Monetary Authority of Singapore Crypto Oversight: What You Need to Know in 2025

Dec, 5 2025

Dec, 5 2025

Singapore Crypto Compliance Cost Calculator

Understand Singapore's Crypto Rules

The Monetary Authority of Singapore (MAS) has implemented strict regulations for crypto businesses. Before June 30, 2025, most new crypto businesses were shut down. Now, only firms meeting rigorous requirements can operate legally in Singapore.

Calculate Your Compliance Costs

Estimated Annual Compliance Costs

Comparison with Other Jurisdictions

Singapore's regulations are among the strictest in the world. Compare your compliance costs to other major crypto hubs:

By June 30, 2025, the Monetary Authority of Singapore (MAS) shut the door on most new crypto businesses. Not with a bang, but with a quiet, final notice: licenses will be issued only in extremely limited circumstances. This isn’t a tweak. It’s a full reset. Singapore, once seen as a crypto-friendly hub, has become one of the strictest places in the world to operate a digital asset business - even if you’re only serving customers overseas.

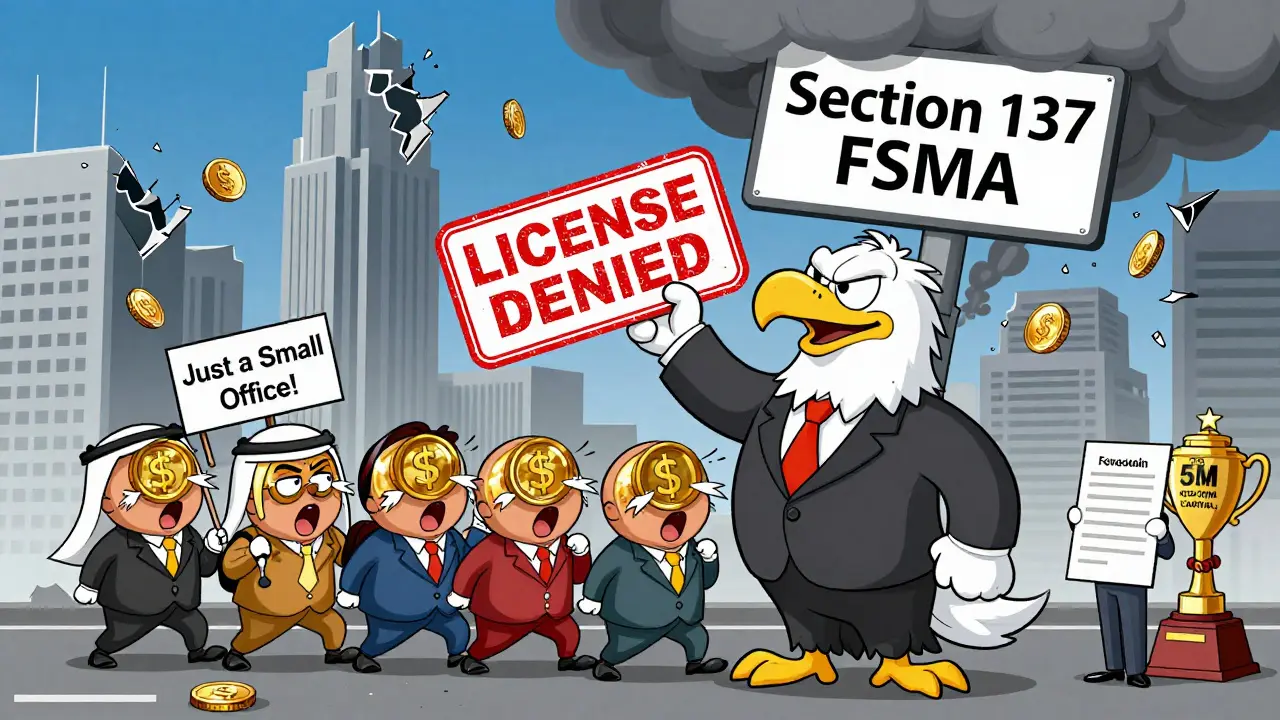

Why Singapore Changed Its Mind

For years, Singapore attracted crypto firms with its stable government, strong legal system, and clear rules. But MAS noticed something troubling. Companies were registering in Singapore not to serve local customers, but to use the country’s reputation as a stamp of legitimacy while operating with little oversight elsewhere. They’d set up a small office in Singapore, get a provisional license, and then run their business from Dubai, London, or Miami - all while letting Singapore’s name carry the weight of trust. MAS called this regulatory arbitrage. And they weren’t willing to let it continue. In June 2025, they made it clear: if you’re based in Singapore, you’re subject to Singapore’s rules - no matter where your users live. That’s thanks to Section 137 of the Financial Services and Markets Act 2022 (FSMA). It gives MAS power over any Singapore-incorporated company, even if all their servers and customers are outside the country. This wasn’t a surprise to regulators. But it was a shock to the industry. Many firms had planned to grow under the old system. Now, they had to choose: build a full compliance operation in Singapore or leave.What It Takes to Get a License Now

Getting a Digital Token Service Provider (DTSP) license from MAS isn’t hard - it’s nearly impossible for most. Here’s what you need:- A minimum capital requirement of SGD 5 million (about USD 3.7 million)

- A Singapore-based compliance officer with proven AML/CFT experience

- Annual independent audits by a MAS-approved firm

- Full implementation of the Travel Rule for all transactions over SGD 1,500

- Robust cybersecurity systems meeting MAS standards

- Customer suitability assessments and clear risk disclosures

The Travel Rule: Not Just a Formality

