Crypto Archives November 2025: Scams, Regulations, and Real Tokenomics

When you look at the crypto archives, a curated collection of verified crypto insights published in November 2025. Also known as crypto resource library, it shows you what actually matters in a market full of noise. This isn’t just a list of articles—it’s a record of what happened when hype met reality. From ghost tokens with zero supply to governments writing new rules, these posts cut through the fluff and show you where the real risks and opportunities lie.

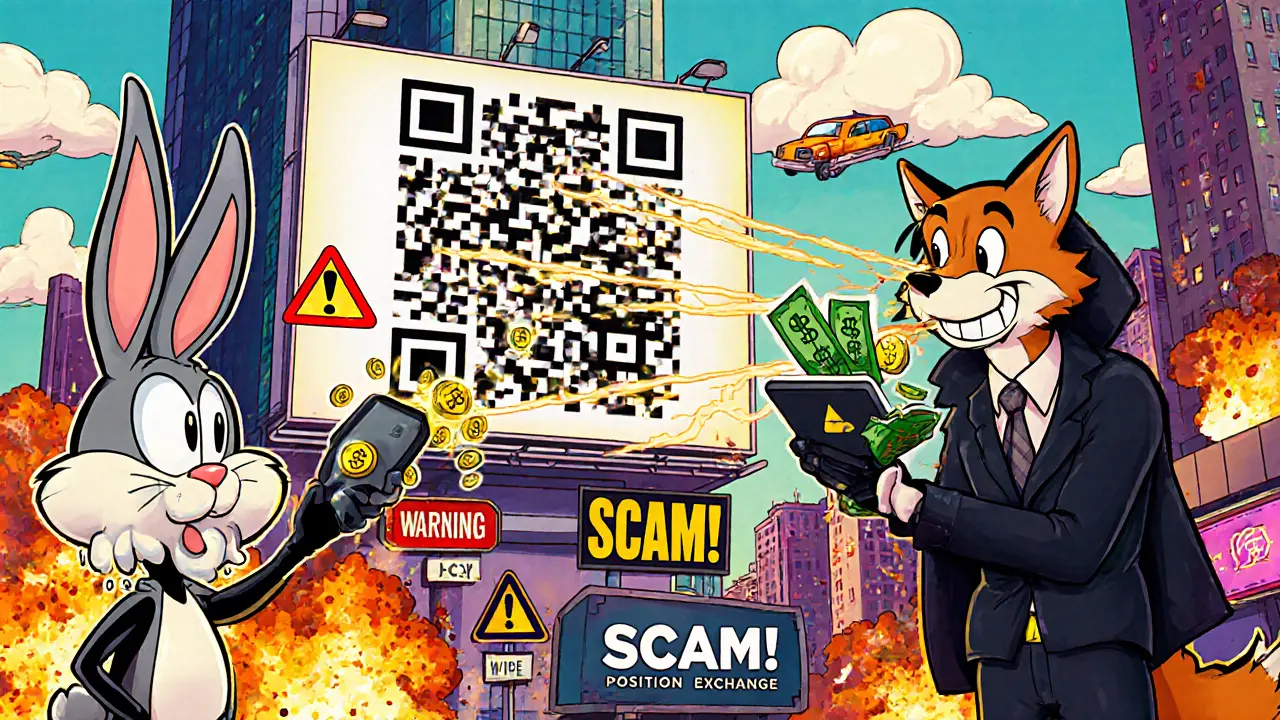

One big theme? crypto scams, fraudulent schemes disguised as opportunities, like fake airdrops and non-existent exchanges. Also known as crypto fraud, it exploded in November 2025. The Times Square billboard airdrop? Pure fiction. The ElonTech (ETCH) drop? Dead since 2022. Even the WELL token claim? Nothing but phishing links. These weren’t just random lies—they were coordinated attacks targeting people who didn’t know how real airdrops work. Meanwhile, fake exchanges like Coinrate and AIA Exchange popped up with zero reviews, no regulation, and no security. They looked real. They weren’t. And the archives make it clear: if you can’t find a single trusted user review or official listing, walk away.

