DeFi Token: What It Is, How It Works, and What to Watch For

When you hear DeFi token, a digital asset built to run financial applications without banks. Also known as decentralized finance token, it enables lending, trading, and earning interest directly on the blockchain—no middlemen needed. Unlike Bitcoin or Ethereum, which are native coins, DeFi tokens live on top of existing blockchains like Ethereum or Polygon. They’re the fuel behind apps that let you lend your crypto, swap tokens, or earn yield—all without handing your money to a bank or exchange.

Not every token labeled "DeFi" is real. Many are just hype with no utility. A true DeFi token, a digital asset built to run financial applications without banks. Also known as decentralized finance token, it enables lending, trading, and earning interest directly on the blockchain—no middlemen needed. has clear rules: a fixed supply, transparent ownership, and real use inside a working protocol. Look for tokens tied to actual platforms like Aave or Uniswap—not vague projects promising 1000% returns. The tokenomics, how a token’s supply, distribution, and incentives are designed. Also known as economic model, it determines if the token holds value long-term or collapses overnight. Bad tokenomics? That’s how you lose everything. Unlimited supply, hidden team wallets, or fake staking rewards? Run.

DeFi tokens also connect to blockchain governance, the system that lets token holders vote on protocol changes. Also known as on-chain voting, it gives users real power over the software they use. If a project lets you vote on fees, upgrades, or new features just by holding its token, that’s a sign of real decentralization. But if the team controls everything behind closed doors? That’s not DeFi—it’s a centralized app with a fancy label.

You’ll see DeFi tokens pop up in airdrops, like the OwlDAO or BNC drops mentioned in our posts. But not every airdrop is worth your time. Some are just traps to steal your wallet keys. Real airdrops don’t ask for your private key. They don’t promise instant riches. And they’re always announced through official channels—not a billboard in Times Square.

Whether you’re holding a DeFi token, staking it, or just trying to avoid scams, the key is simple: know what you’re buying. Look at the code, check the team, read the whitepaper—not the Telegram hype. The best DeFi tokens don’t shout. They build. And they let you use them, not just speculate on them.

Below, you’ll find real stories from people navigating DeFi—some got lucky, others lost everything. We’ve got reviews of exchanges that list real tokens, breakdowns of tokenomics traps, and warnings about fake airdrops pretending to be DeFi. No fluff. Just what you need to stay safe and make smarter moves in the open streets of blockchain.

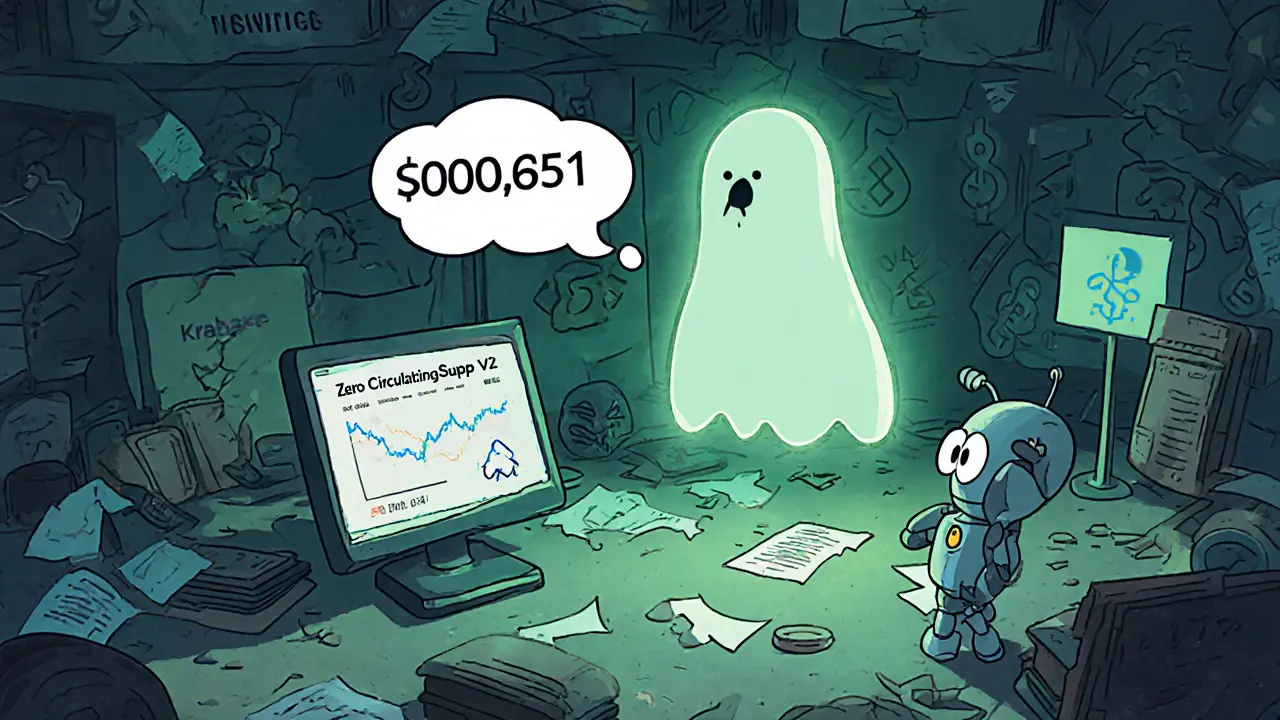

What is Anatolia Token (ANDX) Crypto Coin? A Real Look at the Zero-Circulating Supply Token

Anatolia Token (ANDX) claims to be a community-driven DeFi token, but it has zero circulating supply, no exchange listings, and no active development. Here's what's really going on with this ghost token.