Why Crypto Trading Volume Declined After New Regulations (2023‑2025)

Mar, 27 2025

Mar, 27 2025

Crypto Trading Volume Impact Calculator

Enter values and click Calculate to see estimated volume impact.

Based on historical data from 2023-2025, regulatory changes typically cause volume declines ranging from 10% to 60% depending on jurisdiction and policy clarity.

Platforms with clear, stable frameworks (like Japan and Switzerland) experience minimal disruption compared to regions with abrupt or ambiguous rules.

When governments across the globe tightened crypto rules starting in 2023, the market reacted in a surprisingly blunt way: trading activity on major platforms fell sharply, even as prices kept climbing. This article unpacks the why and how of that drop, walks through the data from the past three years, and shows what traders, investors, and exchanges can expect once the regulatory dust settles.

Regulatory pressure as the main trigger

Cryptocurrency regulatory restrictions are government‑issued rules that require exchanges to obtain licences, enforce stricter KYC, or limit the listing of certain tokens. After the GENIUS Act passed in the United States mid‑2025, and the European Union rolled out its MiCA framework, many platforms saw volume tumble between 10% and 60% within the first quarter of compliance.

Analysts agree that the speed of the drop matches the timing of regulatory announcements. SQ Magazine’s 2025 analysis shows a 10‑25% immediate dip in volume across affected jurisdictions, followed by a deeper contraction as users adjust to new verification hurdles.

2023‑2025: A data‑driven timeline

Three key reports give us a clear picture:

- Chainalysis’s 2025 Global Adoption Index recorded a quarterly swing in monthly crypto transfer volume of over $2trillion in North America, directly linked to each regulatory rollout.

- CoinGecko’s Q22025 report documented a -27.7% quarterly decline in spot trading volume, falling from $5.4trillion to $3.9trillion, even as Bitcoin topped $70k.

- TRM Labs noted illicit transaction volume shrinking to 0.4% of total activity in 2025, a 51% year‑over‑year fall that mirrors stricter enforcement.

These numbers illustrate a paradox: price rallies co‑existed with a shrinking market‑wide activity base, a pattern not seen in previous bull cycles.

