Market Cycles: How Crypto Phases Shape Trading, Regulation and DeFi

When navigating market cycles, the recurring patterns of price expansion and contraction that drive the crypto world. Also known as crypto market phases, it sets the stage for everything else.

Another key player is trading volume, the total amount of coins bought and sold across exchanges during a given timeframe. High volume often fuels a bullish swing, while a drop can signal the start of a bear market. Then there’s crypto regulation, government rules that affect how and where digital assets can be used. New rules can spark sudden market shifts, either tightening sentiment or unlocking fresh growth opportunities. DeFi also weaves into the picture: decentralized finance projects create fresh liquidity pools that can amplify a cycle’s momentum. Finally, the debate between staking vs mining, two ways of securing blockchain networks and earning rewards influences investor behavior, especially when yields change between cycles.

Putting these pieces together, a typical cycle looks like this: a bullish phase kicks off when trading volume spikes and positive regulatory news lifts sentiment; DeFi protocols attract capital, boosting token prices; as returns wane, some investors shift from staking to mining or vice‑versa, gradually softening demand; eventually volume contracts, a bearish correction sets in, and the market waits for the next catalyst. This pattern shows up in real‑world data—like the volume dip after 2023‑2025 regulations that many traders still talk about. Below you’ll find a curated set of guides, reviews and deep‑dives that unpack each of these elements, from exchange fee breakdowns to staking vs mining battles, so you can see the theory in action.

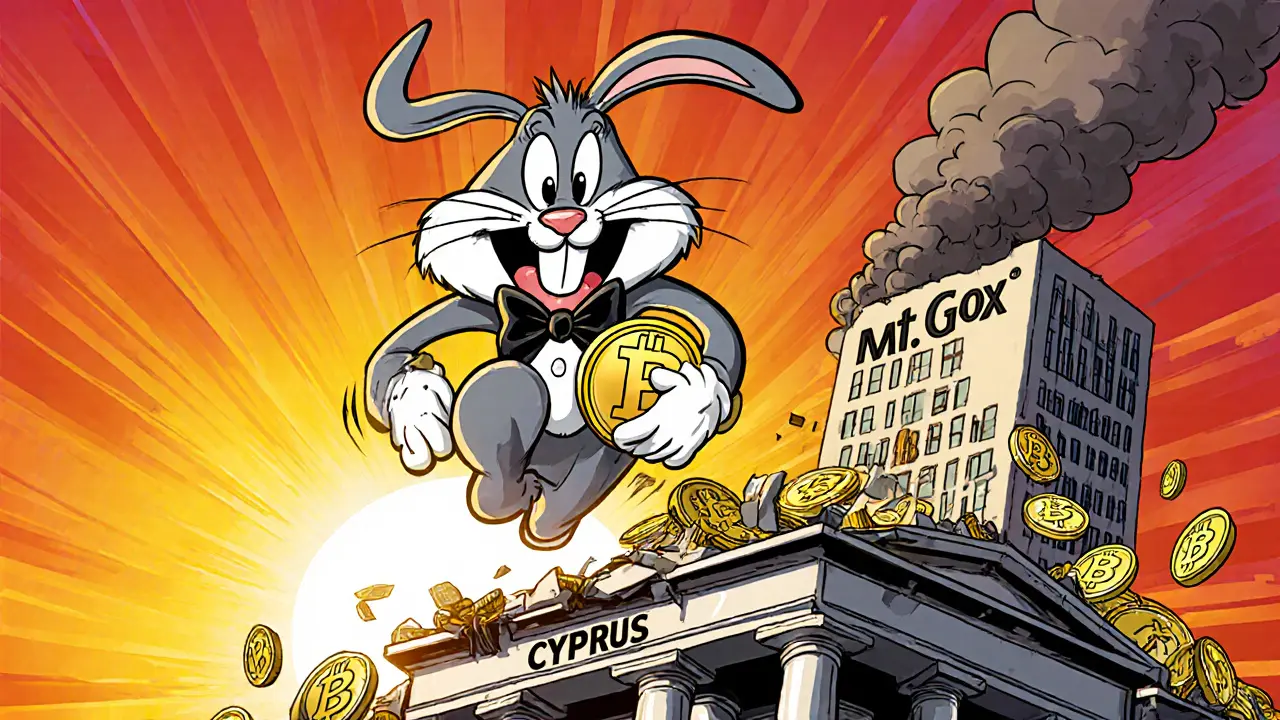

Historical Bitcoin Bull Runs Analysis: Patterns, Drivers & What to Expect

A deep dive into Bitcoin's four major bull runs, the forces behind each surge, and practical ways to spot the next cycle and manage risk.