The Travel Rule isn’t optional. Under Notice PSN02, every crypto transfer over SGD 1,500 must include sender and receiver details: full name, ID number, account info. This isn’t like bank wire rules - it’s stricter. Many platforms didn’t collect this data before. Now, they need software that can automatically extract, verify, and send it to other platforms globally. Implementation costs? Between SGD 50,000 and SGD 200,000, depending on transaction volume. Smaller firms can’t afford it. Even medium-sized ones are struggling. Notabene’s June 2025 analysis showed that over 60% of firms that applied for a license couldn’t meet this requirement in time. And it’s not just about tech. You need legal teams that understand how this interacts with GDPR in Europe, KYC laws in the U.S., and data rules in Southeast Asia. That’s a compliance nightmare.

Consumer Protection: No More Credit Card Crypto

MAS didn’t just target businesses - they protected consumers too. In September 2024, they banned crypto purchases using credit cards. Why? Because people were borrowing money to gamble on volatile assets. Losses piled up. Complaints rose. Now, every customer must pass a suitability test. Platforms have to ask: Do you understand the risks? Can you afford to lose this money? Are you using this for speculation or long-term holding? These aren’t checkboxes. They’re live assessments - often requiring interviews or detailed questionnaires. Stablecoins are also under tighter control. MAS requires them to maintain a 1:1 reserve with high-quality, liquid assets. No shady backing. No algorithmic tricks. Just cash or government bonds. This rule, finalized in November 2023, applies to all stablecoins issued or traded in Singapore.Penalties Are Brutal - And Immediate

There’s no grace period. No warnings. Miss the June 30, 2025 deadline? You’re done. Penalties include:- Fines up to SGD 200,000 (USD 147,000)

- Imprisonment for executives found knowingly violating rules

- Forced shutdown of operations in Singapore

- Blacklisting from future licensing applications

What Happened to the Crypto Scene in Singapore?

Before June 2025, around 200 firms had applied for or held provisional DTSP licenses. By July 2025, only 18 had met all requirements. That’s a 91% drop. Job postings for crypto roles in Singapore fell 37% in Q1 2025 compared to Q4 2024, according to LinkedIn data. Many firms moved teams to Dubai, Switzerland, or Hong Kong. Others shut down entirely. The ripple effect hit startups, freelancers, and even local tech vendors. Companies that sold compliance software, KYC tools, or blockchain analytics services lost their biggest client base overnight. Even big names like Binance and Kraken pulled back. They didn’t apply for licenses. They just stopped serving Singapore-based customers. That’s how serious this got.How Singapore Compares to Other Hubs

Switzerland still welcomes crypto firms with clear licensing paths. The UAE’s Virtual Asset Regulatory Authority (VARA) offers fast approvals and sandbox programs. Even Japan, known for being strict, still issues licenses to hundreds of firms each year. Singapore? It’s now the opposite. It’s not about being the biggest. It’s about being the cleanest. MAS isn’t trying to be the crypto capital. They’re trying to be the most trusted financial center in Asia. And they’re willing to sacrifice growth to protect that reputation.What’s Next for Singapore’s Crypto Rules?

