How Chinese Banks React When You Try to Withdraw Crypto to Fiat

Feb, 1 2026

Feb, 1 2026

Chinese banks don’t just block crypto-to-fiat withdrawals-they shut down accounts and report you to authorities

If you’re in China and try to turn your Bitcoin, Ethereum, or any other cryptocurrency into yuan through a bank, the system doesn’t just say no. It freezes your account, flags your name, and sends a report to the government. There’s no gray area in the process. It’s not about being careful or using the right method. It’s about the fact that crypto-to-fiat conversions are illegal under Chinese law, and banks are legally required to act as enforcers.

This isn’t a recent crackdown. It’s the result of a multi-year escalation that started in 2013, when the People’s Bank of China (PBoC) first declared Bitcoin a commodity-not money-and banned banks from handling it. By 2017, ICOs and domestic crypto exchanges were shut down. Then, in September 2021, the government dropped the hammer: all crypto trading, including peer-to-peer and over-the-counter conversions to fiat, was labeled an “illegal financial activity.” Banks got the message loud and clear. They were told to cut off every possible channel.

How banks detect crypto transactions-before you even try to cash out

Chinese banks don’t wait for you to deposit crypto. They watch your behavior before you even get close to withdrawing. Their systems are built to catch patterns, not just transactions. If you’ve been sending small amounts of money-say, ¥5,000 or ¥10,000-to the same five different accounts over a week, that’s a red flag. Why? Because that’s how people move crypto proceeds: breaking large sums into smaller chunks to avoid detection.

They also scan for wallet addresses. China maintains a public blacklist of over 14,000 crypto-related addresses linked to exchanges, mining pools, and DeFi platforms. If your bank account sends money to any of those addresses-even once-it gets flagged. In 68% of cases where accounts are frozen, the trigger is a connection to one of these blacklisted addresses. Other common triggers include rapid transfers between multiple accounts (23% of cases) and transactions originating from IP addresses tied to known crypto platforms.

