What is AKAS (AS) crypto coin? Full guide on the new DeFi project and scam warnings

Jan, 3 2026

Jan, 3 2026

AKAS (AS) is a cryptocurrency project that launched on May 29, 2025, claiming to be a next-generation, fully on-chain DeFi protocol built on an upgraded version of OlympusDAO 4.0. Based in Tórshavn, Denmark, it positions itself as a community-driven financial system with no central authority, no private sales, and no whitelists. But behind its clean marketing and technical jargon, serious red flags are emerging - and many investors are already losing money.

How AKAS (AS) claims to work

AKAS calls itself a Full-Chain Resonance Protocol. That’s a fancy way of saying it tries to do everything on the blockchain - no off-chain backups, no hidden teams, no secret wallets. The core idea is the COC model: Co-Creation. Everyone who joins is supposed to be a co-founder, not just an investor. You’re not buying a token; you’re helping build the system. To join, you have to participate in the Genesis LP (Liquidity Provider) program. You lock up ETH or another major crypto, and in return, you get AKAS tokens. The earlier you join, the better the deal. Early participants get up to a 30% bonus on their tokens. That bonus drops by 0.5% every 24 hours. So if you wait a week, you’re getting 26.5% less than the first person. That creates pressure - a classic tactic to rush people into decisions. There are four participation tiers: V1 through V4. Each one gives you more voting power in the DAO. V1 might let you vote on minor updates. V4 lets you propose major changes to the protocol. The higher your tier, the more influence you have. But to reach V4, you need to stake your AKAS tokens for 360 days - almost a full year. That means your money is locked up. If the project collapses, you can’t get out.What makes AKAS different - or so they say

AKAS says it’s fixing the biggest problems in DeFi. Most DeFi projects start with private sales. Big investors get cheap tokens before the public even knows the project exists. Then they dump them on the open market, crashing the price. AKAS claims to ban all of that. No private sales. No bots. No whales. Everyone starts on the same day, with the same rules. It also says it’s fully on-chain. That means all rules are written in smart contracts. No team can change them later. No CEO can decide to freeze wallets. Everything is automated. That sounds great - until you realize that if something goes wrong, there’s no one to call. No customer support. No refund policy. Just code. The project also claims to be globally synchronized. That means the launch happens at the same moment for everyone, everywhere. No time zone advantages. No insider access. Sounds fair. But fairness doesn’t mean safety.The scam warnings you can’t ignore

