What is Adonis (ADON) Crypto Coin? Privacy, Price, and Problems Explained

Jan, 31 2026

Jan, 31 2026

Adonis (ADON) isn't another Bitcoin clone. It claims to be digital cash built for secrecy - where no one can see who sent money, who received it, or how much changed hands. But behind the marketing, there’s confusion. Some say it’s a breakthrough in privacy. Others say it’s a house of cards built on inconsistent data and unverified claims.

What ADON Actually Does

Adonis (ADON) is a cryptocurrency designed to make transactions untraceable. According to its own documentation, it uses advanced cryptography to hide sender, receiver, and transaction amounts. That sounds like Monero or Zcash - but ADON doesn’t work the same way. Unlike those coins, which are open-source and have been audited by cryptographers for years, Adonis doesn’t publish a technical whitepaper. There’s no public codebase showing how its privacy layers actually work.

The Adonis Network says it’s built for "infrastructure-ready digital cash for global usage." That sounds impressive - until you dig deeper. The platform also runs a centralized exchange called Adonis Exchange, which requires KYC (Know Your Customer) verification. That’s a direct contradiction. If your coin is meant to be untraceable, why force users to hand over government ID just to trade it?

Price and Market Data - A Mess

As of January 2026, ADON trades between $0.99 and $1.31, depending on the exchange. CoinGecko lists it at $0.9997. Coinbase says $1.31. Why the difference? Because liquidity is thin. The 24-hour trading volume is around $6,700 - barely enough to move the needle on any major exchange.

Its all-time high was $1.78 in March 2023. Since then, it’s lost nearly 50% of its value. Over the past 7 days, ADON dropped 9%, while the broader crypto market rose 7.2%. That’s not just underperforming - it’s collapsing in a rising tide.

And here’s the biggest red flag: circulating supply. Coinbase claims zero ADON tokens are in circulation. CoinGecko shows a $6,700 daily trading volume. How can you trade something that doesn’t exist? Either one of them is wrong - or the entire system is built on illusion.

Supply and Mining - No Clarity

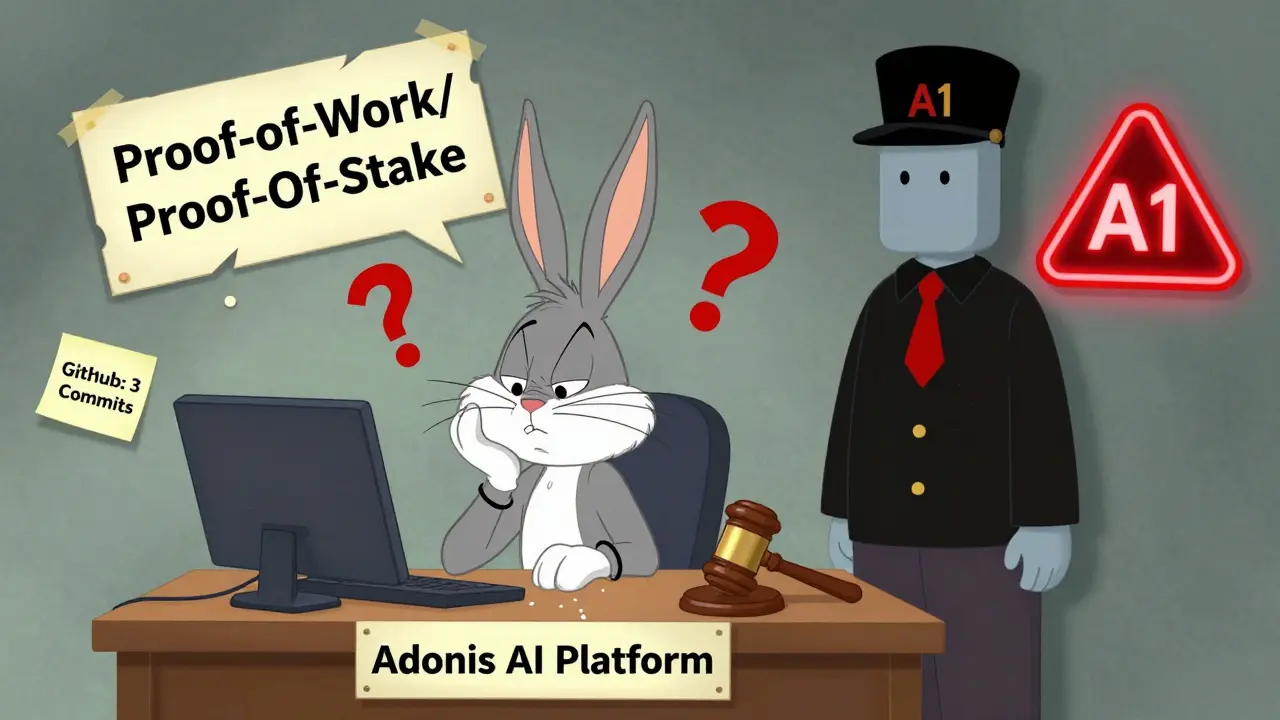

Adonis has a fixed total supply of 10 billion tokens. That’s clear. But how many are actually out there? No one knows. The official site says users can stake ADON to earn rewards. Staking usually means proof-of-stake. But Symlix says ADON uses proof-of-work - meaning you mine it like Bitcoin. Which is it? The documentation doesn’t say. The community is split. Developers don’t respond. GitHub shows only 3 commits in the last year.