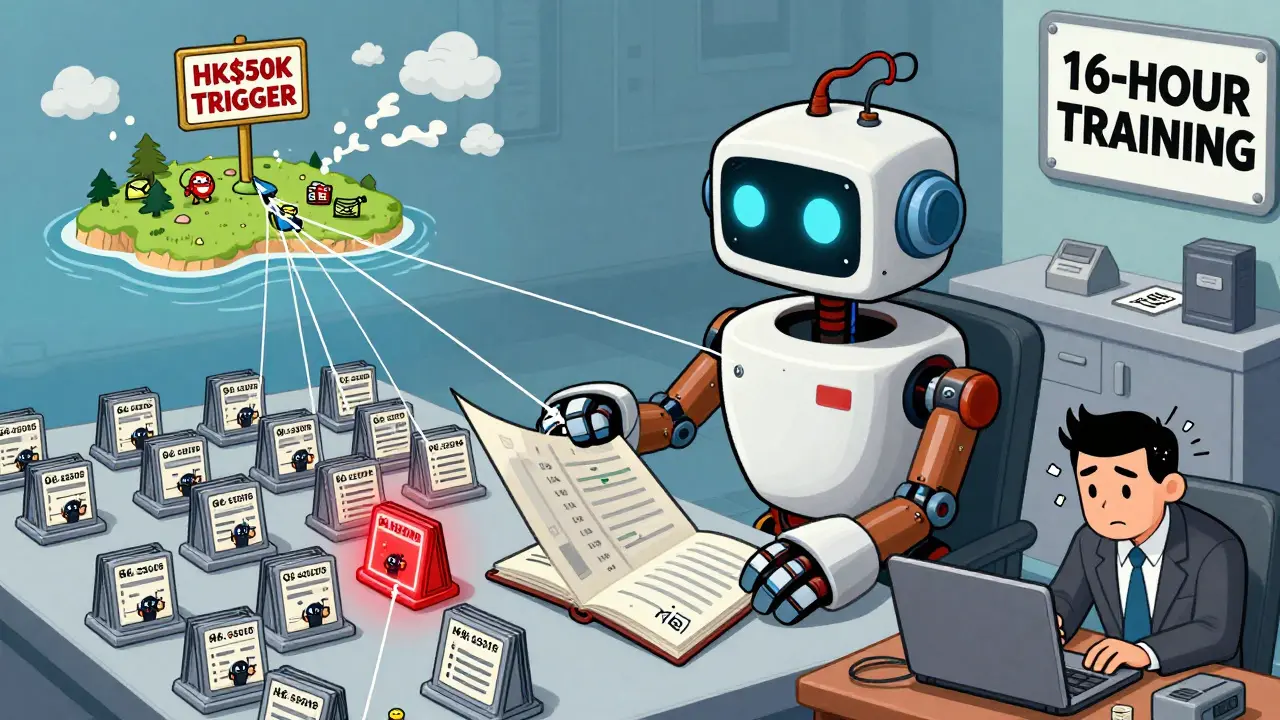

It’s not just software. Banks have teams of compliance officers trained to spot anomalies. Since 2023, every front-line employee at Chinese banks must complete 16 hours of crypto-specific AML training annually. They learn to recognize how crypto users behave: sudden large cash deposits after months of low activity, multiple small transfers from different people into one account, or funds moving out to overseas accounts in Hong Kong or Singapore.

What happens when you get caught

Once a bank detects suspicious activity, the clock starts ticking. They have 24 hours to report it to the China Anti-Money Laundering Monitoring and Analysis Center (CAMLMAC) and the local branch of the PBoC. Then, they freeze your account-usually for at least 72 hours. In 89% of cases, the freeze lasts longer than 30 days. During that time, you can’t withdraw, transfer, or even pay bills from that account.

Some people think they can fix it by calling the bank. They can’t. There’s no appeals process. If your transaction matches a known crypto pattern, the bank has no discretion. They’re legally bound to freeze and report. Even if you swear the money came from selling a car or a family gift, the system doesn’t care. The pattern is the crime.

In April 2025, the Agricultural Bank of China froze 217 accounts in Guangdong Province after detecting coordinated transfers to offshore exchanges. The bank didn’t accuse anyone of theft or fraud. They didn’t need to. The movement of funds matched the signature of crypto-to-fiat laundering. Those accounts stayed frozen for over two months. Some customers lost access to their salaries. Others had their credit cards suspended. No warning. No explanation. Just silence.

Why you can’t use Hong Kong as a loophole

Many Chinese residents try to work around the ban by using Hong Kong. After all, Hong Kong launched its own Stablecoins Ordinance in August 2025, allowing licensed platforms to offer crypto-to-fiat services. But here’s the catch: mainland Chinese banks are now required to monitor all transfers to Hong Kong accounts with extra scrutiny. Since June 2025, any transfer exceeding HK$50,000 (about $6,400) to a Hong Kong account triggers an automatic report to the State Administration of Foreign Exchange.

And it gets worse. If you’re caught using a Hong Kong exchange to convert crypto and then wiring the yuan back to your mainland account, the bank will treat it as a single violation-not two. They see the whole chain: crypto → Hong Kong exchange → bank transfer → mainland account. The system connects the dots. And they’re getting better at it. By Q2 2026, banks will roll out AI tools that can trace crypto flows across Bitcoin, Ethereum, and other blockchains with 92% accuracy.

What about holding crypto? Is that illegal?

It’s legal to hold crypto in China. No one will come to your door for owning Bitcoin in a private wallet. The law only bans financial institutions from facilitating conversions to fiat. That’s the gray zone: you can own it, but you can’t spend it like money through the banking system.

That’s why an estimated 12.7 million Chinese citizens still hold cryptocurrency-mostly through offshore exchanges like Binance, OKX, or Bybit. But holding doesn’t mean you can access it. If you try to turn it into yuan through any bank, you’re breaking the law. And banks are watching.

The cost of non-compliance for banks-and why they’re so strict

Chinese banks aren’t being overly cautious. They’re terrified. The penalties for letting crypto transactions slip through are brutal. If a bank is found facilitating crypto-to-fiat conversions, it can lose its business license. Senior managers can face criminal charges. Fines can reach five times the value of the transaction.

