What is Fake USD One (USD1) Crypto Coin? The Scam Explained

Jan, 30 2026

Jan, 30 2026

There’s no such thing as a legitimate USD1 crypto coin you can buy right now - and if someone tells you otherwise, they’re trying to steal your money. In March 2024, a wave of fake tokens called USD1 flooded blockchain networks like Solana, Ethereum, and BNB Chain. These weren’t just random coins. They were carefully crafted scams designed to look exactly like a real stablecoin project tied to World Liberty Financial (WLFI), a company that had been quietly developing a USD-pegged token. The problem? The real USD1 hadn’t launched yet. But scammers didn’t wait. They jumped in the moment the project got public attention.

How the Fake USD1 Scam Worked

The scam started when Changpeng Zhao (CZ), former CEO of Binance, publicly acknowledged the real USD1 smart contract on BNB Chain. That single tweet triggered a feeding frenzy. Within hours, fake versions of USD1 appeared on decentralized exchanges. Each one had the same name, logo, and even similar website domains like usd1-worldlibertyfi[.]com - a tiny misspelling of the real site, worldlibertyfinancial.com. The goal? Trick you into connecting your crypto wallet. Once you connected your wallet - maybe because you saw a tweet from someone pretending to be CZ, or clicked a link in a YouTube video using a deepfake of a well-known crypto influencer - you were asked to "approve" a transaction. That approval didn’t just let you claim free tokens. It gave the scammer’s code full, unlimited access to everything in your wallet. ETH, BTC, SOL, USDT - all of it. In seconds, your balance was drained. Security firms like ESET and TRM Labs confirmed these weren’t just phishing sites. They were smart contracts built to auto-siphon funds. Victims lost an average of $2,850 each. One Reddit user lost 1.2 ETH ($3,650 at the time) after clicking a link from a Twitter search result. Another user on Bitcointalk reported seeing fake USD1 tokens on 12 different exchanges across seven blockchains.Why People Fell for It

