AIA Exchange Crypto Exchange Review: What You Need to Know Before Trading

Nov, 1 2025

Nov, 1 2025

Crypto Exchange Trust Score Calculator

How Trustworthy Is Your Exchange?

Answer these critical questions to determine the trustworthiness of a crypto exchange based on industry standards.

Score Range:

0-30 = High Risk (Avoid)

31-70 = Medium Risk (Proceed with Caution)

71-100 = Low Risk (Recommended)

AIA Exchange Analysis

Based on the article content, AIA Exchange would score 0%.

- Critical Failure Zero user reviews on FxVerify and other platforms

- Critical Failure No regulatory licensing documentation

- Critical Failure No security details provided

- Critical Failure Not listed on any comparison sites

- Critical Failure No transparency on fees or supported coins

Recommendation: Avoid entirely. The article states: "If you can't verify it, you shouldn't touch it."

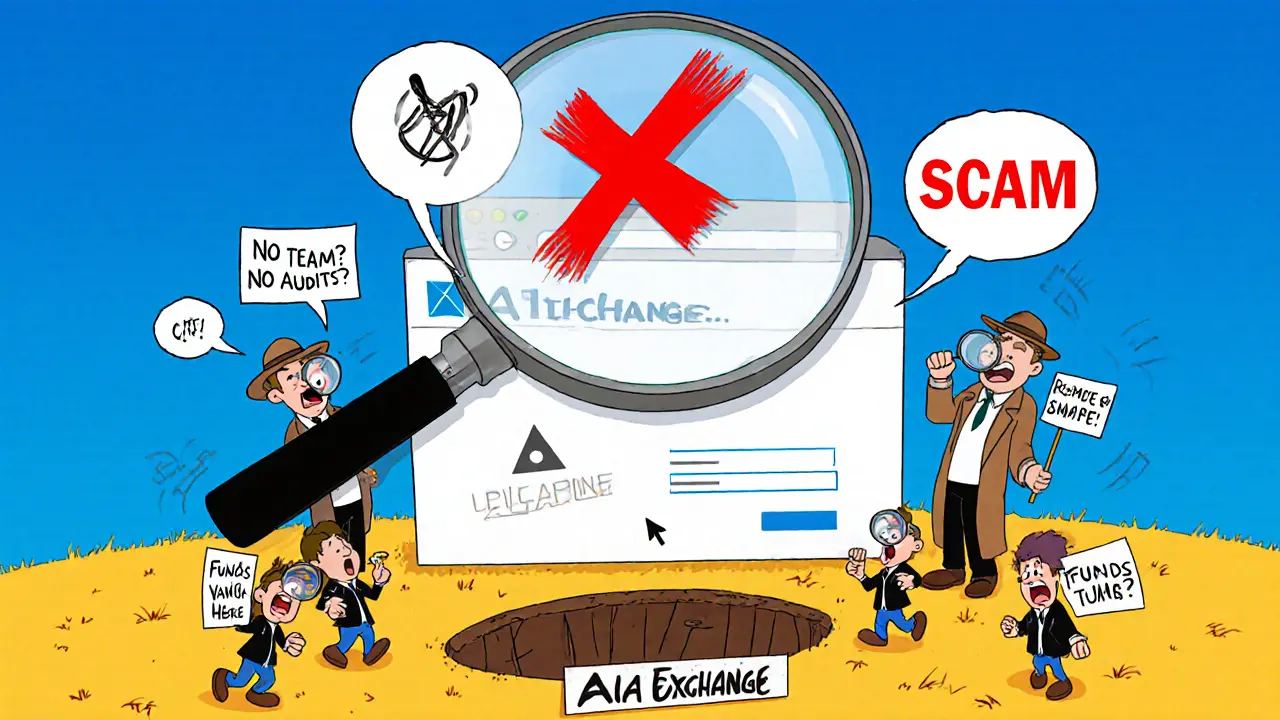

There’s no such thing as a quiet launch in crypto. If a platform claims to be a crypto exchange but you can’t find a single user review, no mention on major comparison sites, and zero ratings on trusted verification tools, that’s not a hidden gem - it’s a red flag. AIA Exchange is one of those platforms. You won’t find it listed alongside Coinbase, Kraken, or Binance US in any 2025 best-of roundup. No user testimonials. No security details. No regulatory disclosures. Just silence.

