Crypto Compliance Singapore: Rules, Risks, and Real-World Impact

When it comes to crypto compliance Singapore, the set of legal and operational rules that cryptocurrency businesses must follow to operate legally in Singapore. Also known as virtual asset regulation, it’s not about stopping crypto—it’s about making sure it doesn’t become a tool for money laundering, tax evasion, or fraud. Unlike countries that ban crypto outright, Singapore says: "Do it right, and we’ll give you a license."

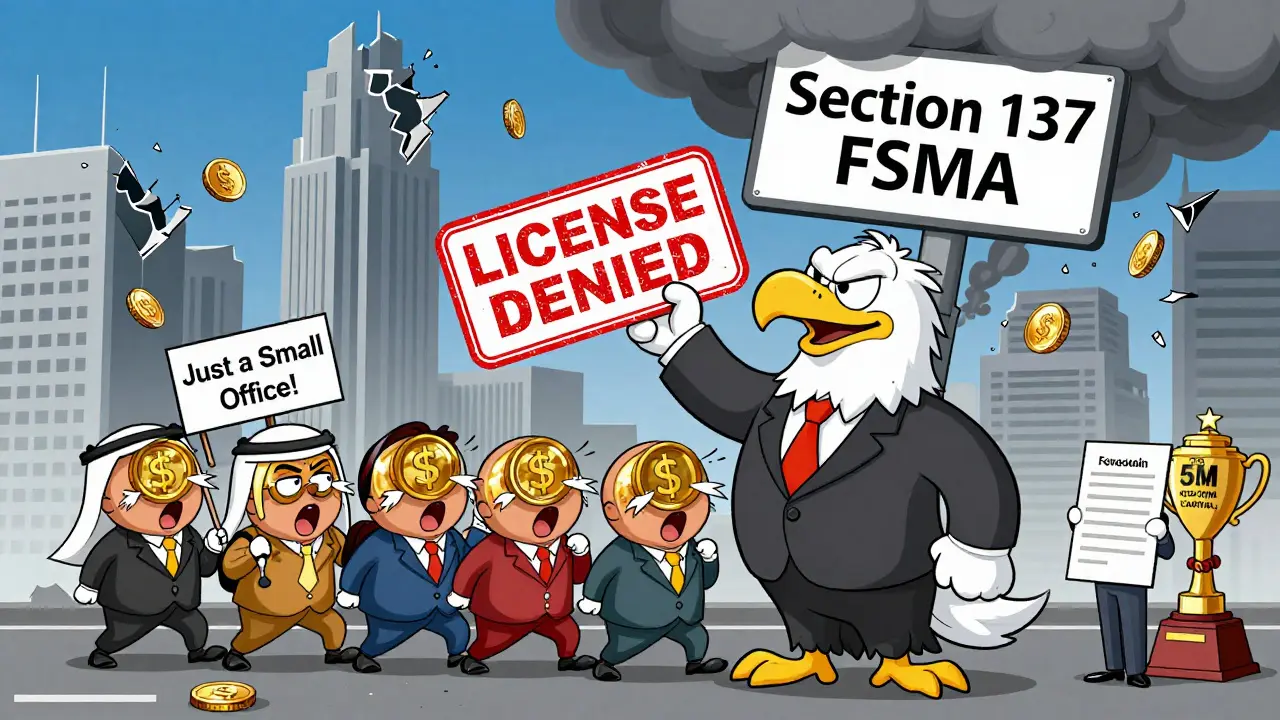

This means companies need a MAS license, a formal authorization from the Monetary Authority of Singapore to offer crypto services like trading, custody, or payment processing, and must follow strict AML rules, anti-money laundering requirements that force exchanges to verify users, track transactions, and report suspicious activity. If you’re a business, you need proof of capital, a local office, and a compliance officer. If you’re a user, you’re not banned—but you can’t use unlicensed platforms. The MAS doesn’t just check paperwork. They audit trading logs, wallet addresses, and even how customer support handles disputes.

Why does this matter? Because Singapore is a global hub. Banks, hedge funds, and Web3 startups all set up shop here—not because it’s easy, but because it’s predictable. You know exactly what’s allowed. You know who to talk to. You know the penalties if you slip up. That’s why so many crypto firms in Southeast Asia choose Singapore over Thailand, Vietnam, or Indonesia. But compliance isn’t cheap. Licensing fees start at $10,000. Ongoing reporting costs thousands more. And if you ignore the rules? You could lose your license, face fines up to $2 million, or even get your executives jailed.

It’s not just about exchanges. Wallet providers, DeFi platforms, and even NFT marketplaces need to prove they’re not enabling anonymous transfers or hiding user identities. The MAS requires real-name verification for every customer. No VPNs. No offshore accounts. No "I didn’t know" excuses. This is why some smaller projects avoid Singapore entirely—they can’t afford the overhead. But for serious players, it’s worth it. The country even has a sandbox for testing new crypto products under supervision, so innovation isn’t blocked—it’s guided.

And taxes? Yes, they’re clear too. Capital gains aren’t taxed, but if you’re trading crypto as a business, profits are. Mining income? Taxable. Staking rewards? Taxable. The Inland Revenue Authority of Singapore (IRAS) treats crypto like property, not currency. Keep records. Report everything. Don’t assume anonymity means invisibility.

What you’ll find below are real examples of how crypto compliance plays out—not in theory, but in practice. From how exchanges in Singapore handle KYC to how regulators shut down unlicensed platforms, from the cost of getting licensed to the hidden traps that catch even experienced operators. These aren’t guesses. They’re stories from the ground. And if you’re thinking about operating in Singapore—or just want to know why it’s one of the few places where crypto isn’t a gamble—it’s all here.

Monetary Authority of Singapore Crypto Oversight: What You Need to Know in 2025

Singapore's MAS has imposed one of the world's strictest crypto frameworks, effectively banning most new licenses. Learn the rules, penalties, and real impact on businesses and investors in 2025.