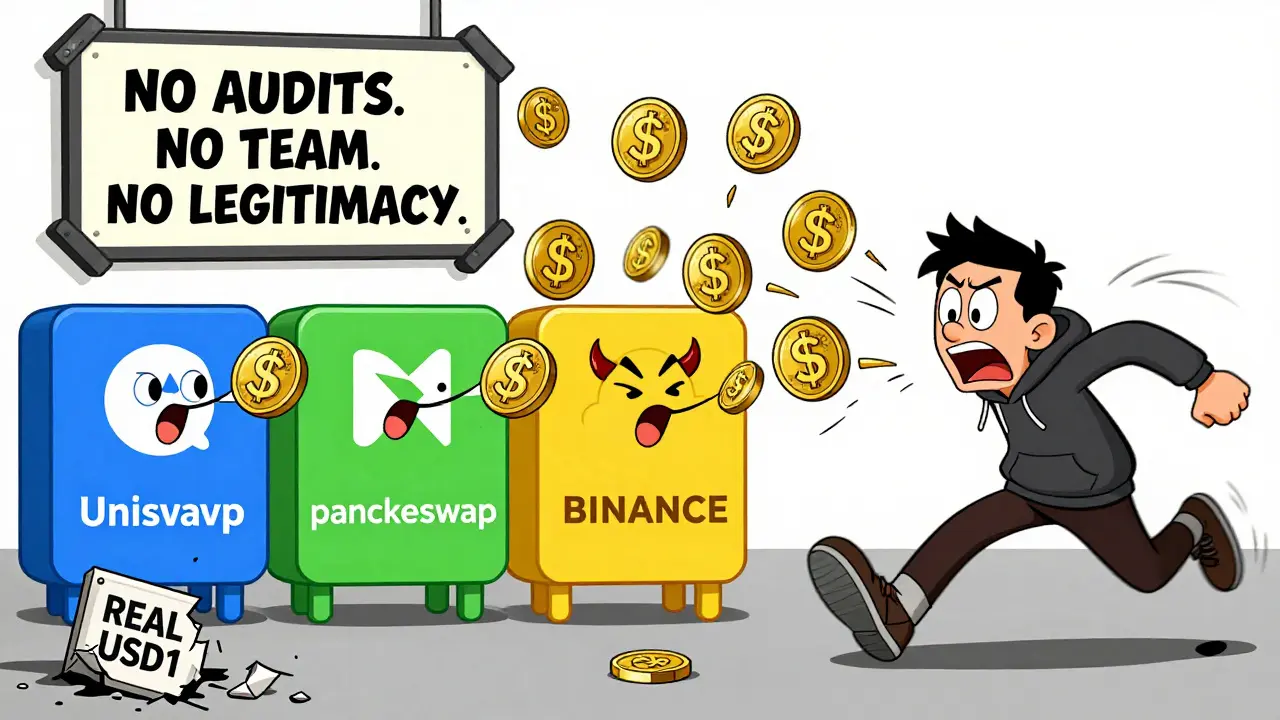

This scam worked because it exploited trust. The real WLFI project had ties to people in the public eye - including family members of former U.S. President Donald Trump. That association gave it credibility. Scammers used that. They created fake news articles, cloned official-looking websites, and even posted videos with AI-generated voices saying, "USD1 is live - join now!" The California Department of Financial Protection and Innovation (DFPI) found that 78% of crypto investment scams in 2023 used fake tokens impersonating real projects. And 63% of victims said the websites looked professional - no spelling errors, clean design, SSL certificates. They looked real. But they weren’t. Legitimate stablecoins like USDT and USDC have billions in reserves. They’re audited monthly. They have public team members, GitHub code, and official support channels. The fake USD1 had none of that. No audits. No team names. No reserve proofs. Just a contract designed to steal.

How to Spot a Fake Crypto Token

If you’re ever looking at a new token - especially one that sounds too good to be true - check these five things:- Verify the official website - Type it manually. Don’t click links from tweets, DMs, or search results. Look for exact matches. Misspellings like "worldlibertyfi" instead of "worldlibertyfinancial" are dead giveaways.

- Check the smart contract address - Go to the project’s official Twitter, Telegram, or website. Compare the address they list with the one on the exchange. If they don’t match, walk away.

- Never approve "unlimited" transactions - Legit projects never ask you to approve your entire wallet. If you see a popup asking for "unlimited approval," close it. Immediately.

- Look for audits - Real projects get audited by firms like CertiK or PeckShield. If there’s no audit report, assume it’s unsafe.

- Check the liquidity pool - Fake tokens often have less than $50,000 in liquidity. Real ones have millions. If the token’s trading volume is tiny but the hype is huge, it’s a red flag.

The Bigger Picture: Why This Keeps Happening

Crypto scams aren’t getting worse - they’re getting smarter. Chainalysis reported $3.8 billion lost to crypto scams in 2023, up 52% from 2022. Spoof tokens like USD1 are now the fastest-growing scam type. Why? Because they’re cheap to make and easy to deploy. A scammer can copy a smart contract in minutes and launch it on ten blockchains at once. The real USD1 project eventually released its official contract address and verified social channels. But by then, scammers had already moved on. PeckShield reported fake USD1 tokens appearing on 17 different blockchains by the end of March 2024. And TRM Labs found that scammers now act within 24 hours of any major project announcement - down from 72 hours just a year earlier. This isn’t just about USD1. It’s about how the crypto space still lacks clear guardrails. Investors are hungry for the next big thing. Scammers know that. And they’re ready to pounce the second a name gets mentioned.

What to Do If You Got Scammed

If you already connected your wallet to a fake USD1 site, here’s what to do right now:- Stop using that wallet. Move any remaining funds to a new one.

- Revoke permissions on the malicious contract. Use tools like revoke.cash (or similar) to cancel unlimited approvals.

- Report it. File a complaint with the FTC (U.S.) or your local financial regulator. The California DFPI has a public tracker of these scams.

- Don’t expect your money back. Blockchain transactions are irreversible. Recovery is nearly impossible.

Final Warning

There is no official USD1 token trading as of January 2026. Any site, app, or person claiming to sell, airdrop, or trade USD1 is running a scam. The real project, if it ever launches, will announce it through verified channels - not DMs, not search ads, not TikTok influencers. Crypto moves fast. But your safety shouldn’t. Always take 45 minutes to verify a new project before touching your wallet. Check the official website. Read the audit. Look at the team. See if the contract matches. If anything feels off - it is. Don’t chase the hype. Protect your assets. The only thing you’ll gain from fake USD1 is a empty wallet.Is USD1 a real cryptocurrency?