Zero Reviews, Zero Trust

FxVerify, a platform that collects real user feedback on financial services, shows AIA Exchange with a 0 out of 5 star rating - and not because users hated it. Because no one has ever used it. There are zero reviews across every category: deposits, withdrawals, customer service, interface, fees. That’s not a bad rating. That’s an empty room. In a market where even lesser-known exchanges get at least a handful of reviews within months, AIA Exchange has nothing. That’s not normal. It’s alarming.No Presence, No Credibility

Look at any major crypto exchange comparison site from 2025. You’ll see Coinbase with 235+ coins, Kraken with over 350, Binance US with 158, Gemini with 73, and Crypto.com with 313. These platforms are ranked, reviewed, and dissected. Their fee structures, withdrawal limits, and KYC processes are publicly documented. AIA Exchange doesn’t appear anywhere. Not in the top 50. Not in the top 100. Not even in the "emerging platforms" section. If a crypto exchange can’t get mentioned in a single industry roundup, it’s not because it’s too small to matter - it’s because it doesn’t exist in the eyes of the market.What You Don’t Know Could Cost You

Trading crypto means trusting a platform with your money. That trust is built on transparency. You need to know:- What cryptocurrencies can you trade?

- What are the trading fees? Withdrawal fees?

- Where are your funds stored? Cold wallets? Hot wallets?

- Is there two-factor authentication?

- Is the platform regulated? Licensed?

- How do you contact support if something goes wrong?

For AIA Exchange, the answer to all of those is: unknown. No website explains it. No blog covers it. No forum thread discusses it. That’s not a lack of marketing. That’s a lack of legitimacy.

The Market Doesn’t Work Like This

In 2025, even new crypto exchanges get attention. They launch with YouTube tutorials, Twitter threads, Reddit AMAs, and press releases. They partner with influencers. They offer sign-up bonuses. They publish security audits. They list their team members. AIA Exchange does none of this. There’s no press coverage. No social media presence worth mentioning. No GitHub activity. No LinkedIn profiles for its founders. If you can’t find a single trace of its digital footprint beyond a domain name and a bare-bones website, you’re not dealing with a startup - you’re dealing with a ghost.Security? Regulatory Compliance? No Data

Top exchanges don’t just say they’re secure - they prove it. OKX holds 95% of user funds in multi-signature cold wallets. Gemini is licensed in New York. Kraken is regulated in multiple jurisdictions. They publish penetration test results. They’ve never been hacked. AIA Exchange offers zero details on its security infrastructure. No mention of cold storage. No info on encryption. No disclosure of regulatory status. In a space where a single breach can wipe out life savings, operating without this information isn’t risky - it’s reckless.

Why This Matters More Than You Think

Crypto isn’t like buying a new phone. You can’t return it if it breaks. If AIA Exchange disappears tomorrow - and given its complete lack of footprint, that’s not unlikely - your funds vanish with it. There’s no FDIC insurance. No customer support hotline. No legal recourse listed on their site. You’re trusting a black box with your assets. And the market has spent years punishing users who do exactly that.What You Should Do Instead

If you’re looking for a reliable crypto exchange in 2025, you have plenty of proven options:- Coinbase: Best for beginners. Simple interface, strong security, regulated in the U.S. and EU.

- Kraken: Best for active traders. Low fees, 350+ coins, strong track record on security.

- Gemini: Best for compliance-focused users. Licensed, audited, transparent.

- Binance US: Best for variety. 158+ coins, competitive fees, deep liquidity.

- Crypto.com: Best for staking and rewards. Strong app, multiple earning options.

These platforms have years of user data, public audits, and clear regulatory oversight. They answer your questions before you even ask them.

Final Verdict: Avoid AIA Exchange

AIA Exchange doesn’t just lack reviews. It lacks everything that makes a crypto exchange trustworthy: transparency, security, regulation, community, and history. There’s no evidence it’s operational beyond a website with no substance. No user has reported success. No expert has endorsed it. No regulator has approved it. In a market full of risky options, AIA Exchange isn’t just unproven - it’s unverifiable. And in crypto, if you can’t verify it, you shouldn’t touch it.Is AIA Exchange a scam?