Since 2022, Chinese banks have spent between $350 million and $400 million annually just on crypto monitoring systems. That’s 15-20% of their total AML budget. They’ve hired data scientists, built custom AI models, and partnered with blockchain analytics firms. They’re not just complying-they’re investing heavily to avoid being punished.

Compare that to Hong Kong, where banks can legally offer crypto services under a regulated framework. In mainland China, there’s no middle ground. No licensing. No exceptions. Just a hard wall.

What’s next? The digital yuan and the future of crypto in China

China isn’t rejecting digital money. It’s building its own. The digital yuan (e-CNY) is being rolled out across the country, with pilot programs in over 200 cities. The government sees it as a way to control the financial system, not decentralize it. S&P Global predicts that crypto restrictions won’t ease until the digital yuan makes up 30% of retail payments-something not expected before 2028.

Until then, the message is clear: if you want to use crypto in China, keep it offline. Don’t touch a bank account. Don’t try to convert. Don’t assume you can outsmart the system. The tools to detect you are already here. And they’re only getting smarter.

Real people, real consequences

One user in Shenzhen tried to cash out $15,000 worth of Ethereum through a peer-to-peer buyer. He received the yuan in his bank account, then transferred it to pay off his mortgage. Within 48 hours, his account was frozen. He lost access to his salary for six weeks. His credit score dropped. He couldn’t rent a new apartment. He had to borrow money from family just to buy groceries.

He didn’t know the buyer’s wallet address was on the blacklist. He didn’t know the transfer pattern looked like crypto laundering. He thought he was just selling crypto like a used phone. He wasn’t. And the bank didn’t care about his intent. Only the pattern.

That’s the reality in China today. It’s not about trust. It’s about control. And the banks? They’re not the gatekeepers. They’re the enforcers.

Can I legally hold cryptocurrency in China?

Yes, it’s legal to hold cryptocurrency in China. The law does not ban individuals from owning Bitcoin, Ethereum, or other digital assets in private wallets. However, converting those assets into yuan through banks or payment platforms is strictly prohibited. The ban targets financial institutions, not personal possession.

What happens if my bank account gets frozen for crypto activity?

If your bank detects crypto-related transactions, your account will be frozen for at least 72 hours. In 89% of cases, the freeze lasts more than 30 days. You won’t be notified why, and there’s no formal appeal process. Banks are required to report the activity to the central bank and anti-money laundering authorities. Your only option is to wait and hope the investigation clears you-though most frozen accounts remain restricted indefinitely.

Can I use a Hong Kong exchange to convert crypto and send yuan back to China?

No. Since June 2025, Chinese banks are required to report any transfer exceeding HK$50,000 ($6,400) to a Hong Kong account. Even if the exchange is legal in Hong Kong, the transfer back to your mainland account is treated as a crypto-to-fiat conversion attempt. Banks use AI tools to trace the full chain-from crypto wallet to offshore exchange to bank transfer-and will freeze your account if they detect the pattern.

Do Chinese banks monitor every transaction for crypto links?

Yes. All transactions are scanned automatically using AI systems trained to detect crypto patterns. Over 95% of transactions are screened by software that flags known wallet addresses, rapid fund movements, and unusual transfer patterns. The remaining 5% are manually reviewed by compliance officers. Banks are legally required to monitor all activity, and failure to do so results in heavy fines or license revocation.

Is there any way to legally convert crypto to fiat in China?

No. There are no legal channels to convert cryptocurrency into yuan through banks, payment apps, or licensed exchanges in mainland China. All such services have been banned since September 2021. The only legal digital currency in China is the digital yuan (e-CNY), which is issued and controlled by the central bank and cannot be exchanged for Bitcoin or other cryptocurrencies.

Why do Chinese banks care so much about crypto if it’s not their money?

Because they face severe consequences if they don’t. Banks that allow crypto transactions risk losing their operating licenses, paying fines up to five times the transaction value, or having executives face criminal charges. The government treats crypto as a threat to financial stability and monetary control. Banks aren’t acting out of preference-they’re acting out of survival.

Elle M

February 1, 2026 AT 08:21Rico Romano

February 2, 2026 AT 18:34