There’s no evidence of active mining pools. No public blockchain explorer. No way to verify transactions independently. That’s not how real cryptocurrencies work. Even obscure coins have public ledgers. Adonis doesn’t. That’s not privacy - that’s opacity.

Staking Rewards - The Only Real Feature

One thing users consistently report: staking ADON works. A YouTube reviewer tested it for six months and got consistent 8.2% annual returns. That’s higher than most stablecoin yields. And there are no reports of downtime.

But here’s the catch: you can only stake ADON through the Adonis Exchange. And that exchange has terrible reviews. On Trustpilot, users say withdrawal requests take up to 14 business days - even though the site promises 24 to 48 hours. One person lost over $2,000 waiting for a simple transfer. If your coins are locked in a platform that can’t move money on time, are you really earning rewards - or just trapped?

The AI Layer - Marketing or Reality?

Adonis doesn’t just talk about crypto. It talks about AI. The platform has something called "Adonis AI Platform (A1)" that supposedly governs everything: task execution, payments, validation, even scoring user behavior. It’s described as an "AI judge" with human backup.

But there’s no public demo. No API. No documentation on how it works. No case studies showing real-world use. It sounds like a sci-fi feature tacked on to make the project sound futuristic. In reality, it might just be a fancy name for a basic automated system - or worse, a distraction.

Who’s Using ADON?

Almost no one.

Adonis has 2,847 followers on Twitter and 1,532 members on Telegram. That’s less than a small local crypto meetup. No major exchanges list it besides Bitbegin, which handles just 38% of its volume. No businesses accept it. No wallets recommend it. No developers contribute to it.

It’s not competing with Monero or Zcash. It’s not even competing with newer privacy coins like TurtleCoin or Firo. It’s competing with silence.

Regulatory Red Flags

Blockchain legal analyst Sarah Chen pointed out the core conflict in her January 2026 article: "The Privacy Paradox: When KYC Meets Untraceable Coins." You can’t have both. If you require ID to trade ADON, you’re not building a privacy coin - you’re building a token that pretends to be private.

That’s dangerous. Regulators don’t like coins that claim anonymity but force users to identify themselves. It’s a compliance nightmare. If the Adonis Network ever gets audited, it could be shut down for misleading users.

Is ADON Worth It?

Let’s cut through the noise.

If you’re looking for a privacy coin with real security, proven code, and active development - look at Monero. It’s been around for a decade. It’s open-source. It’s audited. It’s used by real people.

If you’re chasing high staking yields and don’t mind locking your coins in a sketchy exchange - ADON might give you 8% returns. But you’re taking on massive risk. What if the exchange freezes withdrawals? What if the price crashes again? What if the team vanishes tomorrow?

And if you’re hoping ADON will become the next Bitcoin? That’s not happening. The technology isn’t transparent. The team isn’t visible. The community is tiny. The market is dying.

ADON feels like a startup that ran out of funding and started selling tokens to keep the lights on. It has all the hallmarks of a low-cap speculative asset - not a serious cryptocurrency.

Final Verdict

Adonis (ADON) is not a reliable crypto project. It makes bold claims about privacy but hides its tech. It promises fast withdrawals but delivers delays. It says it’s decentralized but runs a KYC-heavy exchange. Its market data contradicts itself. Its codebase is dead.

There’s one reason to even consider ADON: staking rewards. But even then, you’re betting on a platform that could disappear overnight. If you’re willing to risk your money on a gamble with no transparency - go ahead. But don’t call it an investment. Call it a lottery ticket.

For everyone else - walk away. There are better, safer, and more proven ways to earn in crypto. You don’t need to chase shadows.

Is Adonis (ADON) a real cryptocurrency?

Adonis (ADON) exists as a token on some exchanges, but it lacks the core features of a real cryptocurrency. There’s no public blockchain explorer, no verified codebase, and no transparent supply data. While it has a price and trading volume, its infrastructure is centralized, opaque, and inconsistently reported across platforms.

Can I mine Adonis (ADON)?

The official Adonis Network site promotes staking, not mining. But some third-party sources claim it uses proof-of-work. There’s no consensus. No mining software is available. No public mining pools exist. The lack of clarity suggests either outdated information or intentional obfuscation.

Why is the circulating supply of ADON so confusing?

Coinbase reports zero ADON in circulation, while CoinGecko shows active trading volume. This contradiction is unresolved. It suggests the token’s supply data is either inaccurate, manipulated, or not properly tracked. A legitimate cryptocurrency always has verifiable on-chain supply metrics - ADON does not.

Is staking ADON safe?

Staking ADON through the Adonis Exchange has delivered consistent returns for some users - but only if you trust the exchange. Multiple Trustpilot reviews report withdrawal delays of up to two weeks. If the exchange freezes or shuts down, your staked coins could be lost. There’s no insurance, no decentralization, and no backup.

Does Adonis have a future?

Based on current data, Adonis has little chance of long-term survival. Its developer activity is nearly nonexistent. Its community is tiny. Its technology is unverified. Its market performance is declining. Even its own claims contradict each other. Without major changes - like open-sourcing its code, fixing supply transparency, and removing KYC from its privacy narrative - it will remain a speculative token with no real utility.

Rob Duber

January 31, 2026 AT 23:49Gary Gately

February 1, 2026 AT 22:10Joshua Clark

February 3, 2026 AT 14:35