Two-Way Peg: How Blockchain Bridges Connect Chains and Why It Matters

When you move Bitcoin to Ethereum to earn yield, you’re not really sending BTC—you’re using a two-way peg, a mechanism that locks an asset on one blockchain and issues a wrapped version on another, with a reversible process to unlock the original. Also known as asset locking, it’s the quiet engine behind most cross-chain DeFi. Without it, Bitcoin holders couldn’t lend on Aave, trade on Uniswap, or stake in Lido. It’s not magic—it’s math, smart contracts, and trust minimization.

But here’s the catch: not all two-way pegs are built the same. Some use trusted custodians (like Wrapped Bitcoin), others rely on decentralized oracles (like Across Protocol). The best ones keep the original asset locked securely while the wrapped version trades freely. The worst? They collapse when the bridge gets hacked or the collateral dries up—like Real USD (USDR), which crashed because its real estate backing couldn’t be sold fast enough. A two-way peg isn’t just about moving tokens; it’s about trust, liquidity, and timing.

That’s why you’ll see posts here about cross-chain bridges, systems that enable asset transfer between different blockchains using various security models. Also known as blockchain interoperability, it’s the reason you can use your ETH on Arbitrum or your SOL on Polygon. You’ll also find deep dives into wrapped tokens, tokenized versions of assets from other chains, created through a two-way peg mechanism to maintain price parity. Also known as synthetic assets, they’re the lifeblood of DeFi liquidity pools. Some are safe. Some are scams. Some are just outdated. We don’t guess—we check the ledger.

Every post here cuts through the noise. No fluff. No hype. Just real data: Which bridges actually lock assets securely? Which wrapped tokens have zero trading volume? Which projects pretend to be interoperable but rely on a single operator? You’ll find reviews of Across Protocol, analysis of failed stablecoins, and warnings about fake airdrops tied to broken bridges. If it’s about moving value between chains, we’ve looked at the code, the collateral, and the community. You don’t need to be a coder to understand it—you just need to know what to ask.

Below, you’ll find real-world examples of two-way pegs in action—and in failure. Some are still alive. Some are ghosts. All of them teach you how to spot the difference before you lock your coins in.

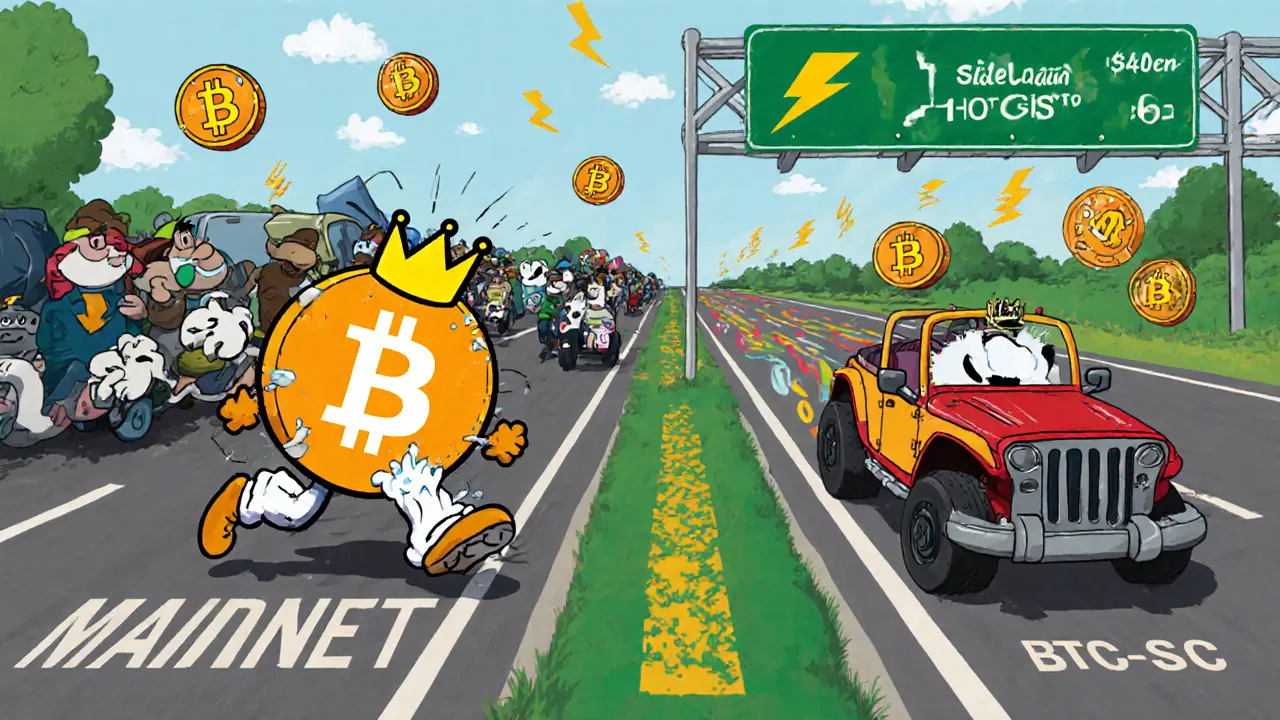

What Are Sidechains in Cryptocurrency? A Simple Guide to Scalable Blockchain Networks

Sidechains are independent blockchains connected to mainnets like Bitcoin or Ethereum via a two-way peg. They enable faster, cheaper transactions and smart contracts without compromising mainchain security.