Then there’s tokenomics, the economic design behind a crypto project, including supply, distribution, and utility. Also known as crypto token structure, it became the filter for separating winners from waste. Anatolia Token (ANDX) and Carboncoin (CARBON) both claimed to be the next big thing—but neither had trading volume, no team, and no real use case. Their tokenomics had red flags: unlimited supply, no vesting, no community. The posts here don’t just call them scams—they show you exactly what to look for. Seven warning signs. One checklist. No jargon. Just facts. And it’s not just about scams. Real projects like Bifrost’s BNC airdrop and OwlDAO’s CoinMarketCap drop had clear rules, verifiable steps, and transparent tokenomics. The difference? One was built to last. The others were built to disappear.

Regulations also shifted in November. crypto regulations, government rules that determine how crypto can be used, taxed, or banned. Also known as crypto legal framework, it got real in Zug, Switzerland, where capital gains are tax-free and DLT trading is legal. But in Australia, privacy coins like Monero got quietly blocked from exchanges. In Afghanistan, Bitcoin was banned—but people still used it underground. And in China, traders found legal workarounds to buy crypto with fiat. These weren’t abstract policies. They affected real people trying to protect their money.

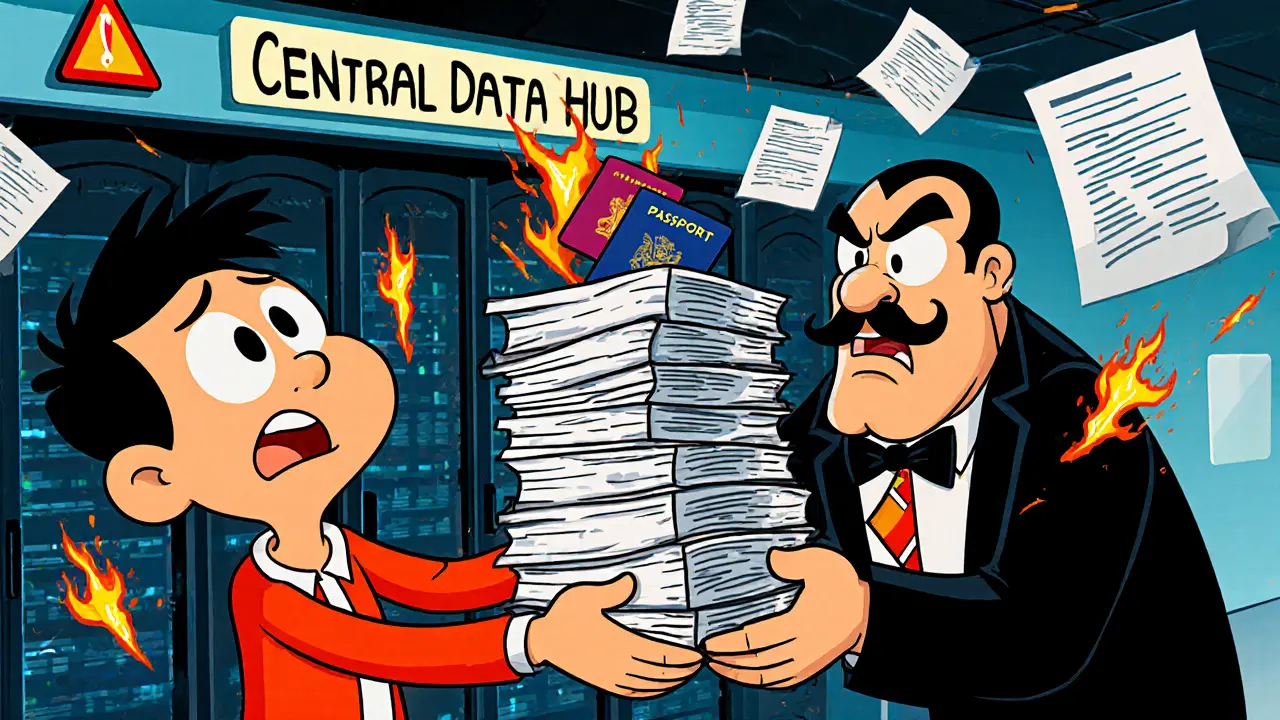

And then there’s decentralized identity—something most people ignore until it matters. The post on self-sovereign identity didn’t just explain DIDs and verifiable credentials. It showed how you can prove who you are without handing your data to a company. That’s not future tech. It’s the only way to stay safe in a world where every exchange wants your phone number, your ID, and your face.

