department.

From July2025 an 18% Goods and Services Tax (GST) applies to the fees charged by crypto platforms. This turns the compliance landscape into a three‑tier structure: 30% income tax, 1% TDS, and 18% GST on exchange charges.

How India’s rate stacks up globally

| Country | Tax Rate on Gains | Loss Offset Allowed? | TDS / Withholding |

|---|---|---|---|

| India | 30% (plus surcharge & cess) | No | 1% TDS on >₹50k |

| United States | 0‑20% (long‑term), 0‑37% (short‑term) | Yes | None |

| Germany | 0% after 1‑year hold, otherwise personal income tax | Yes | None |

| Singapore | No capital‑gains tax | N/A | None |

| United Kingdom | 10% or 20% (depending on total income) | Yes | None |

Simply put, India sits at the top of the tax‑burden curve. The lack of a long‑term discount and the prohibition on offsetting losses make it especially harsh for active traders.

Step‑by‑step compliance checklist for Bitcoin traders

- Gather every Bitcoin transaction from all exchanges and wallets (date, amount in INR, USD/INR rate, fee).

- Calculate the cost of acquisition for each lot you sold (use FIFO or specific identification - whichever you prefer, but stay consistent).

- Apply the (Sell-Buy)×30% formula to each sale.

- Record the tax amount next to each transaction.

- Check if total annual crypto‑related turnover exceeds ₹50,000. If yes, ensure the exchange has deducted 1% TDS.

- Obtain Form16A (TDS certificate) from the exchange for your records.

- Include the GST component of exchange fees in your expense table (18% of the fee amount).

- File ScheduleVDA in ITR‑3 or ITR‑4 (as applicable) for the relevant Assessment Year.

- Enter total gains, tax payable, TDS deducted, and GST paid.

- Pay any shortfall before the income‑tax deadline (usually 31July for self‑assessment).

- Keep records for at least six years - the tax department can request them anytime.

Tools that make life easier

Several Indian‑focused crypto‑tax platforms now support the new ScheduleVDA:

- Koinly - auto‑imports from major exchanges, calculates cost basis, and generates a ready‑to‑file ScheduleVDA.

- ClearTax - integrates TDS certificates and GST on exchange fees into the final ITR.

- Local spreadsheets - if you prefer a DIY approach, a simple Google Sheet with columns for Date, Asset, Bought‑₹, Sold‑₹, Profit, Tax=Profit×30% works fine.

Even with software, double‑check the numbers yourself. The tax authority has been strict about mismatches.

Common pitfalls and how to avoid them

- Missing small trades. Every Bitcoin sale, even a ₹5,000 flip, counts toward the 30% tax.

- Assuming fees are deductible. Only the original purchase price can be subtracted; exchange fees belong to the GST line item.

- Ignoring TDS. If the exchange failed to deduct 1%, you’re liable for both the tax and a possible penalty.

- Mixing fiat and crypto‑to‑crypto trades. Converting Bitcoin to Ethereum still triggers a taxable event - treat each conversion as a sale of the first asset and purchase of the second.

- Relying on foreign exchanges without Indian reporting. The government expects you to declare all worldwide crypto activity, regardless of where the exchange is based.

Impact on the Indian crypto market

Since the 30% tax hit, major Indian exchanges reported a 45% drop in monthly trading volume. Many retail traders migrated to foreign platforms to dodge the immediate TDS and GST burden, even though that raises additional compliance risk. Institutional interest remains muted because the effective tax rate eclipses that of traditional equities.

Despite the slowdown, a niche of long‑term holders has emerged. Holding Bitcoin for years no longer gives a tax break, but the reduced trading frequency means fewer taxable events and less paperwork.

Future outlook

As of September2025, the core tax structure (30% + 1% TDS + 18% GST) stays unchanged. The Income Tax Department is reviewing the loss‑offset rule, and industry bodies have petitioned for a lower flat rate or a tiered system based on income. Until any amendment lands, the safest path is to treat every Bitcoin gain as fully taxable and keep meticulous records.

Frequently Asked Questions

Do I need to pay tax on Bitcoin bought before April2022?

Yes. The tax is retroactive to the start of FY2022‑23. If you sold any pre‑April‑2022 Bitcoin during that year, the profit is taxable at 30%.

Can I offset a loss on Bitcoin against a gain on Ethereum?

No. Indian law forbids loss set‑off across different virtual digital assets. Each asset’s gain is taxed separately.

What is the threshold for TDS on crypto transactions?

If your total crypto‑related turnover exceeds ₹50,000 in a financial year, the exchange must deduct 1% TDS at the time of sale.

Is GST applied to the tax I pay on Bitcoin profits?

No. GST is levied only on the service fee charged by the crypto platform, not on the income‑tax itself.

Do I have to file Schedule VDA if I have no crypto gains?

If you had any crypto transactions (buy, sell, swap) during the year, you must file ScheduleVDA, even if the net result is a loss or zero gain.

Rama Julianto

March 14, 2025 AT 23:44Listen up, anyone still thinking the 30% tax is optional is living in a fantasy. The law treats every crypto gain as ordinary income, so you owe the flat rate plus surcharge and cess, no matter how long you held it. Transaction fees don't even count as a deduction – they just add GST on top. If your annual turnover crosses ₹50,000, the exchange will slap a 1% TDS before the money hits your wallet. Miss any of these steps and the tax department will hit you with penalties faster than a price crash. Bottom line: calculate, deduct, and pay – or brace for a nasty audit.

Helen Fitzgerald

March 15, 2025 AT 16:24Great breakdown, thanks for cutting through the jargon!