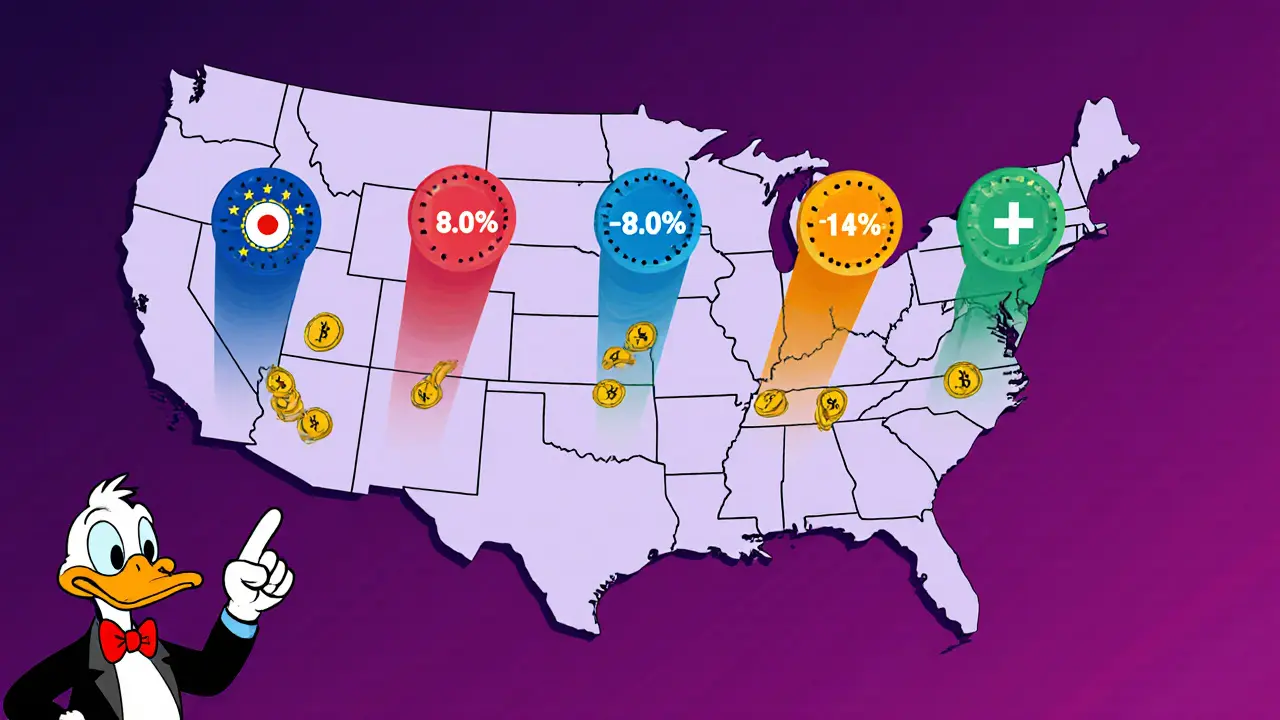

Jurisdictional impact: Who felt the pain most?

The volume crunch wasn’t uniform. Regions with clear, predictable rules saw milder declines, while those with abrupt or ambiguous policies suffered the steepest drops.

| Jurisdiction | Regulation Type | Avg. Volume Decline |

|---|---|---|

| United States | GENIUS Act (stablecoin backing) | 18.7% |

| European Union | MiCA (licensed stablecoins) | 12.3% |

| Japan | Clear licensing framework | 7.3% |

| India | Rapid tax‑reporting rules | 22.1% |

| Switzerland | Precise AML standards | 7.8% |

Clear pathways, like those in Japan and Switzerland, limited the shock to single‑digit percentages. In contrast, the U.S. and India saw double‑digit contractions as users scrambled to meet new compliance thresholds.

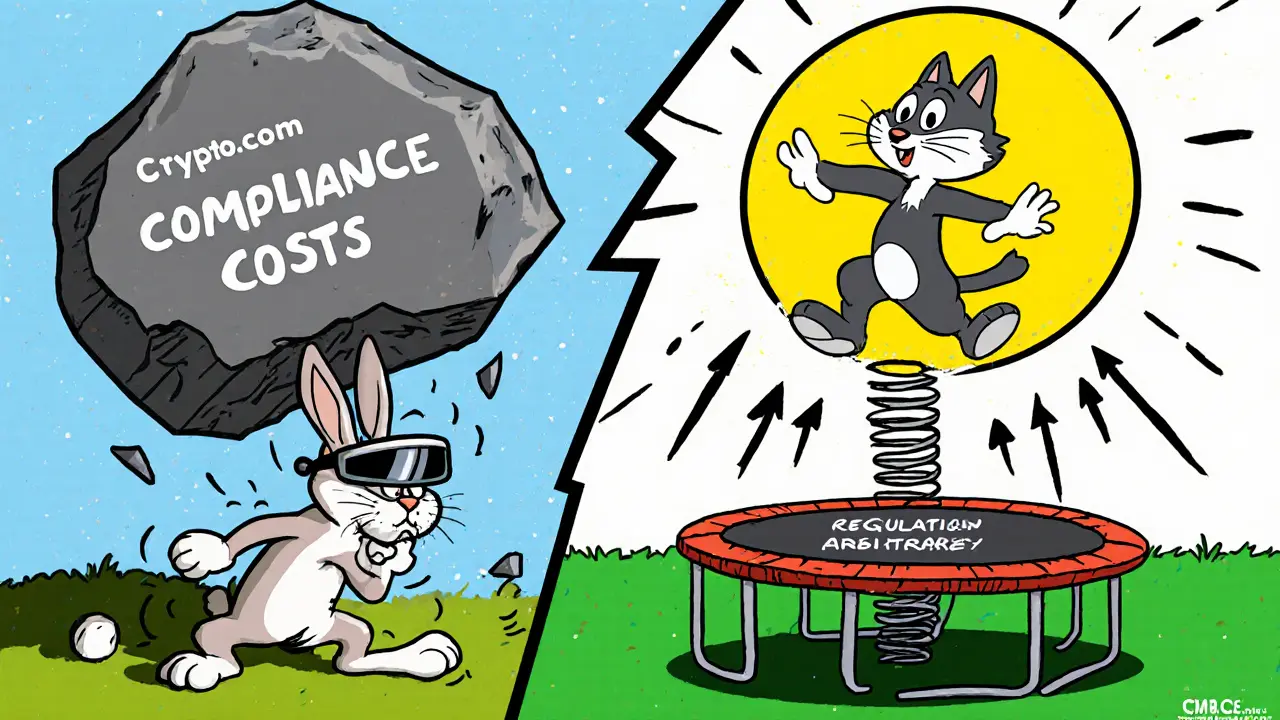

Exchange case studies: Winners and losers

Not all platforms reacted the same way. Two contrasting examples illustrate the strategic choices at play.