No, USD1 is not a real, tradable cryptocurrency as of January 2026. While World Liberty Financial (WLFI) was developing a USD-pegged stablecoin called USD1, it never launched for public trading. All tokens labeled USD1 available on exchanges or airdrop sites are fraudulent and designed to steal funds.

How can I tell if a crypto token is fake?

Check for four things: 1) The official website URL - look for misspellings. 2) The smart contract address - compare it with the project’s official channel. 3) Smart contract audits - real projects get audited by firms like CertiK. 4) Liquidity pool size - fake tokens often have under $50,000. If any of these are missing, it’s likely a scam.

Why did so many people lose money to the fake USD1 scam?

Scammers exploited trust by mimicking the real WLFI project, which had ties to high-profile figures. They used fake websites, deepfake videos, and misleading social media posts to make the scam look legitimate. Victims were tricked into approving transactions that gave scammers full access to their wallets. Once approved, funds were drained instantly and irreversibly.

Can I recover my money if I got scammed by USD1?

Almost certainly not. Blockchain transactions are permanent. Once funds are sent to a scammer’s wallet, there’s no central authority to reverse them. Your best move is to revoke contract permissions using tools like revoke.cash and stop using the compromised wallet. Report the scam to authorities, but expect no refund.

Are there any legitimate USD1 tokens I can buy?

No. As of January 2026, no official USD1 token has been launched. Any token with that name on Uniswap, PancakeSwap, or any other exchange is fake. Only trust official announcements from verified channels like the WLFI website or their verified social media accounts - and even then, wait for a public launch announcement before doing anything.

How do scammers get fake tokens listed on exchanges?

Decentralized exchanges like PancakeSwap and Uniswap allow anyone to create and list tokens for free. Scammers create a token with the same name as a real project, add a small amount of fake liquidity (often under $50,000), and promote it through social media. The low liquidity makes it look like a new opportunity - but it’s just a trap. Real projects pay for audits, listings, and compliance - scammers do none of that.

Richard Kemp

January 31, 2026 AT 10:36bro i just lost 0.8 ETH to one of these fake USD1 things last week. thought it was legit ‘cause the site looked like a real bank. my bad. 🤦♂️

Jerry Ogah

February 1, 2026 AT 00:22Oh my god, this is the third time this month someone’s pulled this exact scam. It’s like they have a scam template folder on their desktop. ‘Hey look, it’s CZ!’ Nope. It’s a 14-year-old in a basement with a Midjourney prompt and a fake Twitter blue check. 😤

Christopher Michael

February 2, 2026 AT 05:53Let me be very clear: legitimate stablecoins have audits, liquidity proofs, and team transparency. USD1? Zero. Nada. Zilch. The fact that people still click ‘approve unlimited’ without checking the contract address is not ignorance-it’s negligence. And yet, here we are. Again.

Always verify the contract on Etherscan or Solana Explorer before signing anything. If the name matches but the address doesn’t? That’s not a coin. It’s a trapdoor.

Also, if you’re using a wallet that auto-connects to sites you didn’t visit? Stop. Right now. Turn off wallet connect permissions. Use a burner wallet for sketchy tokens. It’s not paranoia-it’s hygiene.

And for the love of Satoshi, don’t trust Twitter threads. Even verified ones. I’ve seen deepfakes of Vitalik now. You think CZ is safe?

Scammers don’t need to be smart. They just need you to be lazy.

Elle M

February 2, 2026 AT 07:59Wow. A whole article about how dumb people are. And yet, here we are. Still clicking ‘approve’ like it’s a free pizza coupon. 🇺🇸 We built the internet. Now we’re giving our life savings to AI-generated CZs. America, you’re a masterpiece.

Rico Romano

February 3, 2026 AT 10:21Let’s be honest-this isn’t about USD1. It’s about the collapse of intellectual standards in crypto. The average investor doesn’t understand smart contracts, liquidity pools, or cryptographic signatures. They see ‘USD-pegged’ and think ‘free money.’ This isn’t a scam problem. It’s a literacy problem. And we’re not fixing it. We’re just monetizing the ignorance.