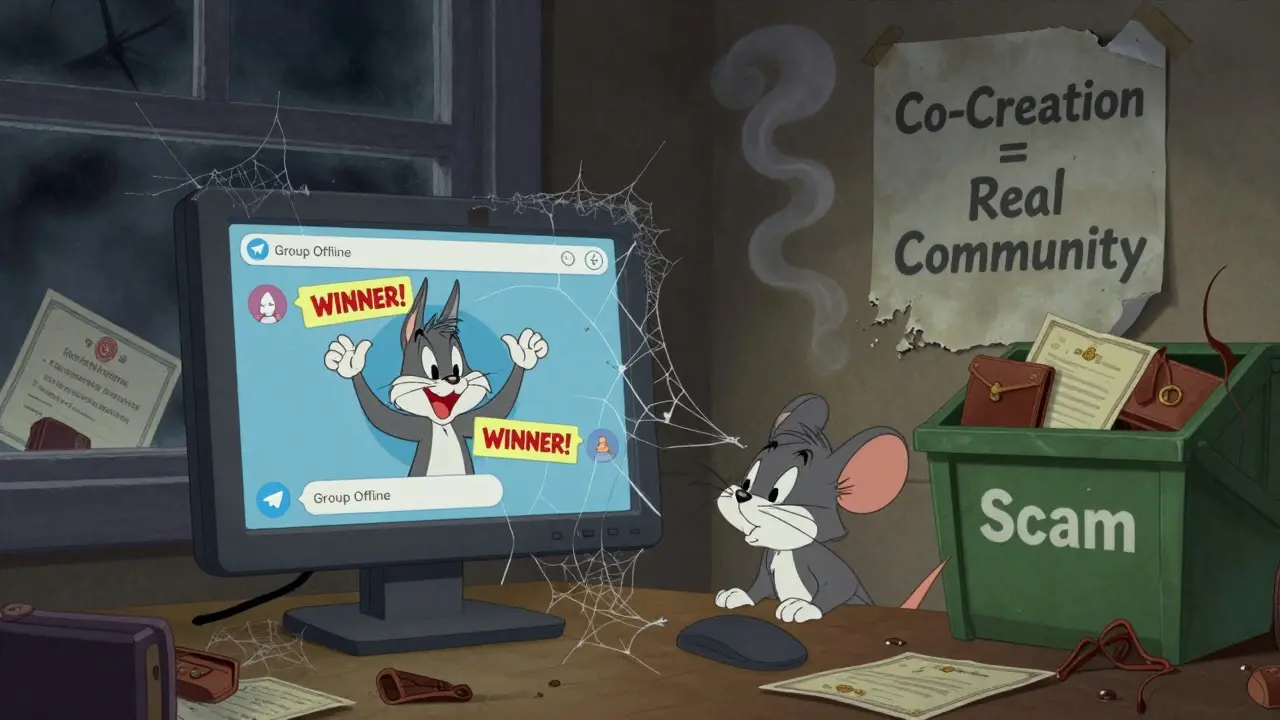

Here’s the part most guides won’t tell you: AKAS is being flagged as a potential pig butchering scam. Pig butchering scams don’t start with a bang. They start with trust. You join a Telegram group. People are friendly. They share success stories. Someone posts a screenshot of their 500% gain. You start to believe it’s real. Then they convince you to send crypto to the Genesis LP. You get your AKAS tokens. You see your balance go up. You feel smart. Then, slowly, the messages stop. The Telegram group goes quiet. The website stops updating. The Twitter account stops posting. And your tokens? Worthless. The money is gone. And there’s no way to get it back. Multiple independent investigators have published reports warning about AKAS. They’ve found patterns that match other known scams: fake team photos, vague whitepapers, no audited code, and a heavy focus on urgency. The 30% bonus? It’s not a reward - it’s a hook. And here’s the kicker: AKAS has no public team. No LinkedIn profiles. No real names. No track record. Just a website and a Telegram channel. That’s not decentralization. That’s anonymity.

Market data: Is AKAS growing or fading?

As of October 2025, AKAS trades at $9.08 per token. The 24-hour trading volume is $2.73 million. That’s tiny compared to top DeFi coins like AAVE or UNI, which trade in the hundreds of millions daily. Low volume means low liquidity. If 100 people try to sell at once, the price crashes. The price has dropped 2.05% in the last 24 hours. That’s normal in crypto. But AKAS has only been trading for about five months. There’s not enough data to say if it’s trending up or down. What we do know is that new projects with low volume and no team often vanish within months. The 360-day staking requirement makes it harder for people to exit. That’s presented as a sign of commitment. But in scams, it’s a way to trap people. Once your money is locked, you’re less likely to complain. And by the time you realize something’s wrong, it’s too late.Should you invest in AKAS?

If you’re looking for a safe, long-term crypto investment, AKAS is not it. If you’re looking for a high-risk, high-reward gamble with a high chance of total loss - then maybe. But even then, there are better options. Projects like Ethereum, Solana, or even newer but audited DeFi protocols offer more transparency, more history, and more accountability. AKAS checks almost every box of a scam: anonymous team, aggressive urgency tactics, no code audit, no public track record, and a flood of warning signs from investigators. The fact that it uses DeFi buzzwords like “DAO,” “on-chain,” and “co-creation” doesn’t make it real. It just makes it sound real. If you’ve already invested, don’t add more. If you’re thinking about it, walk away. There’s no upside worth the risk. Even if the project turns out to be legitimate - which is extremely unlikely - the 360-day lock-up means you’re tied to it for a year. That’s a long time to wait for something that might never deliver.