- Crypto.com chose to fully comply with the GENIUS Act, relocating its U.S. operations to a stricter jurisdiction. The result? A jaw‑dropping -61.4% quarterly volume plunge from $560.2billion to $216.4billion, sinking its rank from #2 to #8 among global exchanges.

- MEXC, HTX and Bitget did the opposite: they shifted key operations to jurisdictions with lighter regulatory burdens. Each posted modest QoQ growth (3.7%-5.4%) during Q22025, demonstrating that regulatory arbitrage still pays off for agile firms.

These outcomes suggest a simple rule of thumb: if you can move quickly to a compliant but permissive jurisdiction, you may offset the volume loss; if you stay put and overhaul compliance, expect a steep short‑term dip.

What happened to illicit activity and institutional investors?

Regulation did more than curb legitimate trades. TRM Labs’ 2025 Crypto Crime Report shows illicit volume halved, falling from 0.9% to 0.4% of total transactions. That drop aligns with stricter KYC/AML mandates and the crackdown on unlicensed token listings.

At the same time, institutional capital kept flowing into regulated vehicles. SQ Magazine recorded $5.95billion in weekly inflows to crypto ETFs during 2025, indicating that compliance can attract large players even as retail activity shrinks. Stablecoin usage tells a similar story: USDT and USDC continued to dominate, processing over $1trillion monthly, while EU‑backed EURC grew 79% month‑over‑month as firms chased license‑compliant alternatives.

Looking ahead: Will volume rebound?

Most analysts agree the worst is behind us. By Q42025, exchanges will have completed most regulatory migrations, and the market is already showing signs of stabilization:

- Bitwise Investments notes Bitcoin’s 30% quarterly price rise despite volume pressure, signaling confidence in the asset’s fundamentals.

- JPMorgan forecasts an extra $1.4trillion of dollar demand from stablecoins by 2027, suggesting that clear rules could boost long‑term liquidity.

- CoinGecko projects a return to volume growth in Q12026 once the GENIUS Act and MiCA are fully operational.

In short, the dip in crypto trading volume decline appears to be a market‑maturation phase rather than an irreversible collapse. Traders should monitor regulatory calendars, consider jurisdiction‑agnostic platforms, and keep an eye on institutional adoption metrics to gauge the next wave of activity.

Practical checklist for traders and exchanges

- Track upcoming regulatory dates (e.g., U.S. stablecoin rules, EU MiCA rollout).

- Assess where your primary exchange is incorporated and its compliance roadmap.

- Maintain flexible KYC/AML procedures to reduce onboarding friction.

- Diversify across assets that are less likely to face sudden delistings (e.g., Bitcoin, regulated stablecoins).

- Watch institutional inflow data-ETF and fund entries often precede volume rebounds.

Frequently Asked Questions

Why did trading volume drop even when crypto prices were rising?

Regulators introduced new licensing, KYC, and token‑listing rules that forced exchanges to restrict access or delist assets. Users pulled back or moved to compliant platforms, trimming overall activity despite bullish price signals.

Which jurisdictions saw the smallest volume declines?

Japan and Switzerland, both of which have clear, stable regulatory frameworks, experienced average declines of roughly 7%.

Did illicit transaction volumes drop because of the regulations?

Yes. TRM Labs reported illicit activity falling from 0.9% to 0.4% of total transactions in 2025, a direct effect of tougher AML/KYC enforcement.

Can I avoid volume loss by switching exchanges?

Exchanges that relocated to friendlier jurisdictions (e.g., MEXC, HTX) kept their volumes stable or grew. Moving to a compliant but permissive platform can mitigate short‑term drops, but you’ll need to handle cross‑border tax and reporting rules.

What’s the outlook for crypto trading volume in 2026?

Industry forecasts (CoinGecko, JPMorgan) suggest volume will resume growth in early 2026 once major regulatory frameworks are fully implemented and users regain confidence.

Carol Fisher

March 27, 2025 AT 05:06Patriotic investors will never let foreign regulators cripple the market! 🇺🇲

Melanie Birt

March 27, 2025 AT 10:40The recent regulatory wave clearly targets stablecoin transparency, which is good for institutional credibility. :) However, the abrupt 18% dip in US volume shows that markets need more grace periods. A phased rollout would let liquidity providers adjust without panic. In short, smarter implementation beats blunt force.

debby martha

March 27, 2025 AT 16:13i think they overreacted, volume drop is real but not all bad.

