MAS Travel Rule: What It Means for Crypto Transfers and Global Compliance

When you send crypto from one exchange to another, you might not realize you’re also sending personal data—name, address, account number. That’s because of the MAS Travel Rule, a regulatory requirement from Singapore’s Monetary Authority that forces crypto firms to share sender and receiver info on transactions above a certain amount. Also known as the FATF Travel Rule, it’s not just a Singapore thing—it’s part of a global push to stop money laundering through digital assets. This rule isn’t about spying on users. It’s about making sure crypto platforms can’t be used as invisible pipelines for illegal cash. If you’re sending $1,000 or more in crypto, the exchange you’re using must verify who you are and who you’re sending it to—just like a bank would with a wire transfer.

The MAS Travel Rule ties directly into how exchanges handle anti-money laundering, policies designed to detect and prevent criminals from using financial systems to hide illegal money. In places like Singapore, UAE, and Australia, exchanges now build compliance into their systems. That means longer processing times, extra verification steps, and sometimes even blocked transfers if the other side doesn’t meet the same standards. It’s why you can’t just send USDT from a non-compliant exchange to Bitget or CEX.IO anymore—those platforms have to check the origin of the funds. This rule also connects to crypto regulation, the growing set of laws governments use to control how digital assets are issued, traded, and stored. Countries that ignore these rules risk being cut off from the global financial system. That’s why even exchanges in places like Algeria or Afghanistan, where crypto is banned, still face pressure to track transfers—they’re not just local laws, they’re global standards.

What you’ll find in the posts below are real cases of how this rule plays out. From how Alipay and WeChat Pay block crypto payments in China, to how Australia keeps privacy coins off exchanges because they can’t trace them, to how UAE free zones require full KYC for crypto businesses—these aren’t random stories. They’re all pieces of the same puzzle: a world where crypto can’t operate in the shadows anymore. You’ll see how compliance affects everyday users, how businesses adapt, and why some projects fail because they refuse to play by these new rules. This isn’t about stopping innovation. It’s about making sure innovation doesn’t become a tool for crime. The MAS Travel Rule is the line in the sand—and the posts below show exactly what happens on both sides of it.

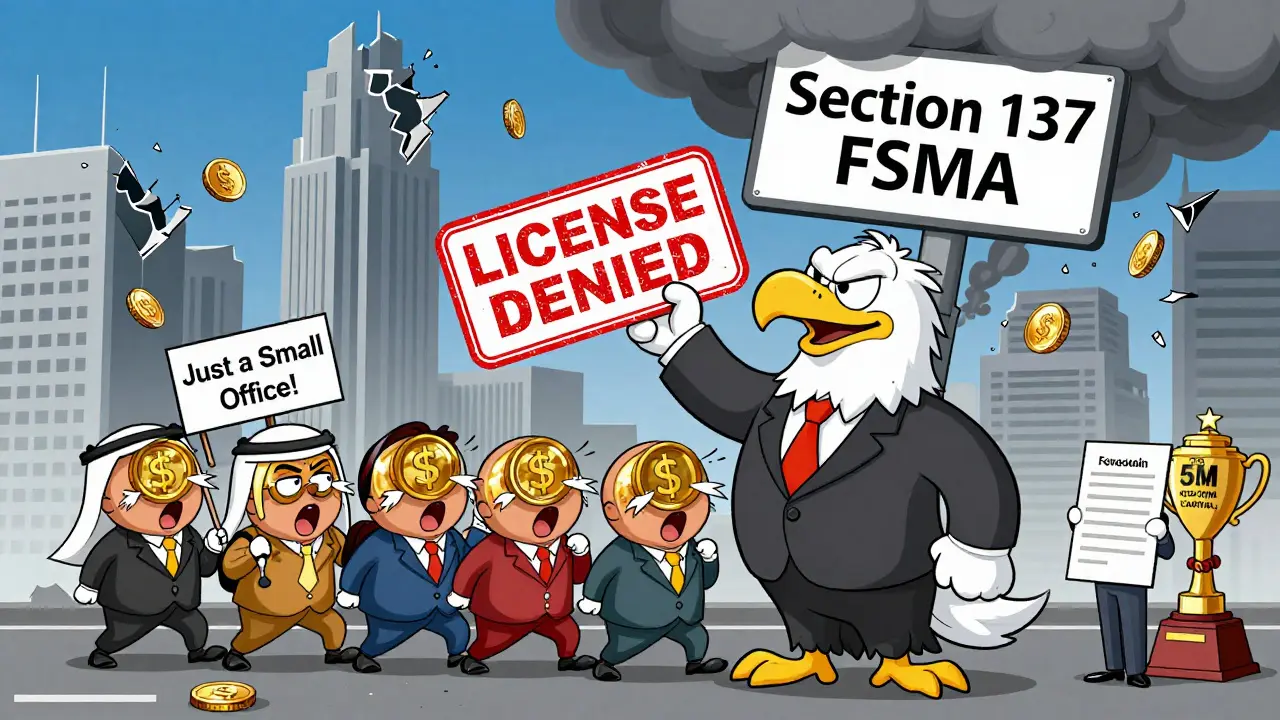

Monetary Authority of Singapore Crypto Oversight: What You Need to Know in 2025

Singapore's MAS has imposed one of the world's strictest crypto frameworks, effectively banning most new licenses. Learn the rules, penalties, and real impact on businesses and investors in 2025.