Singapore Crypto Rules: What You Can and Can't Do in 2025

When it comes to Singapore crypto rules, the regulatory framework set by the Monetary Authority of Singapore (MAS) that defines how digital assets can be issued, traded, and used legally. Also known as MAS crypto regulation, it’s one of the few places in the world where crypto isn’t just tolerated—it’s structured, supervised, and treated like a legitimate financial instrument. Unlike countries that ban crypto outright or ignore it entirely, Singapore built a system that forces companies to play by clear rules. If you’re trading, mining, or launching a token here, you need to know what’s allowed—and what gets you fined or locked out.

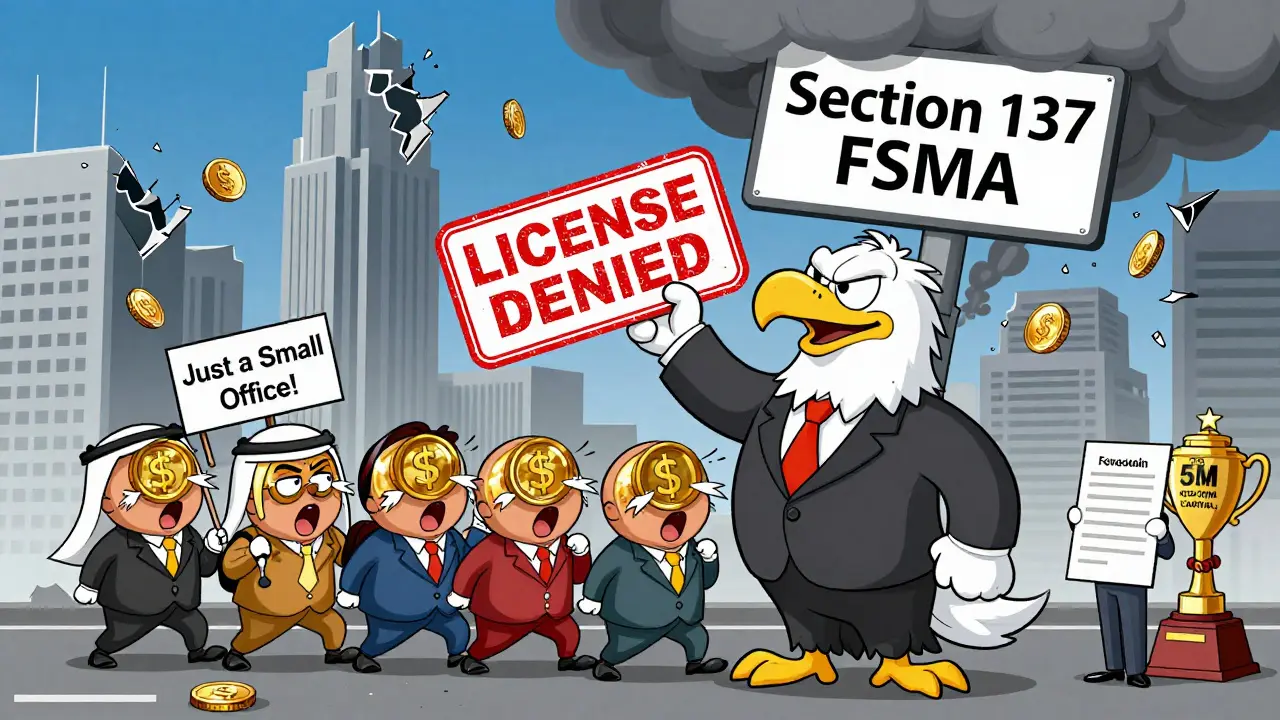

At the heart of this system is the Monetary Authority of Singapore (MAS), the central bank and financial regulator that controls all digital asset activities in the country. Also known as MAS crypto regulation, it doesn’t just react to crypto—it shapes it. Every exchange, wallet provider, or DeFi platform operating in Singapore must get a license from MAS. That means background checks, capital requirements, AML systems, and regular audits. No license? You can’t legally serve customers in Singapore. And if you try to sneak in through P2P or offshore servers? MAS still tracks you. They’ve fined foreign platforms before, even if they’re based in the Caymans or Dubai. Then there’s the digital asset licensing framework, the official set of rules under the Payment Services Act that classifies crypto services into four categories: exchange, custody, payment token issuance, and money transmission. Also known as MAS licensing requirements, it forces platforms to prove they’re not just tech startups—they’re financial institutions in disguise. You can’t just launch a token and call it a coin. If it acts like a security, MAS treats it like one. If it’s used for payments, it needs anti-fraud controls. If it holds user funds, it must be insured and segregated.

What about regular users? If you’re buying Bitcoin or Ethereum on a licensed exchange like Kraken or Binance SG, you’re fine. But if you’re running a crypto ATM, offering staking rewards without a license, or promoting an unregistered token to Singaporeans? That’s a violation. The rules don’t just target big firms—they catch individuals too. And while personal holdings aren’t taxed, any income from trading or mining? That’s taxable under income tax laws. Singapore doesn’t tax capital gains, but if you’re trading like a business, they’ll treat it like one.

There’s no gray area here. No "crypto-friendly" myths. No "regulatory holidays." Singapore’s approach is simple: if you want to operate here, you submit, you comply, you prove you’re not a risk. And if you don’t? You’re blocked. That’s why so many global projects pick Singapore for their headquarters—it’s not because it’s easy, it’s because it’s predictable. Below, you’ll find real breakdowns of how these rules affect exchanges, users, and startups. No fluff. Just what actually happens when you try to do crypto in Singapore in 2025.

Monetary Authority of Singapore Crypto Oversight: What You Need to Know in 2025

Singapore's MAS has imposed one of the world's strictest crypto frameworks, effectively banning most new licenses. Learn the rules, penalties, and real impact on businesses and investors in 2025.