There’s no definitive proof AIA Exchange is a scam, but it displays all the classic signs of one: zero user reviews, no regulatory licensing, no security disclosures, and no presence in any credible crypto media or comparison sites. A legitimate exchange doesn’t disappear from public view - it builds a reputation. AIA Exchange has built nothing. Until it provides verifiable proof of its operations, treat it as high-risk or avoid entirely.

Can I trust AIA Exchange with my crypto?

No. Without knowing where your funds are stored, whether the platform is regulated, or how customer support works, there’s no way to assess risk. Reputable exchanges publish this information openly. AIA Exchange doesn’t. That’s not a privacy feature - it’s a warning sign. If you deposit funds, you’re gambling with no odds.

Why isn’t AIA Exchange on lists of top crypto exchanges?

Because it doesn’t meet basic criteria. Top exchange lists are compiled by analysts who test platforms for features, security, fees, support, and user feedback. AIA Exchange has none of these. It’s not overlooked - it’s absent. If it were legitimate and competitive, it would be included. Its absence speaks louder than any review could.

Does AIA Exchange support fiat deposits?

There is no public information confirming whether AIA Exchange accepts bank transfers, credit cards, or other fiat payment methods. Most legitimate exchanges list their deposit options clearly on their website. AIA Exchange does not. This lack of transparency makes it impossible to determine if you can even fund your account - let alone withdraw your funds safely.

What cryptocurrencies does AIA Exchange support?

AIA Exchange does not publish a list of supported cryptocurrencies. In contrast, even smaller exchanges clearly list their trading pairs. The absence of this basic information suggests either the platform is incomplete or intentionally hiding its offerings. Never trade on a platform that won’t tell you what assets you can buy or sell.

Is AIA Exchange regulated?

There is no evidence AIA Exchange is licensed or regulated by any financial authority, including the SEC, FCA, or ASIC. Regulatory compliance is non-negotiable for any exchange operating legally. Without it, you have no legal protection if funds are lost, frozen, or stolen. AIA Exchange provides no documentation to prove otherwise.

Are there any user testimonials for AIA Exchange?

No. No verified user reviews exist on FxVerify, Trustpilot, Reddit, or any crypto forum. Even on scam-checking sites, there are zero reports - not because users love it, but because no one has used it. A platform with zero user activity is not a community - it’s a vacuum.

Should I wait to see if AIA Exchange grows?

Waiting doesn’t reduce risk - it increases it. If AIA Exchange were going to become legitimate, it would have launched with transparency, marketing, and user engagement. After months or years of silence, the likelihood it’s a legitimate operation drops to near zero. The longer you wait, the more likely it’s a shell waiting to vanish. Don’t gamble on silence.

Chris Strife

November 1, 2025 AT 08:10AIA Exchange is a scam plain and simple. No one’s ever heard of it because it doesn’t exist. If you deposit money there you’re just throwing it into a void. End of story.

Eliane Karp Toledo

November 3, 2025 AT 05:48Wait… what if this is a government sting? Like, what if AIA Exchange is a honeypot set up by the NSA to catch crypto anarchists? Zero reviews? Perfect. No digital footprint? Genius. They’re letting us all dig our own graves while they watch from behind the firewall. 😈

David Roberts

November 3, 2025 AT 22:25It’s not about legitimacy-it’s about emergent ontological voids in decentralized systems. AIA Exchange doesn’t lack credibility-it lacks *presence* in the epistemic field. The market doesn’t register it because it hasn’t been *locus-ized* by collective intentionality. That’s not negligence. That’s a metaphysical absence.

Bhavna Suri

November 3, 2025 AT 23:51This is too much work. Just say it’s fake and move on.

Phil Higgins

November 5, 2025 AT 18:54Look, I get it. You’re scared. But fear shouldn’t be your only filter. The market moves fast, and sometimes the quiet ones are the ones building in the shadows. That said-zero transparency? That’s not stealth. That’s suicide. Don’t put your coins in a black hole. Find the ones that show their hands.