Where AKAS is active - and why that doesn’t matter

AKAS has a presence on Facebook (AKASOfficialFB), Twitter (@AKASOfficial_), and Telegram (t.me/akasdao). The Telegram group is the main hub. It’s active. People post screenshots. People cheer. It feels real. But so did every other scam. Fake activity is easy to create. Bot accounts can post. Paid moderators can answer questions. Professional-looking websites cost less than $500 to build. The presence of social media doesn’t prove legitimacy. It proves someone knows how to market. Don’t be fooled by the numbers. A Telegram group with 50,000 members doesn’t mean 50,000 people are making money. It means 50,000 people are being targeted.What to do instead

If you want to get into DeFi, start with projects that have been around for years. Look for ones with:- Public, verifiable teams with LinkedIn profiles

- Audited smart contracts from reputable firms (like CertiK or SlowMist)

- On-chain governance with real voting history

- Trading volume over $10 million daily

- No urgency tactics or bonus timers

Final warning

AKAS isn’t just risky. It’s dangerous. The combination of fake fairness, locked funds, anonymous operators, and scam warnings makes this one of the most hazardous crypto projects launched in 2025. The promise of decentralization is real. But AKAS isn’t delivering it. It’s using it as a disguise. If you lose money on AKAS, no one will help you. No regulator will step in. No developer will fix it. The blockchain doesn’t care. And once your funds are gone, they’re gone forever. Don’t be the next victim. Walk away.Is AKAS (AS) a real cryptocurrency?

AKAS exists as a token on the blockchain, so technically yes - it’s a real cryptocurrency. But being real doesn’t mean it’s legitimate. Many scams have real tokens. What matters is whether the project is trustworthy. AKAS has no public team, no code audit, and multiple scam warnings. That makes it dangerous, not real in any meaningful sense.

Can I make money with AKAS?

Some people may see short-term price gains, but the odds of making real, lasting money are extremely low. The 30% bonus is designed to lure you in, and the 360-day lock-up prevents you from leaving if things go bad. Most users who invest end up losing everything. This isn’t investing - it’s gambling with a rigged system.

Why is AKAS being called a scam?

Multiple investigators have linked AKAS to pig butchering scams - a type of fraud where victims are emotionally manipulated into investing. Red flags include anonymous founders, fake social proof, urgency tactics (like the 24-hour bonus drop), and no public audits. The project also lacks any verifiable track record, which is a hallmark of scams.

What is the 360-day staking requirement for AKAS?

To reach the highest governance tier (V4), you must lock your AKAS tokens for 360 days. The project says this ensures long-term commitment. But in practice, it traps your money. If the project turns out to be a scam, you can’t withdraw your funds. That’s not a feature - it’s a trap.

Is AKAS built on Ethereum?

AKAS is built on the Ethereum blockchain, like most DeFi projects. But being on Ethereum doesn’t make it safe. Ethereum hosts both legitimate projects and scams. What matters is who built it, whether the code was audited, and whether the team is accountable. AKAS fails all three.

Where can I buy AKAS (AS) tokens?

AKAS is available on a few small decentralized exchanges (DEXs), but the only way to get it at launch is through the Genesis LP program on their official website. Be warned: if you’re not joining through their official site, you’re likely being phished. Even then, joining the Genesis LP is extremely risky due to the scam warnings.

Has AKAS been audited?

No, AKAS has not published any smart contract audits from reputable firms like CertiK, PeckShield, or Trail of Bits. Without an audit, there’s no proof that the code works as claimed - or that it doesn’t have backdoors. This is a major red flag in any DeFi project.

Who is behind AKAS?

The team behind AKAS is completely anonymous. There are no names, no LinkedIn profiles, no public interviews, and no history of previous projects. The project claims to be based in Tórshavn, Denmark, but there’s no registered company or legal entity linked to it. An anonymous team in DeFi is a huge risk - not a feature.