MAS Crypto Regulation: What It Means for Crypto Users and Businesses

When you hear MAS crypto regulation, the rules set by Singapore’s Monetary Authority of Singapore to oversee digital assets and financial innovation. Also known as Singapore cryptocurrency rules, it’s one of the clearest, most predictable frameworks in the world — and it’s changing how people trade, invest, and build crypto businesses. Unlike countries that ban crypto outright or let it run wild, MAS takes a balanced approach: protect users, prevent crime, and let innovation grow — but only if you play by the rules.

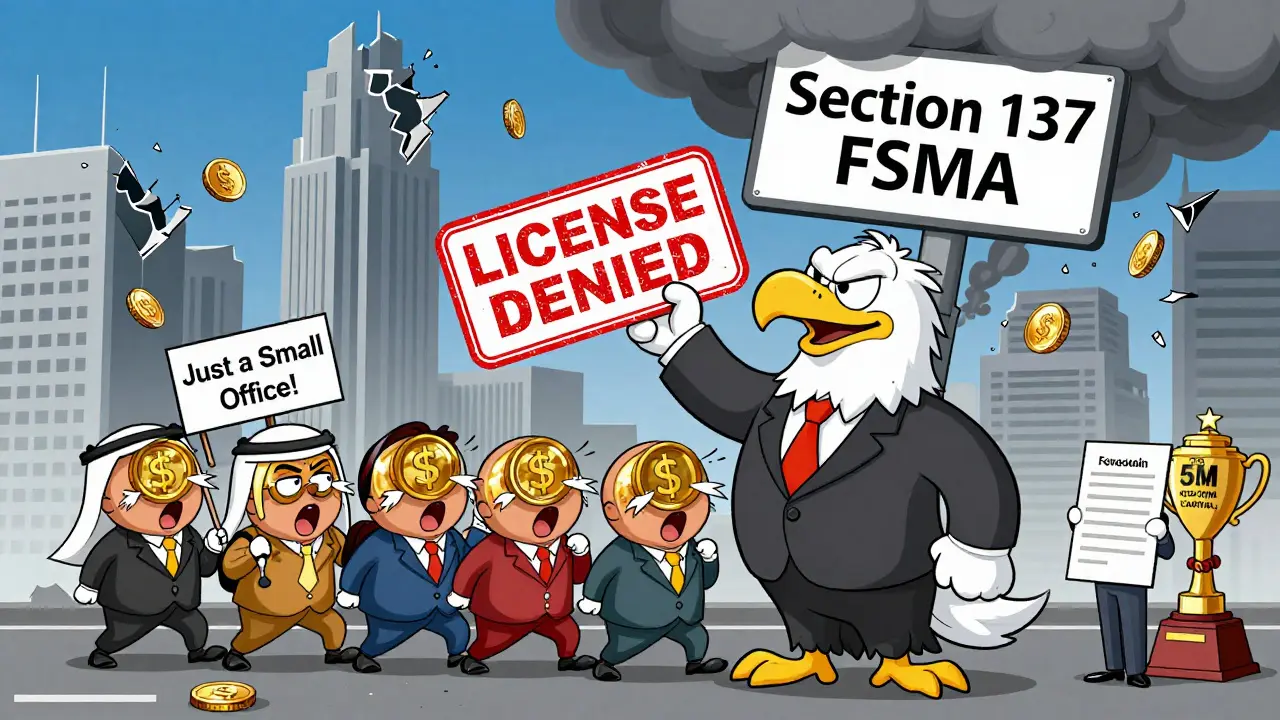

This isn’t just about exchanges. Digital asset licensing, the official process crypto firms must go through to operate legally in Singapore is strict. You need capital, anti-money laundering systems, and clear disclosures. That’s why you see big names like Coinbase and Binance operating under MAS oversight — and why shady platforms vanish. It’s also why Singapore has become a hub for serious crypto teams, not just speculators. The rules force transparency. If a project can’t explain its tokenomics, its team, or its compliance plan, it doesn’t get a license.

And it’s not just businesses. Crypto compliance Singapore, the everyday rules that affect how individuals buy, hold, and report crypto matters too. If you’re trading on a licensed exchange, your funds are protected by strict custody rules. If you’re using a wallet, you’re not breaking any laws — but you’re on your own if something goes wrong. MAS doesn’t regulate wallets or personal holdings, but it does demand that exchanges know who their users are. That means KYC is non-negotiable. No anonymous trading. No shady P2P deals through unlicensed platforms. If you want to operate legally in Singapore, you play by MAS rules — or you don’t play at all.

What you’ll find below are real stories from the ground: how crypto businesses navigate licensing, how users deal with restrictions, and how some projects get crushed by the rules while others thrive. You’ll see how Singapore’s approach compares to places like the UAE, Switzerland, and Australia — and why MAS is often the gold standard for clarity. No hype. No fluff. Just what’s actually happening under the regulation.

Monetary Authority of Singapore Crypto Oversight: What You Need to Know in 2025

Singapore's MAS has imposed one of the world's strictest crypto frameworks, effectively banning most new licenses. Learn the rules, penalties, and real impact on businesses and investors in 2025.