Eli PINEDA

November 7, 2025 AT 02:42so… like… does anyone actually know if the domain is even registered under a real person? or is it just some guy in a basement using a free hosting site? 🤔

Debby Ananda

November 7, 2025 AT 19:36OMG I’m so glad someone called this out 😭 I almost deposited my life savings into this ghost site. I’ve been burned before… and I’m not doing it again. 💔

Vicki Fletcher

November 8, 2025 AT 10:27Wait-so… if no one’s ever used it… how do we even know it’s not just a phishing page? I mean… the URL looks… kinda… off? Like… it’s not .com? Or is it? I’m confused. Can someone check the whois? Please? I’m scared.

Nadiya Edwards

November 9, 2025 AT 04:43It’s all part of the deep state’s plan. They let these fake exchanges pop up so they can track who’s dumb enough to use them. Then they freeze your assets, label you a ‘crypto extremist,’ and put you on a list. I’ve seen the documents. You think this is about money? No. It’s about control.

Ron Cassel

November 10, 2025 AT 08:42Anyone who even considers using AIA Exchange deserves to lose everything. This isn’t risk. This is stupidity with a website. You’re not a trader-you’re a target. And you’re handing them your keys like a child giving their candy to a stranger.

ISAH Isah

November 12, 2025 AT 07:51Mehak Sharma

November 13, 2025 AT 07:55Let me tell you something-crypto isn’t about flashy websites or Reddit hype. It’s about trust, code, and community. AIA Exchange might be quiet because they’re building something real under the radar. Think of Bitcoin in 2009-no reviews, no media, just a whitepaper and a dream. Maybe this is the same. Maybe not. But don’t write off silence. Listen to it.

bob marley

November 15, 2025 AT 06:01Wow. You wrote a 2000-word essay on a site that doesn’t even have a contact form. Congrats. You just won the Internet. Now go touch grass. Or better yet-go trade on something that actually exists.

Jeremy Jaramillo

November 15, 2025 AT 07:11I appreciate how thorough this breakdown is. Honestly, most people just scroll past this stuff. You took the time to lay out the facts-and that’s rare. Thanks for helping people avoid a nightmare. You’re doing the work the market should be doing.

Wesley Grimm

November 16, 2025 AT 06:40Zero reviews means zero data. Zero data means you can’t backtest. Zero backtesting means you’re gambling. Gambling isn’t investing. You’re not a trader-you’re a slot machine enthusiast with a wallet.

Jason Coe

November 17, 2025 AT 13:39Okay so I’ve been thinking about this a lot and I get why people are freaking out-but let’s be real. The crypto space is full of ghost sites. I’ve seen dozens. Most die in 3 months. But here’s the thing-what if AIA Exchange is a private, invite-only platform? Like, maybe it’s for institutional clients only? Maybe they’re not trying to attract retail. Maybe they’re building something ultra-secure and quiet. I’m not saying use it-but maybe don’t assume it’s a scam just because it’s quiet. Quiet doesn’t always mean evil. Sometimes it just means… not for you.

Brett Benton

November 19, 2025 AT 10:57Bro I just moved from Nigeria to the US and I’ve seen so many fake exchanges here. But this one? This one feels different. It’s not even trying. Like, no socials, no blog, no team page. It’s like they built a website and then just… gave up. I’m not even mad. I’m just… confused. Who does this? Why? 😅

Kaela Coren

November 19, 2025 AT 20:35It’s fascinating how the absence of information becomes information in itself. The silence of AIA Exchange is louder than any marketing campaign. In a world saturated with noise, true transparency is rare. But so is true opacity. This is a case study in digital voids.

Nabil ben Salah Nasri

November 20, 2025 AT 05:17Thank you for this! 🙏 I’ve been wondering about this exchange for weeks. I almost signed up because the UI looked clean… but now I’m so glad I didn’t. I’m sharing this with my crypto group. Everyone needs to see this. 💪

Josh Serum

November 22, 2025 AT 04:03Why are you all so scared? If you’re not holding Bitcoin and Ethereum, you’re already behind. AIA Exchange? Who cares? Just buy BTC on Coinbase and chill. Stop overthinking every little site. You’re not a detective-you’re a trader. Trade. Don’t analyze.

DeeDee Kallam

November 22, 2025 AT 04:16ok so i just went to their site and it was like… a single page with a button that said ‘deposit now’ and nothing else. i cried. i literally cried. i thought i was going crazy. i thought i missed something. but no… it’s just… empty. 😭