What you’ll find below isn’t just a list of articles. It’s a map. A map of what broke, what worked, and what you need to watch out for next. No theory. No guesswork. Just what happened in November 2025—and why it still matters today.

What is Anatolia Token (ANDX) Crypto Coin? A Real Look at the Zero-Circulating Supply Token

Anatolia Token (ANDX) claims to be a community-driven DeFi token, but it has zero circulating supply, no exchange listings, and no active development. Here's what's really going on with this ghost token.

CEX.IO Crypto Exchange Review: Security, Fees, and Real User Experience in 2025

CEX.IO is a reliable, regulated crypto exchange with strong security, 200+ coins, and unmatched payment options. Perfect for global users who need to buy crypto with PayPal, cards, or bank transfers. No breaches in over a decade.

WELL Airdrop Details: What We Know and What to Watch For

There is no confirmed WELL airdrop as of November 2025. Learn why claims about a WELL token drop are likely scams, how real airdrops work, and what projects to watch instead for legitimate opportunities.

Switzerland Crypto Valley Regulations in Zug: What You Need to Know in 2025

Zug, Switzerland, known as Crypto Valley, offers the world's most progressive crypto regulations in 2025-with tax-free capital gains, legal DLT trading, and municipal crypto payments. Here’s how it works.

Position Exchange Times Square Billboard Airdrop: Scam Alert and What to Watch For

A fake 'Position Exchange Times Square billboard airdrop' is spreading online - it's a scam. Learn why billboards can't give you crypto, how the fraud works, and how to protect your wallet from being drained.

Privacy in Decentralized Identity: How You Control Your Data Without Central Authorities

Decentralized identity gives you control over your personal data by letting you prove who you are without sharing it. No central databases. No third-party tracking. Just cryptographically secure, selective disclosure.

Tokenomics Red Flags: 7 Warning Signs That Could Cost You Everything

Learn the 7 critical tokenomics red flags that can destroy crypto investments - from unlimited supply and fake APY to hidden teams and no real utility. Avoid scams and build smarter portfolios.

OwlDAO x CoinMarketCap Airdrop: How to Claim 250 OWL Tokens and What You Need to Know

Claim 250 OWL tokens from the OwlDAO x CoinMarketCap airdrop by completing nine simple steps. Learn how it works, what it’s worth, and why it’s different from other crypto airdrops in 2025.

How to Buy Crypto for Fiat in China in 2025: Legal Workarounds and Safe Platforms

Learn how to legally buy cryptocurrency with fiat in China in 2025 using international exchanges, P2P trading, and secure payment methods-despite strict government restrictions.

Afghanistan's Crypto Ban After the Taliban Takeover: What Happened and Why It Still Matters

After the 2022 Taliban takeover, Afghanistan banned all cryptocurrency, calling it haram. But with banks frozen and inflation soaring, Afghans still use Bitcoin and USDT underground-especially women seeking financial freedom. The ban is strict, but the need is stronger.

Coinrate Crypto Exchange Review: Is It Legit or a Scam?

Coinrate is not a real crypto exchange. This review exposes it as a scam with no regulatory backing, no security measures, and no presence on trusted platforms. Avoid it and use verified exchanges like Coinbase or Kraken instead.

Understanding Bitcoin Network Hash Rate: How Computational Power Secures the Blockchain

Bitcoin's hash rate measures the total computing power securing the blockchain. Higher hash rates mean greater security, resistance to attacks, and network stability - making it the most reliable indicator of Bitcoin's health.