Bitcoin Halving

When you see the term Bitcoin halving, the scheduled reduction of Bitcoin’s block reward that occurs every 210,000 blocks. halving event pop up in news, most people wonder why it matters. In short, each halving slices the new Bitcoin created per block in half, which directly trims the supply growth rate. The Bitcoin halving is not a random tweak; it’s hard‑coded into the protocol to keep inflation predictable.

To understand the ripple effect, look at Bitcoin, the first decentralized cryptocurrency that introduced the concept of digital scarcity. Bitcoin’s design ties the block reward to a fixed schedule, so after every 210,000 blocks the reward drops from 6.25 BTC to 3.125 BTC, then to 1.5625 BTC, and so on. This schedule shapes three key entities: the block reward, the mining ecosystem, and the overall supply curve.

Another core piece is the block reward, the amount of new Bitcoin miners receive for confirming a block. When the reward halves, miners earn fewer coins for the same amount of work, which pushes them to become more efficient or to wait for higher transaction fees. That shift often leads to a temporary dip in hash power, followed by an adjustment in mining difficulty. Difficulty, in turn, influences how quickly blocks are found, keeping the 10‑minute average steady despite the reward cut.

Why the Halving Matters

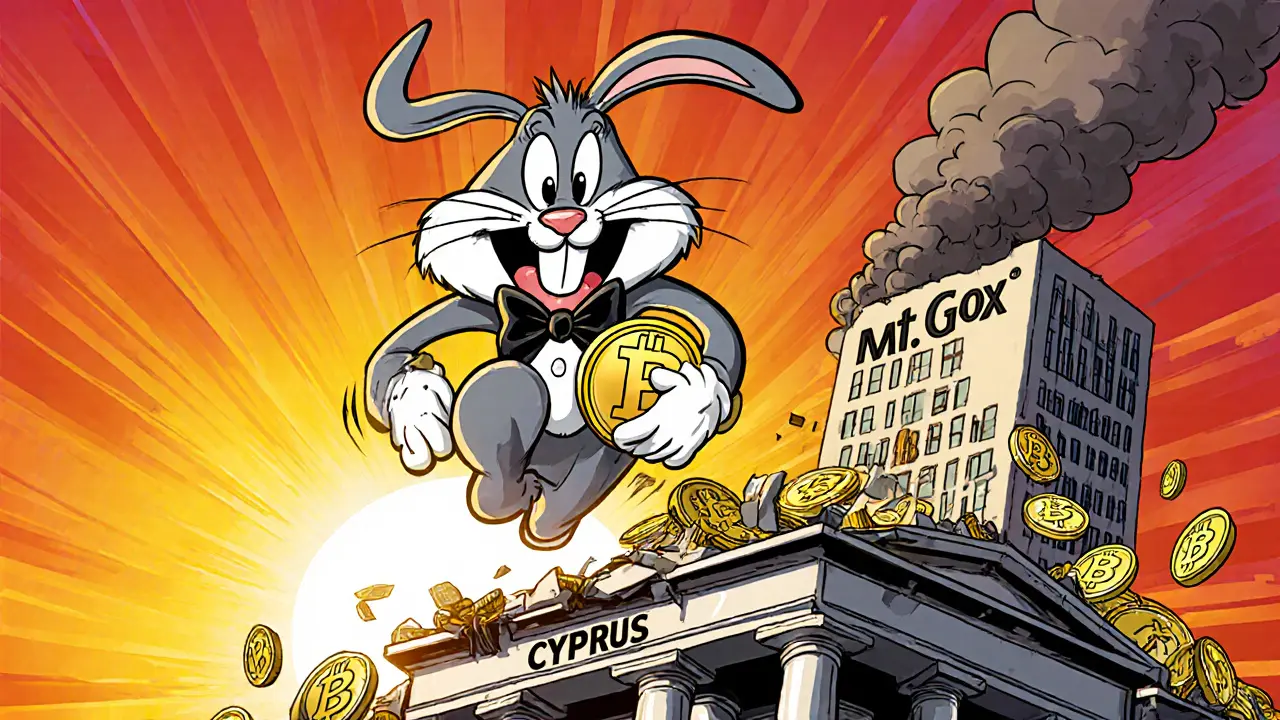

Because the block reward is the main source of new Bitcoin, halving events directly affect the total supply entering the market. Less supply combined with steady or growing demand tends to put upward pressure on price, a pattern many traders watch closely. Historical data shows price spikes occurring months after each halving, though the magnitude varies due to macro factors, regulatory news, and market sentiment.

Mining profitability also hinges on the halving. When rewards shrink, miners rely more on transaction fees to stay profitable. This can lead to higher fee markets during periods of congestion, which in turn can impact user experience and the adoption curve. Some miners upgrade hardware or switch to lower‑cost energy sources, which reshapes the geographic distribution of the mining network.

Supply dynamics don’t stop at the halving. The capped 21 million Bitcoin limit means each halving brings the network closer to its final issuance. Around the year 2140 the reward will effectively become zero, leaving miners to earn solely from fees. Understanding how each halving moves the network toward that point helps investors gauge long‑term scarcity and price expectations.

In practice, the halving influences three actionable areas for anyone following Bitcoin: price speculation, mining strategy, and fee market outlook. Traders often set alerts for the block height that triggers a halving, anticipating volatility. Miners run profitability calculators that factor in the new reward, energy costs, and anticipated fee levels. Developers and wallet providers monitor fee trends to ensure smooth user transactions during high‑demand periods.

The posts collection below dives into these themes from different angles. You’ll find deep‑dive analyses on mining economics, price trends after past halvings, and how the upcoming event could reshape the ecosystem. Whether you’re a casual holder, a miner, or a market watcher, the articles ahead give you the context you need to make sense of the next Bitcoin halving.

Historical Bitcoin Bull Runs Analysis: Patterns, Drivers & What to Expect

A deep dive into Bitcoin's four major bull runs, the forces behind each surge, and practical ways to spot the next cycle and manage risk.