MAS hasn’t said they’re done. In their May 15, 2025 parliamentary reply, they hinted at new rules for DeFi protocols and stablecoin arrangements later in 2025. That means even more complexity ahead. Experts like Dr. Jane Lim from the Asian Fintech Institute warn this could permanently damage Singapore’s role in global crypto innovation. But MAS officials say they’re not interested in being a crypto playground. They want a crypto system that doesn’t risk the integrity of Singapore’s financial system. The long-term test? If crypto-related financial crime drops significantly over the next two years, and investor confidence stays high, then this will be seen as a success. If Singapore becomes a ghost town for crypto, and talent and capital flee, then it’s a cautionary tale. Right now, it’s too early to say which path it takes. But one thing is certain: if you’re thinking of launching a crypto business in Singapore in 2025 or beyond, you’d better have deep pockets, elite compliance teams, and a very clear reason why you need to be there.Can I still trade crypto in Singapore if I’m a retail investor?

Yes. The MAS rules target service providers - not individual traders. You can still buy and sell crypto through platforms that are licensed or operating legally. But you can’t use a credit card to buy crypto anymore, and you’ll be asked to complete a risk assessment before trading. The goal is to protect you from reckless behavior, not to stop you from investing.

What happens if I run a crypto business from Singapore but only serve customers overseas?

You still need a DTSP license. Section 137 of the FSMA gives MAS authority over any Singapore-based company, regardless of where its customers are. If you’re incorporated in Singapore, operate from Singapore, or have a Singapore-based compliance officer, you’re under MAS jurisdiction. No exceptions.

Is there any way to get a DTSP license after June 30, 2025?

Technically, yes - but only in "extremely limited circumstances." MAS has said they will consider applications from firms with elite compliance infrastructure, proven track records, and a strong operational justification. Most industry experts believe fewer than five new licenses will be granted in the next two years. Don’t expect it to be easy.

Why does MAS require a Singapore-based compliance officer?

To ensure accountability. MAS needs someone physically in Singapore who can be held responsible for AML/CFT compliance. They can’t audit or fine someone in another country effectively. The officer must be available for inspections, meetings, and enforcement actions. This rule closes the loophole where firms would outsource compliance to offshore firms with no real oversight.

Are stablecoins banned in Singapore?

No. But they’re heavily regulated. Only stablecoins backed 1:1 by high-quality, liquid assets like cash or government bonds are allowed. Algorithmic stablecoins or those backed by volatile assets are prohibited. Any stablecoin issued or traded in Singapore must comply with MAS’s November 2023 framework.

Lore Vanvliet

December 6, 2025 AT 19:33Scott Sơn

December 6, 2025 AT 20:11Nicole Parker

December 8, 2025 AT 01:47Cristal Consulting

December 8, 2025 AT 17:02sonia sifflet

December 9, 2025 AT 23:24Thomas Downey

December 10, 2025 AT 04:09Jerry Perisho

December 11, 2025 AT 19:13Krista Hewes

December 11, 2025 AT 20:17Noriko Robinson

December 12, 2025 AT 07:37Mairead Stiùbhart

December 14, 2025 AT 01:28Doreen Ochodo

December 15, 2025 AT 20:14Holly Cute

December 17, 2025 AT 14:06Josh Rivera

December 17, 2025 AT 15:36Neal Schechter

December 18, 2025 AT 22:40Billye Nipper

December 19, 2025 AT 14:18Richard T

December 19, 2025 AT 17:34Mariam Almatrook

December 21, 2025 AT 01:08rita linda

December 21, 2025 AT 01:19Frank Cronin

December 22, 2025 AT 21:48Stanley Wong

December 24, 2025 AT 07:09Brooke Schmalbach

December 24, 2025 AT 17:08