Jon Asher

March 16, 2025 AT 09:04Just to add, the 1% TDS only applies when the total crypto turnover exceeds fifty thousand rupees in the FY. If you're under that limit, you can skip the TDS but still owe the 30% income tax. Keep an eye on the exchange statements to verify the deduction.

Scott Hall

March 17, 2025 AT 01:44The market numbers speak for themselves – after the 30% levy was announced, volume on Indian exchanges plunged by almost half. Traders are flocking to offshore platforms where the TDS and GST rules don't bite as hard, even though that raises its own compliance headaches. Institutional players are staying on the sidelines because the effective tax rate dwarfs equity yields. Meanwhile, long‑term holders are shaking out, preferring a buy‑and‑hold strategy to avoid the constant tax paperwork. If the government doesn't relax the rules, we might see a permanent shift of liquidity out of the domestic ecosystem.

Jade Hibbert

March 17, 2025 AT 18:24Wow, so much for “crypto freedom” – now it's just “crypto tax‑nightmare.”

Guess the hype was cheaper than the tax.

Leynda Jeane Erwin

March 18, 2025 AT 11:04From a legal perspective, the Schedule VDA filing requirement is unequivocal for any crypto transaction, regardless of net profit or loss. The absence of a loss‑set‑off provision further constrains taxpayers, compelling them to report each asset's gain separately. While the GST on exchange fees is a separate statutory levy, it does not diminish the income‑tax liability. Accordingly, diligent record‑keeping across all platforms is indispensable to ensure compliance.

Brandon Salemi

March 19, 2025 AT 03:44Exactly, proper documentation is your best defense.

Use a spreadsheet or an automated tool to keep every trade logged.

hrishchika Kumar

March 19, 2025 AT 20:24India’s crypto tax regime is not just a fiscal measure; it’s reshaping the cultural narrative around digital assets. For many Indians, cryptocurrency was once a symbol of financial independence and technological progress, a way to leapfrog traditional banking hurdles. The 30% flat tax, combined with the 1% TDS and 18% GST on exchange fees, has turned that optimism into caution. Traders now discuss tax implications before even thinking about market trends, a conversation that would have been unheard of a few years ago. Families are weighing the risk of a hefty tax bill against the allure of quick gains, and that debate is spilling over into dinner tables across metros and tier‑2 cities alike. Young professionals, who once saw crypto as a side hustle, are now scrutinizing every transaction like a corporate accountant. The fear of non‑compliance is palpable, especially because the tax department can summon records spanning six years without warning. On the other hand, a niche of seasoned holders is emerging, treating Bitcoin as a long‑term store of value rather than a day‑trading instrument, simply to reduce the number of taxable events. This shift is also influencing the startup ecosystem; crypto‑related ventures are now budgeting for tax advisory services from day one. Educational institutions have begun integrating crypto tax modules into finance courses, reflecting the demand for knowledgeable advisors. Moreover, community forums are buzzing with DIY calculators and spreadsheet templates, evidence that the grassroots is adapting. Yet, the cultural stigma attached to crypto persists, as some view the tax as a punitive signal that the state disapproves of the technology. Government outreach programs could help demystify the rules and restore confidence, but they have been sporadic at best. In the meantime, the practical advice circulating among peers remains the same: keep meticulous records, use reputable exchanges that provide TDS certificates, and file Schedule VDA religiously. Only through collective vigilance can the community navigate this high‑tax landscape without losing the innovative spirit that originally attracted us to crypto.

Anjali Govind

March 20, 2025 AT 13:04I’ve started tagging each trade with the INR‑USD conversion rate at the time of execution, which saves a ton of headache later. It also makes filling Schedule VDA a breeze because the numbers line up automatically. If you haven’t tried this approach yet, give it a shot – it’s a game changer.

Ted Lucas

March 21, 2025 AT 05:44Tool‑time! Platforms like Koinly and ClearTax have integrated the new Schedule VDA, pulling transaction data straight from Indian exchanges. They automatically calculate the 30% tax, TDS, and even the GST on fees, spitting out a ready‑to‑file PDF. The biggest win is the audit trail – every line item is backed by a source file, which the tax office loves. 🚀 However, don’t blindly trust the output; run a sanity check against your own spreadsheet. Some users report mismatches when dealing with peer‑to‑peer swaps, so manual verification is still key. In short, use the software as a co‑pilot, not the pilot.

ചഞ്ചൽ അനസൂയ

March 21, 2025 AT 22:24That’s solid advice – the tools are great, but they can’t replace understanding the underlying rules. I always double‑check the GST portion because a tiny error can snowball into a bigger penalty. Also, remember to request the Form 16A from your exchange for the TDS proof. Keeping those documents organized saves stress during the assessment season.

Orlando Lucas

March 22, 2025 AT 15:04Looking ahead, the tax framework could evolve if the industry presents a unified proposal to the finance ministry. A tiered rate based on income levels or a capital‑gain‑style exemption for holdings beyond a year would align India with global best practices. Until then, the safest route is meticulous record‑keeping and leveraging the existing compliance tools. Optimistically, the dialogue between regulators and crypto firms is gaining momentum, which might soften the current burden. In any case, staying informed and proactive is the only way to turn this challenge into an opportunity.

Philip Smart

March 23, 2025 AT 07:44Honestly, the whole 30% flat rate feels like a blunt instrument – it scares away legitimate traders and fuels the black‑market narrative. A more nuanced approach would reward long‑term holding instead of punishing every flip. Right now, the tax code just stifles innovation.

Jacob Moore

March 24, 2025 AT 00:24Exactly, let’s keep the conversation constructive and share practical tips. The more we help each other, the easier compliance becomes.