Orlando Lucas

March 27, 2025 AT 20:23Reflecting on the data, one might argue that regulation is the dialectic between freedom and order. The market's contraction can be seen as a moment of crisis that ultimately leads to a higher synthesis-a more resilient ecosystem. Yet, if the imposed rules are too heavy, the thesis collapses under its own weight, leaving traders disenchanted. We must ask whether the current path nurtures innovation or merely cages it.

Philip Smart

March 28, 2025 AT 03:20Look, the numbers don’t lie – a 22% plunge in India after the new tax rules signals that traders hate surprise fees. Everyone knows that if you want volume, you need predictable rules, not random tax spikes.

Nina Hall

March 28, 2025 AT 08:53Hey folks, it's cool to see the market adjusting, but remember every dip is a chance to learn. 🌈 Embrace the new frameworks, and you might discover fresh opportunities in compliance‑focused products.

Lena Vega

March 28, 2025 AT 13:53Regulations are here; adapt or fade.

Sanjay Lago

March 28, 2025 AT 20:00Yo, the Swiss model shows we can keep volume stable if rules are clear. They didn't just slap a law on us, they gave a roadmap – that's why their decline is only ~8%.

arnab nath

March 29, 2025 AT 00:10Don't be fooled – those 'clear roadmaps' are just smoke screens for deeper surveillance. The real agenda is to control every transaction.

Nathan Van Myall

March 29, 2025 AT 05:26The calculator is handy, but it oversimplifies reality. Market sentiment, macro‑economics, and cross‑border flows play huge roles that a simple percentage can't capture.

Manas Patil

March 29, 2025 AT 11:00Indeed, when you factor in on‑chain analytics, the volume dip aligns with reduced cross‑chain bridge activity post‑MiCA. Jargon aside, the data corroborates the regulatory impact.

Annie McCullough

March 29, 2025 AT 16:50Honestly, I think the whole narrative about volume decline is overblown; some platforms just shifted to off‑chain services, which the calculator doesn't register. So the numbers look worse than they truly are.

Lady Celeste

March 29, 2025 AT 21:00Wow, another drama about numbers. Cry me a river.

Ethan Chambers

March 30, 2025 AT 03:33One must appreciate the subtle elegance with which European regulators have crafted a silken net, luring unsuspecting traders into compliance ballet. Yet, beneath that veneer lies a quixotic ambition to dictate market tempo, a folly worthy of Shakespearean tragedy.

gayle Smith

March 30, 2025 AT 08:33Sure, let’s romanticize over‑regulation while the average retail trader watches their positions evaporate. Reality check: jargon doesn’t fix liquidity.

mark noopa

March 30, 2025 AT 14:06When we contemplate the chronicle of cryptocurrency market dynamics between 2023 and 2025, a tapestry of interwoven forces emerges, each thread tugging at the delicate fabric of trading volume. First, legislative bodies across continents introduced an array of statutes-ranging from the United States' GENIUS Act demanding robust stablecoin backing, to the European Union's MiCA framework stipulating licensing prerequisites. These legal codifications, while ostensibly designed to bolster investor protection, invariably sowed seeds of uncertainty among market participants, prompting a collective retreat from speculative exposure. Moreover, the asymmetry of regulatory clarity manifested starkly: jurisdictions such as Japan and Switzerland, which opted for incremental policy evolution, witnessed muted volume contractions-often hovering below the ten‑percent threshold. In contrast, regions imposing abrupt, opaque mandates experienced precipitous declines, with some platforms reporting attrition as severe as sixty percent. The psychological dimension cannot be overlooked; traders, ever vigilant to risk, recalibrated their risk‑adjusted return expectations, favoring assets with transparent compliance pathways. Concurrently, the advent of rapid tax‑reporting obligations introduced operational friction, compelling exchanges to overhaul reporting architectures, thereby diverting resources from liquidity‑enhancing initiatives. Yet, this period also birthed innovation: compliance‑centric products, such as on‑chain audit tools and regulated stablecoin vaults, began to capture market share, partially offsetting volumetric erosion. Ultimately, the era underscores a paradox-regulation, while curbing certain malpractices, concurrently reshapes the market topology, birthing new opportunities for entities adept at navigating the evolving legal labyrinth.