No Fiat Crypto Exchange: Trade Crypto Without Bank Accounts

When you use a no fiat crypto exchange, a platform that lets you trade cryptocurrencies without depositing or withdrawing traditional money like USD or EUR. Also known as non-custodial exchange, it removes banks from the equation entirely—no KYC, no bank transfers, no delays. This isn’t just for privacy seekers; it’s how traders in countries with banking restrictions, unbanked users, and those tired of account freezes operate every day.

These exchanges run on decentralized exchanges, platforms that don’t hold your funds or control your keys. Unlike centralized platforms like Binance or Coinbase, you connect your wallet—MetaMask, Trust Wallet, or Ledger—and trade directly with others using smart contracts. That means no one can freeze your account, no one can demand your ID, and no bank can block your deposits. This is the core of what makes a peer-to-peer crypto, a system where users trade directly without intermediaries system work. It’s not magic—it’s code. And it’s growing fast, especially as global banking rules tighten around privacy coins, DeFi, and cross-border trading.

Some of the most popular tools for this are non-custodial exchange, platforms like Uniswap, PancakeSwap, or DogeSwap, where you swap tokens without ever giving up control of your wallet. These aren’t meant for buying crypto with your debit card—they’re for moving one crypto to another, fast and anonymously. You’ll find them used heavily by traders dealing with tokens that centralized exchanges won’t list, like obscure DeFi projects, meme coins, or tokens banned in certain countries. That’s why you’ll see posts here about DogeSwap, AIA Exchange, and Braziliex—all of them either operate without fiat or have failed because they tried to add it. The real winners are the ones that never tried to play by bank rules in the first place.

What you’ll find in this collection are real-world breakdowns of exchanges that skip fiat entirely, projects that failed because they tried to force bank integration, and wallets that let you trade without ever touching traditional finance. You’ll learn why Bitget limits fiat options, why Iranian traders rely on VPNs to access these platforms, and how stablecoins like USDR collapsed when they tried to tie crypto to real estate—something banks still control. This isn’t theory. It’s what’s happening on the ground, in real time, by people who don’t want banks in their crypto.

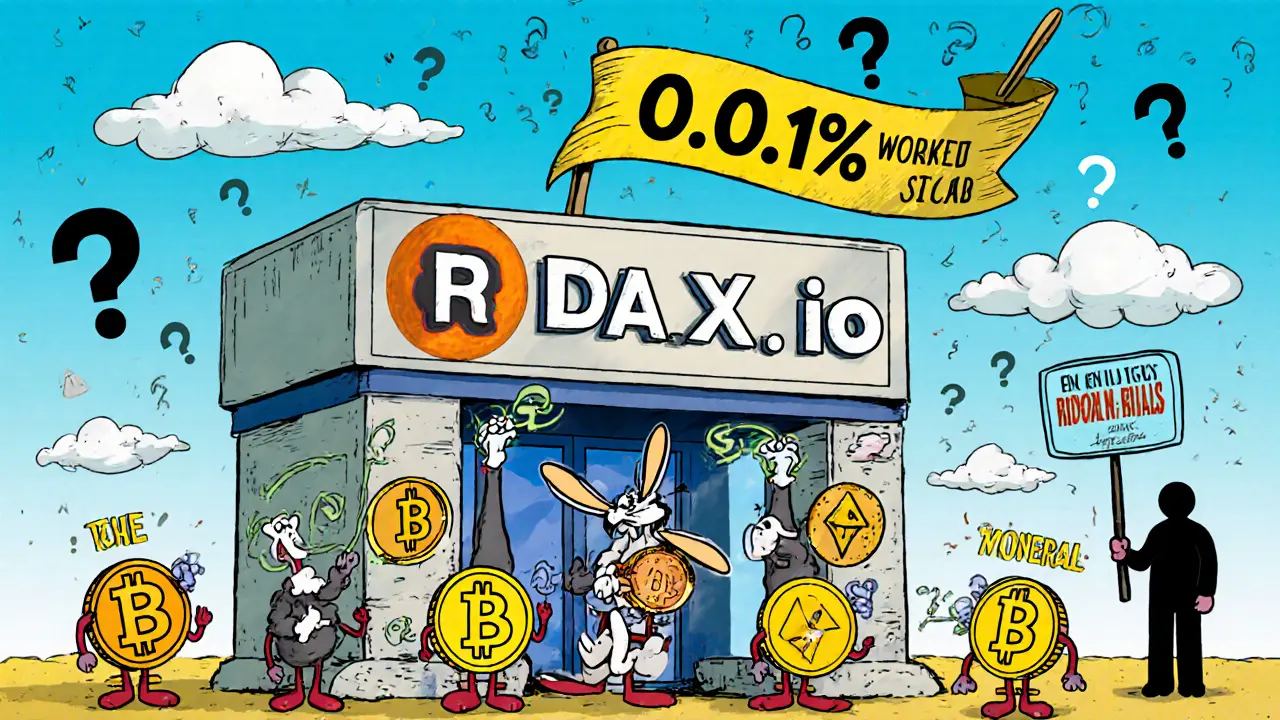

RDAX.io Crypto Exchange Review: Low Fees, No Fiat, and Major Red Flags

RDAX.io offers unusually low crypto trading fees and free withdrawals, but lacks transparency, regulatory status, and user trust signals. With no fiat on-ramp, no security disclosures, and no presence on major crypto platforms, it raises serious red flags for users.